Just how much will individual market policies cost next year?

For all the fuss and bother about how much premiums are expected to go up on a percentage basis next year, using percentages can be misleading, since the lower the premium is to begin with, the more dramatic a percentage increase is going to seem relative to where it started.

With that in mind, I've decided to mush together two recent projects of mine: First, my debunking/correction of the May ASPE report which disingenuously claimed that individual market premiums had "increased by 105% since 2013 due to the ACA"; second, my 2018 Rate Hike Project.

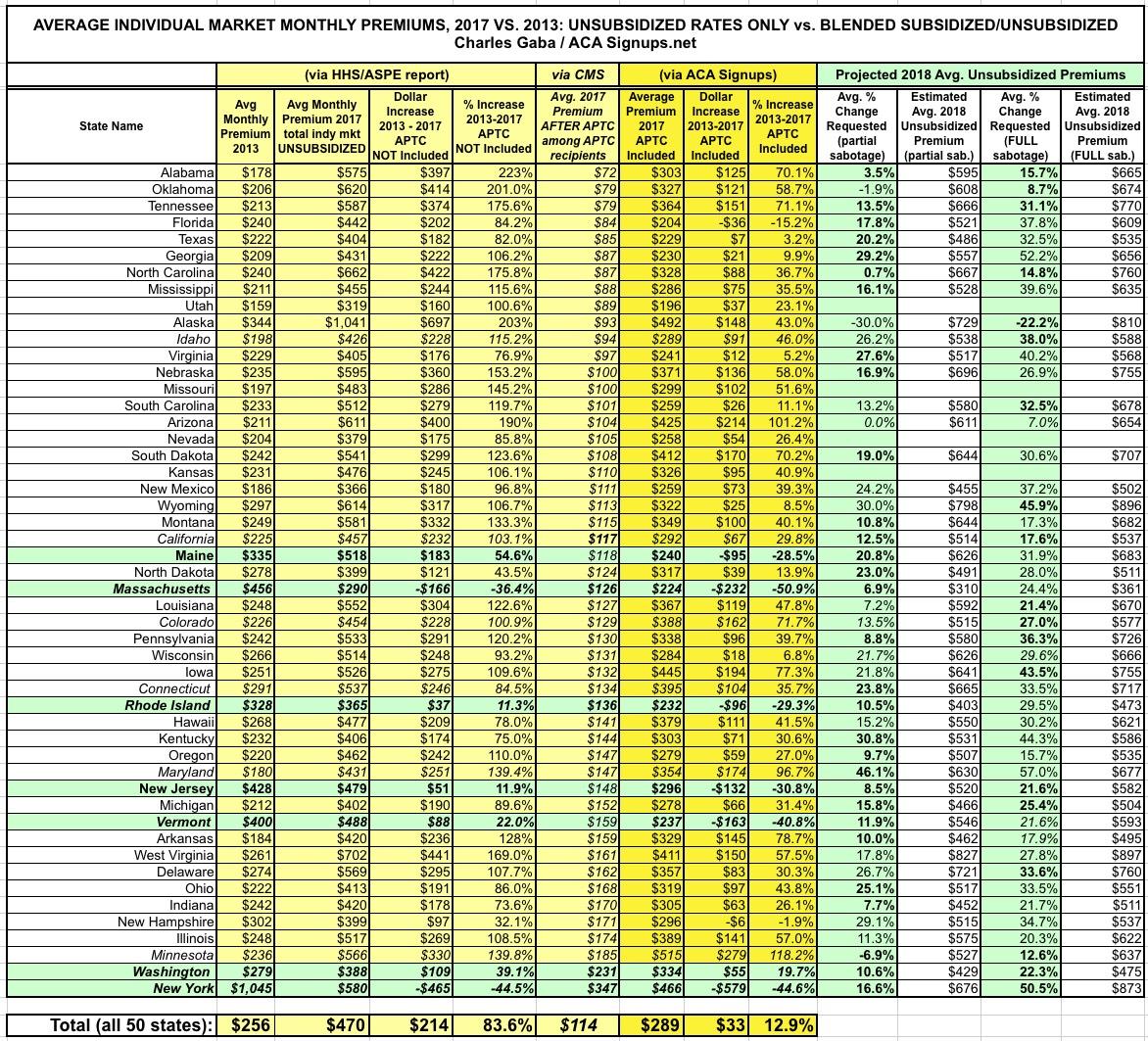

As I noted when I debunked/corrected the ASPE report, not only did it turn out to be somewhat lower when all 50 states were included (84%, not 105%), but the ASPE report completely ignores both the financial assistance provided to roughly half the market and, just as importantly, blows off the apples to oranges mismatch between the numbers, because only a handful of states had guaranteed issue laws in 2013, and only one (NY) had a community rating law. Having said that, as long as you keep those caveats in mind, the (corrected) ASPE report does provide a good baseline for figuring out what the 2018 premiums are likely to be.

By merging the spreadsheets for these projects together, I've come up with a rough idea of what I expect to see in terms of unsubsidized, full-price premiums for individual ACA policies this November. I'm using a median instead of a weighted average this time around because I expect high variables in terms of the number of people who enroll in each state compared to 2017 (unfortunately, I still don't have 2018 data for several states, and I don't have the 2017 dollar average for DC to compare against).

