UPDATE: Ted Cruz comes up with the stupidest BCRAP imaginable.

So the Big News this week is that Ted Cruz has come up with what he thinks is a brilliant solution to the GOP Senate's BCRAP problem:

His proposal, which he’s circulating to his colleagues on typed handouts, wouldn’t explicitly create and fund the special insurance markets, as the House bill did. Instead, insurance experts said, it would create a sort of de facto high risk pool, by encouraging customers with health problems to buy insurance in one market and those without illnesses to buy it in another.

...There is no public legislative language yet, but here’s how Mr. Cruz’s plan appears to work, based on his handout and statements: Any company that wanted to sell health insurance would be required to offer one plan that adhered to all the Obamacare rules, including its requirement that every customer be charged the same price. People would be eligible for government subsidies to help buy such plans, up to a certain level of income. But the companies would also be free to offer any other type of insurance they wanted, freed from Obamacare’s rules.

People who bought the Obamacare-compliant plans would be eligible for subsidies that limit their cost, as long as their income was less than about $42,000 per year for a single person. And those who earn more — or wish to buy skimpier, cheaper plans without all the rules — may also get a discount on those premiums, in the form of pretax health savings accounts, which the legislation would let them use to buy insurance.

As Mr. Cruz told Dylan Scott of Vox.com, “You would likely see some market segmentation,” meaning that healthy and sick customers would probably pick different kinds of insurance. Healthier, wealthier people would tend to gravitate toward the skimpy plans. Sicker people would opt for the compliant plans, which cover more benefits. Even though the compliant plans wouldn’t technically be more expensive for the sick, those choices would mean that mostly sick people would buy them, and the prices could get extremely high.

In other words, the individual market, which is already partly at risk of turning into a de facto high risk pool under the ACA, would be deliberately split into high- and low-risk pools by design.

