BREAKING: CBO finally takes Silver Loading into account re. CSR appropriation

Welp. The Congressional Budget Office just released their latest 10-year economic outlook. There's a whole mess of stuff in there, but let's focus in on one area of particular interest to the healthcare wonk community:

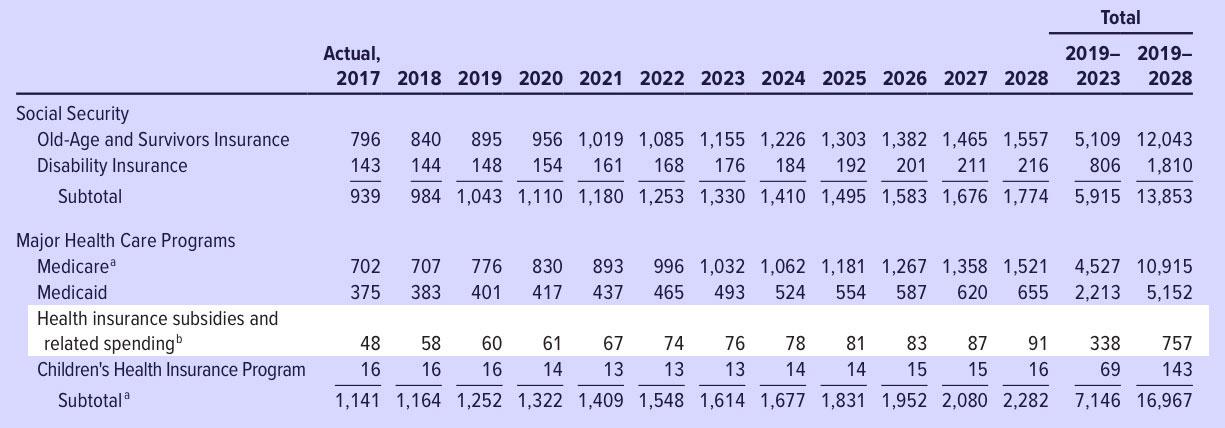

Health Insurance Subsidies and Related Spending. Outlays for health insurance subsidies and related spending are estimated to increase by $10 billion, or 21 percent, in 2018.8 That jump mostly stems from an average increase of 34 percent in premiums for the second-lowest-cost “silver” plan in health insurance marketplaces established under the Affordable Care Act. (Those premiums are the benchmark for determining subsidies for plans obtained through the marketplaces.) Over the 2019–2028 period, the average growth in spending is projected to lessen considerably, to just under 5 percent per year, as per-beneficiary spending rises with the costs of providing medical care. CBO estimates that, under current law, outlays for health insurance subsidies and related spending would rise by about 60 percent over the projection period, increasing from $58 billion in 2018 to $91 billion by 2028.

Yup, thanks to deliberate sabotage from the first two years of the Trump Administration, premiums have spiked by ~30% this year and will do so again next year, requiring federal spending on subsidies to increase accordingly.

...Health Insurance Subsidies and Related Spending. CBO reduced projected outlays for health insurance subsidies and related spending by $206 billion (or 23 percent) for the 2018–2027 period as a result of recently enacted legislation. The elimination of the penalty related to the individual health insurance mandate accounts for most of the net reduction in outlays. As a consequence of that elimination, fewer people are expected to enroll in coverage through the marketplaces established under the ACA—which will reduce subsidies provided by the federal government for that coverage—because some people would have chosen to be covered by insurance to avoid paying the penalty and because some people are expected to forgo insurance in response to the resulting higher premiums.

Yes, that's right: In spite of the increase in premium subsidies, the federal government will still save $206 billion over the next decade...mainly because several million people will "choose" to drop their healthcare coverage (although "choose" is an odd choice of phrase since the very same sentence states that this will be IN RESPONSE TO THE HIGHER PREMIUMS), which in turn will substantially lower the amount of tax credits.

...Health Insurance Subsidies and Related Spending. Technical revisions caused estimates of spending for subsidies for coverage purchased through the marketplaces established under the ACA and related spending to be $44 billion higher, on net, over the 2018–2027 period than in CBO’s June baseline. A significant factor contributing to the increase is that the current baseline projections reflect that the entitlement for subsidies for cost-sharing reductions (CSRs) is being funded through higher premiums and larger premium tax credit subsidies rather than through a direct appropriation. Those estimates are preliminary, and CBO will provide further details about them and their implications for future cost estimates in an upcoming report.

The remaining decline in outlays attributable to legislative changes mostly results from the extension of CHIP funding from 2018 through 2027. Because some people who will gain coverage through CHIP would otherwise have received subsidies for coverage purchased through the marketplaces, the extension of CHIP reduces such outlays.

In other words: Instead of assuming that CSR reimbursements have continued to be paid all this time (which they were apparently legally required to do up until now), the CBO has finally started taking the realities of Silver Loading and the Silver Switcharoo into account instead when running their budget numbers for ACA subsidies and the like.

This is huge, because it helps paint a clearer picture of the true costs and savings surrounding CSR appropriation, APTC subsidy amounts, enrollment projections, premium increase projections and so on.

The danger here is that as helpful as Silver Loading may be, it's actually, as Dave Anderson just pointed out, more vulnerable to being killed off via some type of reconciliation bill by Congress if they do end up formally appropriating CSR reimbursement payments after all.

Eliminating the Penalty for Not Having Health Insurance

The Affordable Care Act includes a provision, generally called the individual mandate, that requires most people to have health insurance meeting specified standards and that imposes a penalty on those who do not comply (unless they have an exemption). Under prior law, the size of the penalty was the greater of two quantities: a fixed amount specified in law, or a specified fraction of a household’s income. The tax act reduces the size of the penalty to zero, starting in 2019.

Because the size of the penalty increased with household income, it acted as a tax on income. In addition, it encouraged some people to buy subsidized insurance through the marketplaces established under the Affordable Care Act; the result was that they faced higher marginal tax rates, because those subsidies shrink as income rises. Both of those effects discouraged work, so the elimination of the penalty is projected to increase the labor supply slightly.

In addition, eliminating the penalty is expected to make insurance premiums in the nongroup market, where insurance is purchased individually, higher than they would otherwise have been. Insurers are required to provide coverage to any applicant, and they cannot vary premiums to reflect enrollees’ health status or to limit coverage of preexisting medical conditions. Those features are most attractive to applicants with relatively high expected costs for health care, so eliminating the penalty will tend to reduce insurance coverage less among older and less healthy people than among younger and healthier people, boosting premiums.