Minnesota: Approved avg. 2022 #ACA rate changes: +9.5% individual market; +2.7% sm. group; families will save $684/yr on average thanks to the #AmRescuePlan

Minnesota Families Will Save an Average of $684 per Year and Access More Heath Plan Choices in 2022

ST. PAUL, Minn.—The Minnesota Department of Commerce and MNsure released information today on 2022 health plan rates and options in advance of the open enrollment period, which begins November 1.

On average, Minnesota families will save $684 per year and will be able to access more health plan choices than previous years. More Minnesotans than ever before are eligible to receive tax credits to lower monthly premium costs through federal funding provided in the American Rescue Plan. Minnesotans who buy their own individual health insurance for 2022 will have access to hundreds of dollars in savings when choosing health plans via MNsure. Minnesotans will also be able to choose from more health plan options being offered through MNsure.

"Most MNsure enrollees who qualify will see significant savings in 2022, making it the best year for consumers to take another look to see how much they can save," said MNsure CEO Nate Clark. "Compared to last January, a family who purchases insurance through MNsure in 2022 will save an average of $684 a year on health insurance thanks to the American Rescue Plan."

Some Minnesotans will see even bigger savings next year. For example, a family of four living in Rochester with an annual income of $110,000 can enroll in a MNsure gold plan and access benefits that would cut their premium nearly in half, saving them about $8,400 per year. In prior years, they would not have qualified for this discount. For examples in other geographic areas, see the scenario packet available from MNsure.

Individual and small group health plans will continue to offer choices for consumers. Every county in Minnesota will have at least two insurers offering individual market plans with the majority (all but seven counties) having three or more insurers. Additionally, every county will have at least 22 separate health insurance plan options available in the individual market. For 2022, five health insurance companies are returning to partner with MNsure to offer qualified health plans to Minnesotans: Blue Plus, HealthPartners, Medica, Quartz and UCare. Dental plans will also be available from Delta Dental and Dentegra. Overall, MNsure’s partners are offering 10 more plans in 2022 than in 2021.

"Minnesota’s health insurance markets remain strong and stable, allowing Minnesota individuals, families and small businesses to choose a quality, affordable health insurance option that best works for them," said Commerce Commissioner Grace Arnold.

The individual health plan market is for people who are not insured through employer-based coverage and are not eligible for Medicare or Medicaid. Currently, about 3% of Minnesotans (163,000 people) have individual health insurance plans, including 107,000 Minnesotans who are covered by health plans offered through MNsure. Income-eligible Minnesotans will be able to find a plan only through MNsure with monthly premiums that cost no more than 8.5% of their household income. To give Minnesotans additional time to shop and compare health plans, MNsure’s open enrollment will be extended three weeks, running from November 1, 2021, to January 15, 2022.

The 2022 insurance rates for individual and small group health plans in Minnesota have been reviewed and approved by the Minnesota Department of Commerce through its annual review process.