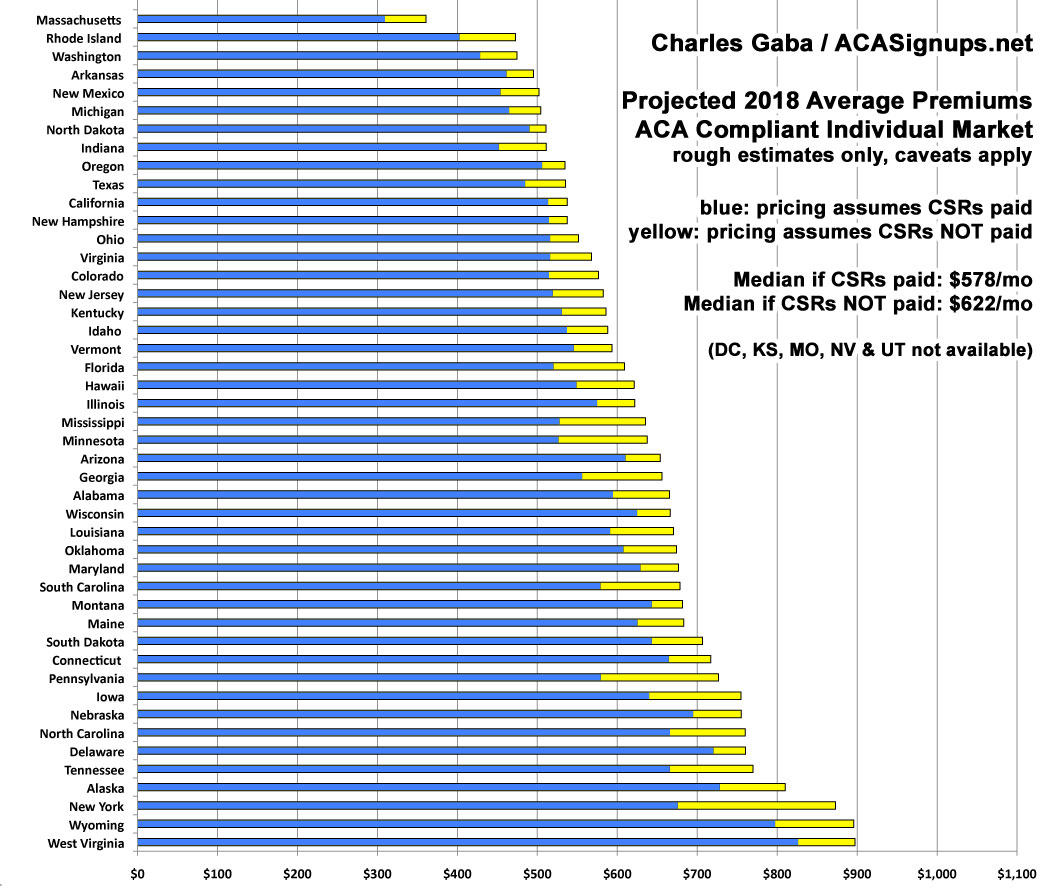

I've ordered the states from lowest to highest based on the assumption that CSR reimbursements aren't made next year ("full sabotage effect"). The blue sections are my best estimates for each state assuming CSRs are paid; the yellow sections represent how much of the average premiums are due to "CSR padding" by the carriers.

Keep in mind that even if CSRs are paid (blue), many carriers have still padded their rates to some degree to account for the individual mandate not being enforced ("partial sabotage"). Unfortnately, I don't have a hard number for that for individual states, but my guess is that it's responsible for around $23/month per person nationally, or roughly 4% of the total premiums.

As always, there are plenty of other major caveats here:

- The projected average increases assume that every single person renews the exact same policy they're enrolled in today (which is never the case; millions switch to different plans every year, either out of necessity because their current carrier drops out or voluntarily due to finding a better deal with a different metal level or carrier)

- The averages assume that all rate changes are finalized exactly as they were when I compiled the requests for that state (there's bound to be some more last-minute revisions, and of course state regulators often change the requested rate changes)

- There's also bound to be a few more last-minute drop-outs and/or coverage expansions in some counties/states, as demonstrated by last week's announcement that Centene will cover the 14 "bare counties" in Nevada

- For the CSR TrumpTax, the state averages assume that the CSR reimbursement costs is spread out across all metal levels, but the reality is that most states will likely load all of the CSR costs onto Silver plans only. This means that while the average premiums are probably fairly close, the median price could be quite different.

...and so on. With all that in mind, here you go:

As far as I can figure, average unsubsidized (full price) indy market rates will range from around $360/month in Massachusetts to $897/month in West Virginia (if CSRs aren't paid). Between significant hikes in WV and Wyoming and the successful reinsurance program being implemented in Alaska, this means that for the first time in forever, AK won't have the most expensive average individual market insurance rates in the country (they should come in at either the 3rd or 4th highest depending on whether CSR payments are made or not).

Oh, just for the heck of it, here's what NON-ACA compliant average premiums looked like in 2013. Again, remember that only a handful of states required guaranteed issue, only one required community rating, and I don't think all 10 of the ACA's mandatory Essential Health Benefits (EHB) were required in any states, though some likely required some of them:

UPDATE: Another bonus graph: Just for the heck of it, here's the actual average 2017 premiums sorted by state lowest to highest based on unsubsidized premiums. The light green bars are the statewide average premiums paid by subsidized enrollees (those on the exchanges receiving APTC assistance).

The statewide subsidized averages come from the official CMS report except for California, New York and Washington State; the averages for those come from reports issued by their respective state-based exchanges: CA / NY / WA

As you can see, unsubsidized residents of Alaska are the worst off by far this year...but subsidized AK residents are among the best off (subsidized AK premiums average the 10th lowest in the country). New York residents, meanwhile, have the highest subsidized rates in the country ($347/mo), most likely due to so many low-end subsidized enrollees being siphoned off by the state's BHP program (Minnesota, the only other state w/BHP in place, is the 3rd highest for subsidized enrollees at $185/mo, although Washington State, oddly, is the 2nd highest after subsidies ($231/mo)...not sure what that's about):