UPDATE: RED ALERT: The Pile of #BCRAP 2.0 is out...

Here it is in all it's glory gory...

Note: The following notes are mostly cribbed from Larry Levitt of the Kaiser Family Foundation via Twitter, plus a few from other folks or tidbits I dig up myself...

- Still cuts off tax credits at 350% FPL instead of the ACA's 400% FPL. Pass.

- Still bases tax credits on a 58% AV Bronze plan instead of the ACA's 70% AV Silver plan. Pass.

- Throws another $70 billion onto the "state stabilization fund" pile for a total of $132 billion

- Throws another $70 billion on to "offset costs for high-risk patients" (I presume this means reinsurance?)

- Yes, it includes the Cruz/Lee "Separate but Unequal" amendment; carriers could indeed go back to offering unregulated plans: No guaranteed issue, no community rating, no essential benefits, as long as they also offer a fully ACA-compliant plan

- Tax credits couldn't be used for the unregulated plans, nor would they be attached to the risk adjustment program. In other words: Segregated risk pools

- Catastrophic plans would be "counted" the same as other plans (ie, tax credits could be used for them), but they'd amount to the same as Bronze plans now anyway

- It includes a #BakedAlaska giveaway to win over Lisa Murkowski...1% of funds have to go to "any state where premiums are 75% higher than average" (i.e., Alaska)

via Topher Spiro of the Center for American Progress (sourced by Kimberly Leonard of the Washington Examiner):

- Nevada Sen. Dean Heller says "fundamentally, they haven't changed the bill"

- "Despite adding $430B to the bill, they're replacing at most 27% of the $1.2 trillion in cuts to subsidies

- It still slashes Medicaid by more than $700 billion over the next decade, by over $2 trillion after that

- It still gives the rich $100 billion in tax shelters

- It still screws over those with pre-existing conditions

- Up to 27 million in employer plans could still face annual/lifetime limits

- It still screws older people with middle incomes

- The Cruz/Lee amendment still "unleashes a death spiral for people with pre-existing conditions"

More to come...

via Margot Sanger-Katz of the New York Times:

- It's still called the Better Care Reconciliation Act plan, or #BCRAP. Fair enough.

- They're throwing in $45 billion in for opioid treatment, plus another $100 million for additiction/pain research

- The Cruz-Lee amendment is complicated

- $70 billion is a direct payout to the insurance carriers for high-cost enrollees, but how it's actually used is pretty vague (left up to Tom Price, oh goodie...)

- Carriers qualify for some of that $70B by offering at least one Gold, Silver and "Benchmark Plan" (ie, watered-down Bronze) in a rating area)

- Carriers could also offer non-compliant, off-exchange plans where there's practically no rules at all (the Cruz-Lee amendment)

Phillip Klein of the Washington Examiner has a list of all the protections the Cruz-Lee amendment would allow carriers to strip from off-exchange plans:

- METAL TIER AV REQUIREMENTS

- COMMUNITY RATING

- GUARANTEED ISSUE

- PROHIBITION ON PRE-EX EXCLUSIONS

- PROHIBITION ON DISCRIMINATION BY HEALTH STATUS

- ESSENTIAL HEALTH BENEFIT REQUIREMENTS

- LIMITATION ON WAITING PERIODS

- [PREVENTIVE SERVICES REQUIRMENT

- MEDICAL LOSS RATIO

The source notes that the bill does not waive the requirement that each state have a single risk pool, meaning the exempted plans and the plans that have to meet Obamacare requirements will be part of the same risk pool.

NOTE: There seems to be some disagreement about this last point.

Honestly, I don't understand how they possibly could be kept as part of the same risk pool.

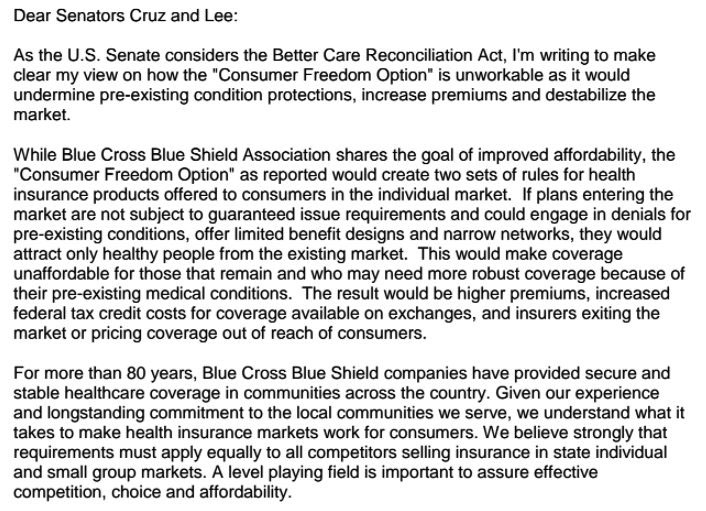

I should note that America's Health Insurance Plans and the Blue Cross Blue Shield Association, the two largest insurance trade groups, are appalled by the Cruz-Lee amendment:

- Opening up non-compliant plans to new purchasers would create greater instability in the marketplace, according to non-partisan experts such as the American Academy of Actuaries. A key contributing factor to the current risk pool instability in certain states was the transitional policy, which allowed individuals to renew non-compliant plans. That is because it segments the market—allowing healthier individuals to remain in their existing medicallyunderwritten plans while depriving the new Exchange markets of younger and/or healthier individuals necessary for risk pool stability. Actuaries estimated that states adopting the transitional policy experienced 10% higher rates for the Exchange market than states that did not elect this policy. Proposals to reopen non-compliant plans would create even greater instability by driving adverse selection and an acceleration of the downward spiral in the Exchange markets of higher premiums and lower enrollment.

- The requirement that insurers also participate in the Exchange market would not preserve protections for those with higher-than-average health care costs. Such protections—such as guaranteed issue, community rating, and banning pre-existing conditions—only work if there is broad participation to assure stable markets and affordable premiums. By bifurcating risk pools and creating separate parallel market—where healthy individuals can select underwritten plans at a preferred rate—this proposal would cause lower enrollment in Exchange markets of the younger and heathier individuals necessary for a stable insurance market. As a result, the Exchange markets would basically function like a high-risk pool—with unaffordable premiums for those with pre-existing conditions. As premiums rose, only those with the highest health needs and expenses would remain thereby accelerating the decline in the Exchange market.

- Including both “compliant” and “non-compliant” plans in a single risk pool would be infeasible and not solve the problems of an unlevel playing field. For a single risk pool to work, all health plans must provide coverage for the same benefit categories – for example, under a common federal benefit “floor.” However, if “skinnier” non-compliant plans could exclude coverage of certain benefit categories (e.g., prescription drugs or maternity) while compliant plans must cover all benefit categories, it would be very challenging to combine those products into a single risk pool. Moreover, important premium stabilization programs such as risk adjustment that compensate plans enrolling higher risk individuals and protect against adverse selection would become unworkable and unsustainable because of likely differences in the benefit categories, health status and costs of enrollees in compliant versus non-compliant plans.

BCBSA (no link, screen shot from Margot Sanger-Katz's twitter feed):

This one strikes me as being pretty significant:

Non-compliant plans don't count as continuous coverage. So, people in them would face a 6-month waiting period to enroll in compliant plans.

— Larry Levitt (@larry_levitt) July 13, 2017

Assuming this is accurate, that's huge.

Louise Norris points out that this is actually pretty much the situation for many people today, who are either uninsured at all, enrolled in Healthcare Sharing Ministries, short-term plans and so forth who have to wait up to 9 months to enroll during the Open Enrollment Period. HOWEVER, without the individual mandate in place and with BCRAP allowing health savings account funding to go towards noncompliant policies, a lot more people would be enrolled in them and find themselves screwed when things go south.

In addition, right now there are basically two coverage categories: Comprehensive...and everything else. Obviously some people will always be clueless about these things, but for the most part, people generally understand that they're either in a policy which has to cover just about everything...or they aren't. They may take the risk, but it's a binary choice.

Under BCRAP, there would basically be a third (or even fourth, or fifth?) tier of policies: Junk plans, "kinda-sorta" decent plans and comprehensive plans. And I guarantee you that people in the "kinda-sorta" decent plans are gonna be a lot less likely to grasp that if they get hit with something nasty, it won't be covered and they'll have to wait at least 6 months to switch to a full policy.

UPDATE: Oh, this is fun: It looks like rescission would also be back.

As my friend Laura Packard noted, the moment you bring back underwriting, you're pretty much guaranteed to bring back rescission. Remember that?

Rescission is the term used when a health insurance policy is canceled retroactively by an insurance company. They can only do this legally under the Affordable Care Act if the patient has committed fraud or if the patient lied deliberately about a material fact in a way prohibited in the terms of the health insurance plan.

In other cases, it is illegal for the insurance company to do a rescission.

In a rescission, the coverage is removed from the beginning of the policy, leaving the patient liable for their costs incurred. Generally, they are refunded the amount of their premiums.

...Rescissions are prohibited (except for fraud and intentional misrepresentation of facts) under the Affordable Care Act by federal regulation 45 CFR 147.128: Rules Regarding Rescissions. It took effect for plan years beginning on or after September 23, 2010.

...Rescissions were often discussed in the development of health care reform, with many practices coming to light. Health insurance companies, in an effort to contain costs, would decide to drop coverage for an insured patient whose care was more expensive than they want to pay.

Once the patient became sick, the insurer would carefully review his or her original application for coverage, find (what they consider to be) a discrepancy, then claim the insured patient lied on his or her application. That gave the insurer legal permission to drop the claim. Some insurance companies developed software the triggered automatic fraud investigations for patients who received a diagnosis for a condition that would become high cost.

Problems developed for patients who have not intentionally lied on their applications, and for whom the insurer found discrepancies that didn't relate. For example, in a case in Texas, a woman's coverage was dropped after she developed breast cancer. The insurer rescinded her coverage by claiming she failed to disclose a visit to a dermatologist for acne, which was clearly unrelated.

Further problems developed for patients who paid premiums for a period time but then had their coverage dropped after they got sick. The insurer didn't bother reviewing the policy until after the person has been paying into the system. They collected money, but then would not provide their promised services. This "drop when you get sick" practice is now subject to the no-rescission clause of the Affordable Care Act.

UPDATE: Oh, more fun...the Congressional Exemption is back (again)!!

Senate Republicans included a provision that exempts members of Congress and their staff from part of their latest health care plan.

This exemption could have the effect of ensuring that members of Congress have coverage for a wider array of benefits than other Americans who purchase their own coverage.

A Senate Republican aide confirmed that the exemption existed but was unable to comment as to the specific effect it would have. The aide said it was included to ensure that the bill hewed to the chamber’s strict reconciliation rules that limit the policies this health bill can include.

The exemption is similar to the one that existed in the House health bill. After Vox reported on its existence, the House voted to close the loophole — and the Senate aide expected their chamber to follow the same path.

The revised Senate health bill draft released Thursday lets health insurers offer plans that do not cover the Affordable Care Act’s essential health benefits, which requires insurers to include a wide array of benefits such as maternity care and mental health services.

Insurers can offer plans without these benefits — unless they’re selling coverage to members of Congress and their staff, who are required to buy coverage on the health law marketplaces. The exemption says this part of the law still applies to any plans sold to Congress.