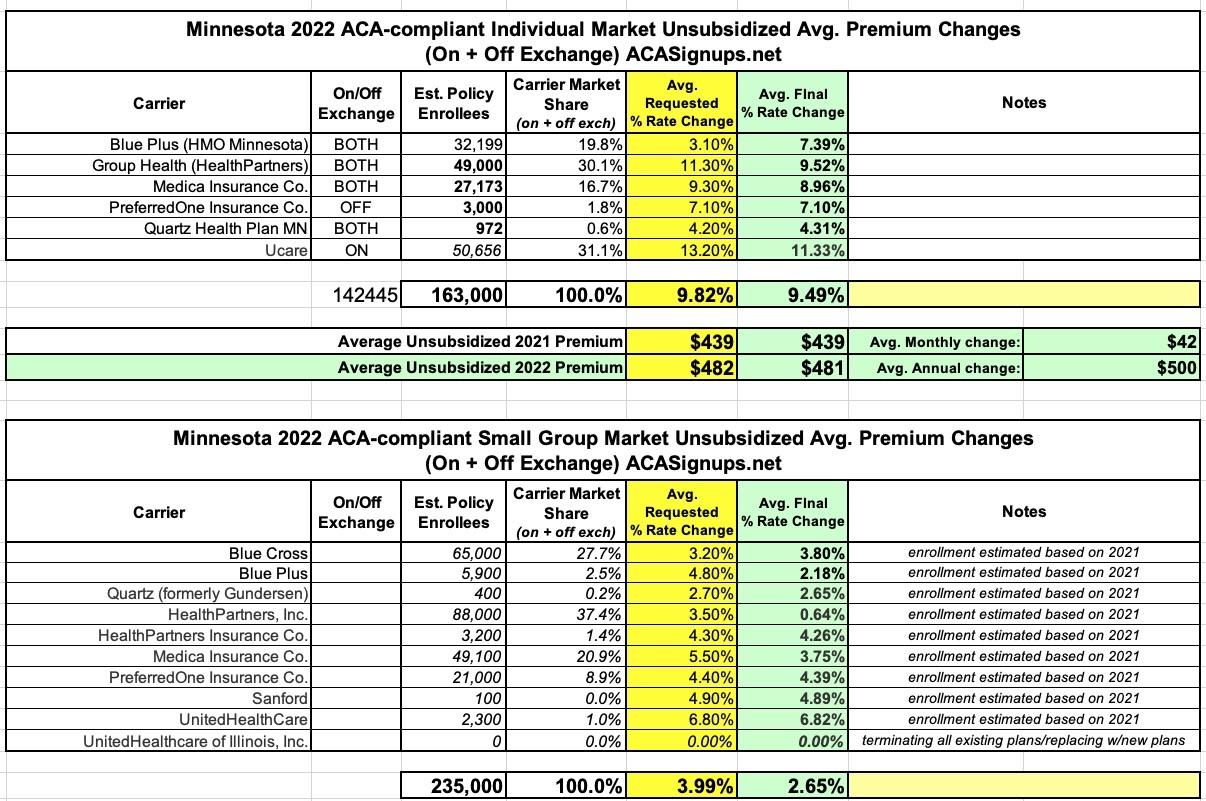

For small group health insurance plans, which serve employers with fewer than 50 full-time employees and cover about 4.1% of Minnesotans (235,000 people), the final average rate changes for 2022 range from 0.6% to 6.8%. For the individual health insurance plans, the final average rate changes for 2022 range from 4.3% to 11.3%.

The actual price a consumer will pay for health insurance can vary depending on factors such as where they live, what plan they choose and their age. When consumers purchase plans through MNsure, they may qualify for tax credits to help lower the cost of their insurance, with more Minnesotans qualifying than ever before.

The state does not regulate self-insured health plans, which cover almost 40% of the state’s population. The largest percentage of Minnesotans get their coverage through their employers’ self-insured group coverage. Medicare covers almost 19% of Minnesotans and Medical Assistance also covers almost 19% of Minnesotans. About 4% of Minnesotans are uninsured.

On behalf of Minnesota consumers, the Department of Commerce reviews health insurance rate proposals each year to make sure they meet actuarial standards and comply with state and federal consumer protection laws. The Minnesota Department of Health evaluates the plans for network adequacy, while MNsure operates the state’s health insurance marketplace where individuals and families can shop, compare and choose health insurance coverage, and receive tax credits if they qualify.

Overall I don't see any significant changes to the offerings from 2021 other than PreferredOne appearing to eliminate one of their two lines on both markets. Also, UnitedHealthcare of Illinois appears to be scrapping their entire line of existing plans on the small group market and replacing them with all-new policies, which means there's technically no current rates for them to compare against.

The other important thing to keep in mind for the small group market is that I can't seem to find the actual current enrollment data for each carrier, so I'm basing the weighted average on 2020 enrollment, which could be way off if there's been significant market share shifts this year. I've reduced the estimates for Ucare on the individual market and for a few of the small group market carriers to bring the total in line with the press release, but that could be off by a bit.

Assuming I have it pretty close, however, Minnesota residents are looking at roughly a 9.5% average rate hike for unsubsidized enrollees only...except of course that anyone enrolling on-exchange receive federal subsidies to bring their net premiums down to no more than 8.5% of their household income regardless of the unsubsidized price.

Small group plans look like they're going up around 2.7% on average.