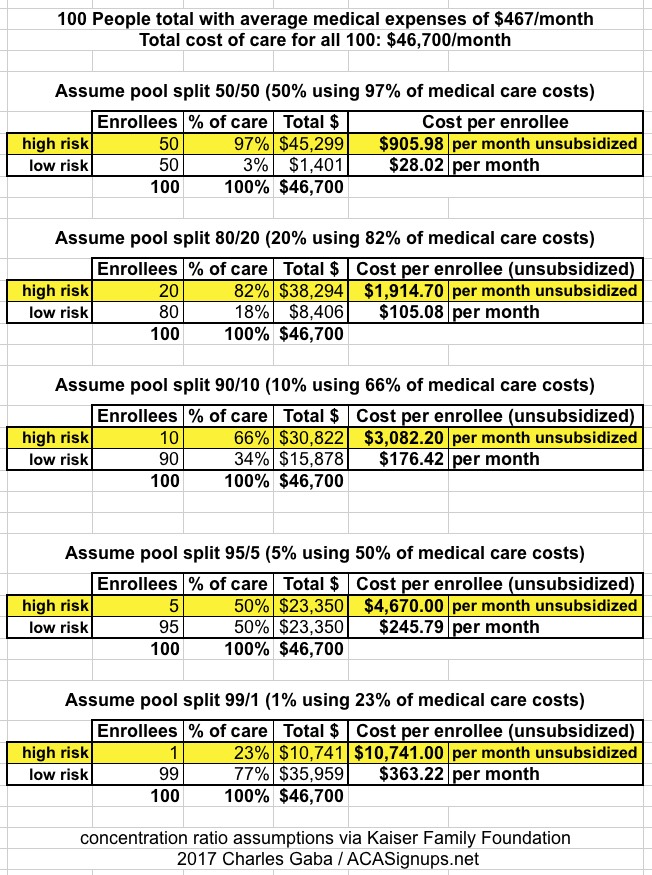

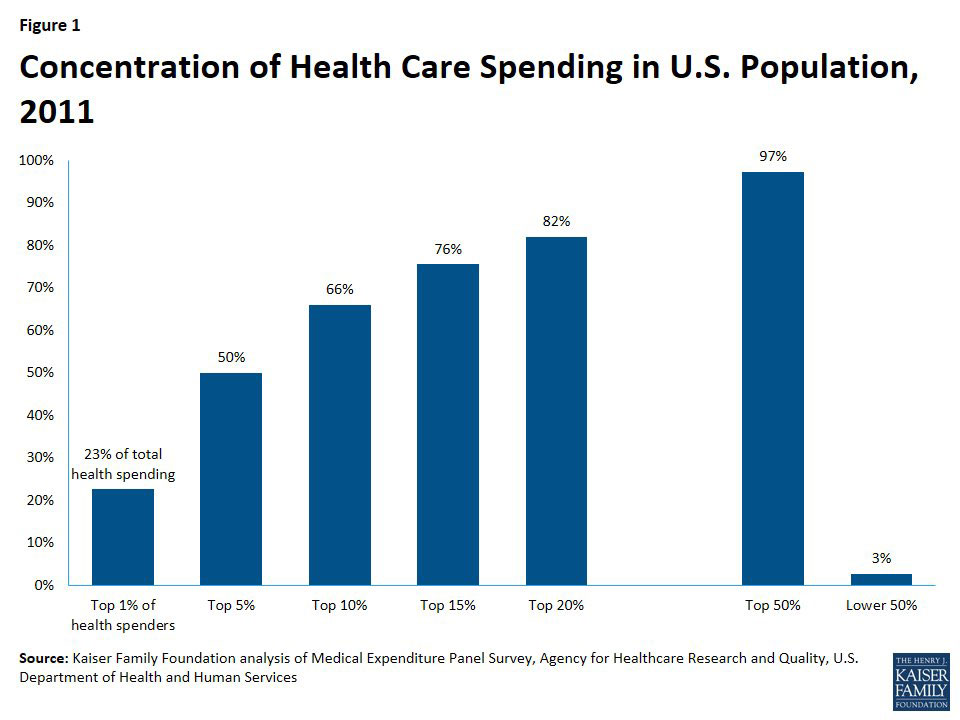

How ugly would this get? Well, according to this study by the Kaiser Family Foundation, 5% of the general population accounts for fully 50% of total healthcare spending, with the other 95% costing the other 50%:

Meanwhile, according to the official numbers from CMS (and this is Trump's CMS, I should remind you), as of today, unsubsidized/full price individual market plan premiums currently average around $467 per month, or $5,604/year, which already stings a bit for most people if they aren't receiving financial assistance. Remember, that's basically for a Silver ACA-style plan.

Let's say that you have 100 people currently using an average of $467/month in healthcare services (for the moment, I'm ignoring profit margins and the like). That's a total of $46,700 per month for all 100 people.

Now, let's split those 100 people into two groups of 50: Half are higher risk and go for the ACA-compliant plan, the other half are lower risk and go for the "Cruz plan". What would they have to pay?

Well, the high-risk half account for 97% of all medical expenses ($45,300), while the low risk half only eat up 3% ($1,400). Based on that, the low-risk half would only have to pay around $28/month, which is awesome for them!

Meanwhile, the high-risk half would have to pay $906/month...nearly double what they are today. Ouch!

Now, the good news is that, like the ACA, many of those folks would receive tax credits to cover a large chunk of their premiums. For instance, a 40-year old single adult earning $42,000/year would only have to pay 12.5% of their income...about $5,250/year, or $437/month. (thanks to Louise Norris for the correction)

UPDATE: Oh, wait...that's what they'd pay for the median Bronze plan under BCRAP, not for a benchmark Silver plan...the silver plan would actually cost more. How much more? Well, according to HealthPocket, the average Bronze plan this year runs around $350/mo for a 40-year old. However, in the "hi/low risk pool scenario", that same Bronze plan would presumably shoot up to something like $680/month for the high risk pool market segment.

So, they'd have to pay $5,250 for a Bronze plan (after receiving $330/mo in tax credits...)

...and for the Silver plan, they'd have to pay $6,912/year after subtracting the $330/month in assistance.

The bad news is that if that same 40-year old single adult earns more than $42,330/year (350% of the Federal Poverty Level) would have to pay the full $906/month, or $10,872/year. That'd be 26% of their gross income.

OK, but what happens if we assume an 80/20 split? That is, 80% of those 100 people choose the cheap/BCRA plan, while the other 20% (who eat up 82% of all medical expenses) choose the fully ACA-compliant policy?

In that case, it looks like this:

80 people out of 100 are only paying $105/month, which is still quite a bargain...but the other 20 are now paying $1,915/month at full price, or nearly $23,000/year. Again, the tax credits would cover most of that for anyone below 350% FPL, but anyone above that income threshold is screwed. That 40-year old exaple above would now have to pay 55% of his total gross income.

OK, what about a 90/10 split? According to Kaiser, 10% of enrollees typically use up about 66% of medical expenses. How does that play out?

You now have 90% of the market paying $176/month, which is still pretty reasonable...but the other 10% are hit for nearly $3,100 per month. The tax credits take care of most of that below 350%...but over that threshold, poor Mr. 40-year old is paying $37,000/year. On a $43,000/year salary. Kind of tight.

Finally, just for completeness sake, what about a 95/5 and 99/1 split?

Yeah...somehow I don't see that working out very well.

Of course, the GOP could resolve this problem by removing that 350% FPL cap and ensuring that no one pays more than a low percentage of their total income in premiums for a comprehensive plan no matter what...which, of course, is exactly what I (and Hillary Clinton, and the Urban Institute) have been proposing under the ACA to begin with.

I don't see the GOP going that route.

It's important to remember that the dollar figures above don't include deductibles or co-pays; remember, that $467/mo is for a decent Silver plan, which only covers about 70% of medical costs.

Also bear in mind that the other major problem with this scenario is that you never know who's going to turn out to have a "high risk" medical condition. Any one of the 50%, 80%, 90% or 99% who choose to enroll in the cheap plan which doesn't cover the ACA's Essential Health Benefits could suddenly find themselve diagnosed with cancer, diabetes, a problematic pregnancy or whatever, and now they're screwed because their "cheap" plan doesn't cover the very healthcare needs that they find themselves requiring.

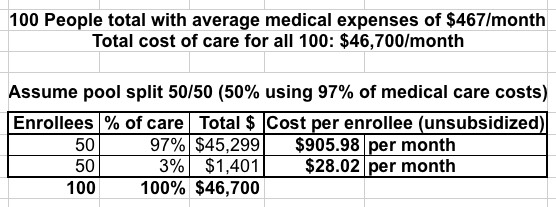

Meanwhile, here's all 5 breakout scenarios in a single graphic, suitable for sharing: