2018 Rate Hikes: Virginia (early look)

UPDATE: As I've been warning for months, at least one of VA's carriers has openly stated that perhaps 40% of their requested rate hike is due specifically to concerns about the Trump administration & the GOP's ongoing sowing of confusion and outright sabotage of the ACA and the individual market.

A couple of weeks ago I noted that Virginia is one of the first states to post their initial premium rate hike filings. At the time, they hadn't posted the actual filings but at least listed the insurance carriers which were planning on participating in the individual and small group markets next year, both on and off the ACA exchange:

- Aetna Health: Individual

- CareFirst Blue Choice: Individual / Sm. Group

- Cigna: Individual

- GHMSI: Individual / Sm. Group

- HealthKeepers: Individual

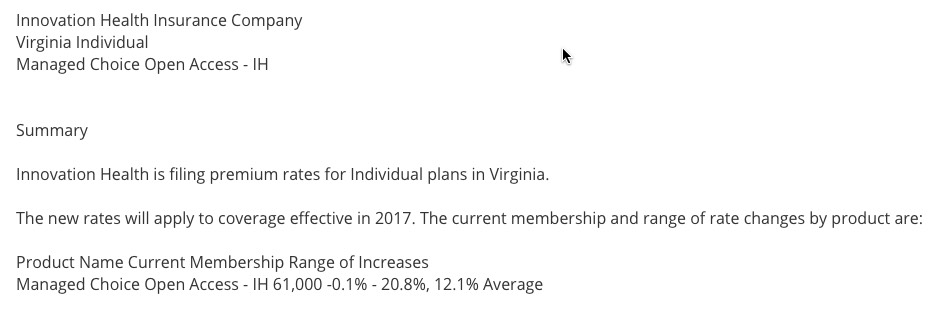

- Innovation Health Insurance: Individual

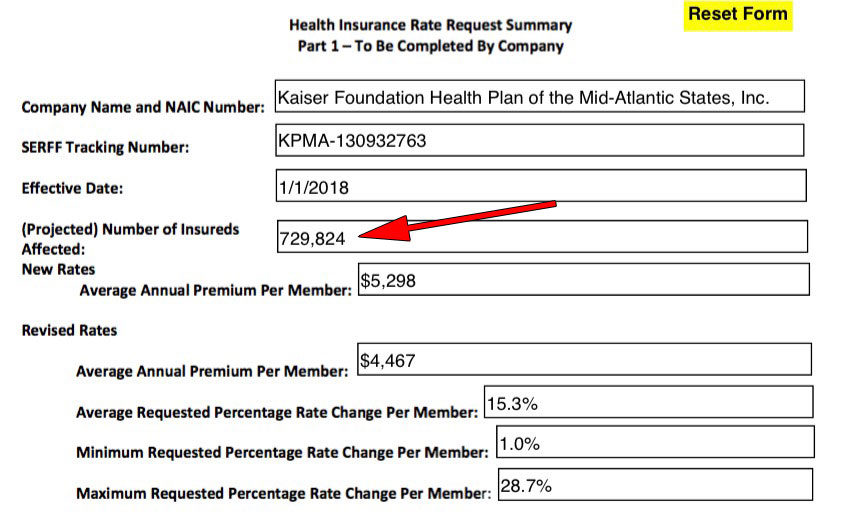

- Kaiser: Individual / Sm. Group

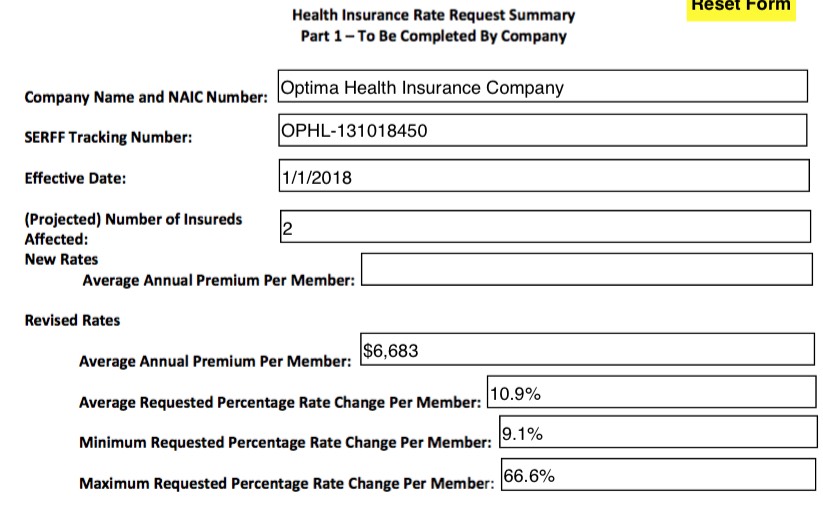

- Optima Health: Individual

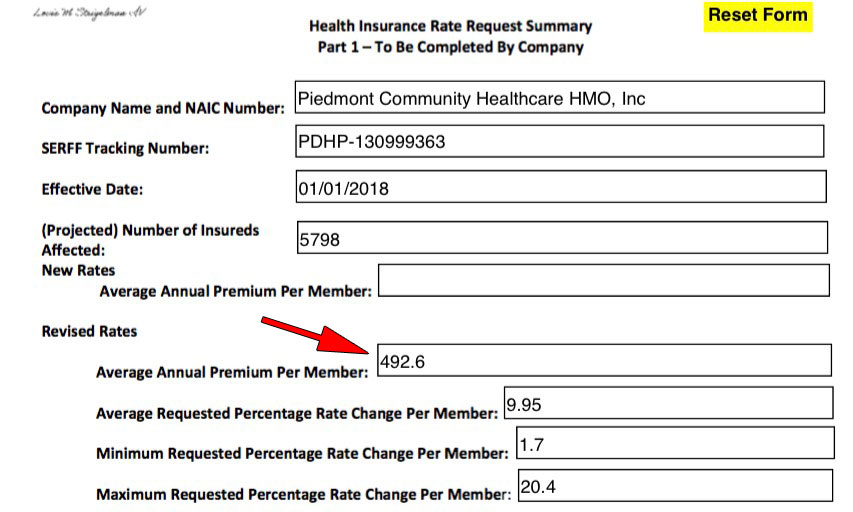

- Piedmont Community HMO: Individual

Shortly after that, however, Aetna announced that they're dropping out of the Virginia ACA exchange. According to Dan Mangan of CNBC, they "will not sell Obamacare plans in Virginia" which suggests that they're dropping off the entire individual market in VA, both on and off exchange. The best estimate I have of how many indy market enrollees Aetna has in VA is from last year's filing, when they had around 61,000 effectuated off-exchange enrollees. I'm assuming that number is somewhat higher today, since it would include on-exchange enrollees as well, but that's the best I can do for now. In addition, it appears that, as M E notes in the comments, "Innovation Health" is apparently owned by Aetna anyway, and in fact that's the only listing for 2017 over at RateReview.HealthCare.Gov:

That leaves 8 carriers (but 9 filings...Optima has separate ones for HMOs and PPOs). There's some important caveats to keep in mind:

- First: I've accounted for 356,000 people projected to be enrolled by the end of 2017. Remember that there's usually some net attrition between the end of Open Enrollment and the end of the year...around 25% the past few years. Therefore, the current enrollment total is likely around 475,000. My best estimate of VA's total individual market enrollment as of March is around 546,000, so either I overestimated it or there's another 70,000 or so unaccounted for. It's likely that Aetna/Innovation's current enrollment total is higher than 61,000, which could account for some/all of that.

- Second: Most of the filing numbers looked about right, but when I looked at Kaiser Permanente's, it was a whopping 729,000 people, which seemed nuts. I called them up and they clarified that this is the number of member months, not covered lives. In other words, I have to divide that number by 12 to get the actual estimate of how many people they expect to be covered at the end of the year. This is confusing since the field label clearly states "Projected Number of Insureds Affected".

- When I called the Virginia DOI, they confirmed that yes, the number in that field is supposed to be actual covered lives, not member months; Kaiser made a mistake.

OK, so it was easy to correct that error (60,818 covered lives makes far more sense), but it also means...what if there are other major errors in the filing forms?

This concern was made worse by Piedmont's filing. Their covered lives number seems right (5,798)...but look at their "Average Annual Premium per Member" of only $492.60?? Remember, this is the unsubsidized price. I find it hard to believe this is the annual total...either there's a missing number or this is the monthly average premium.

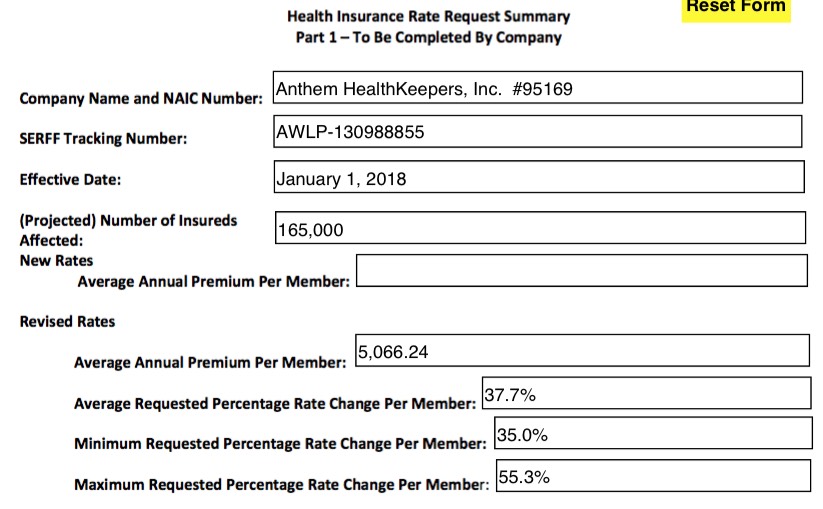

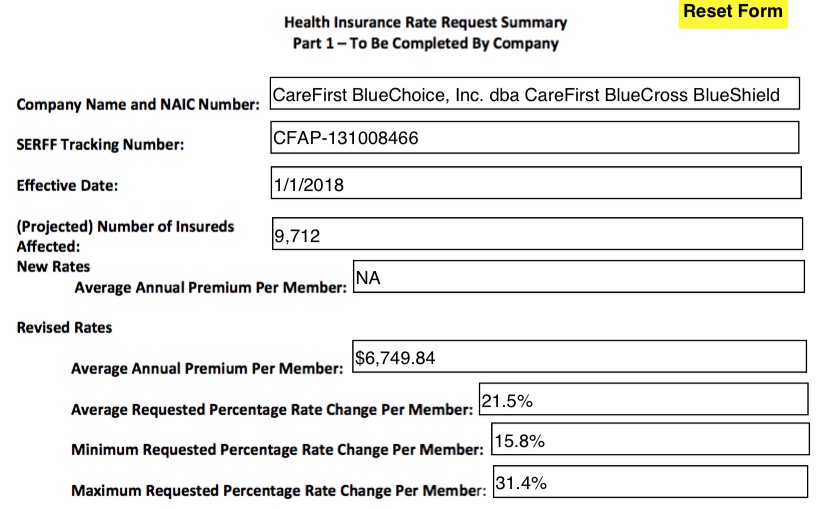

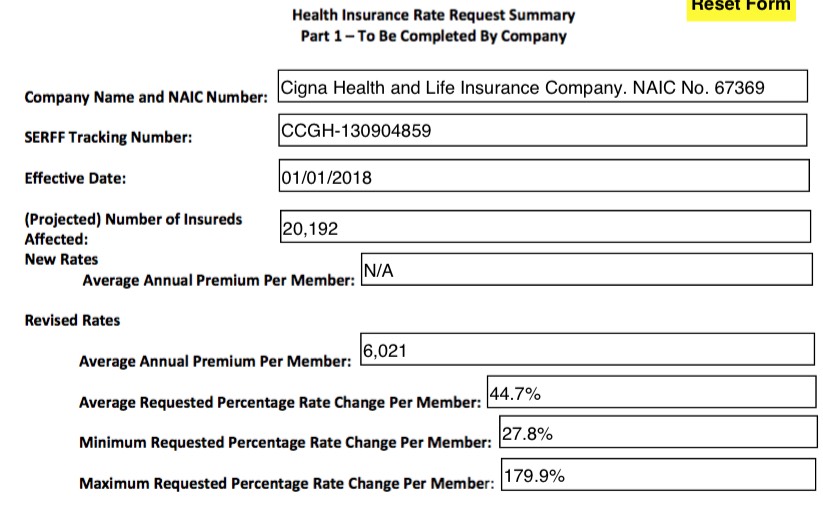

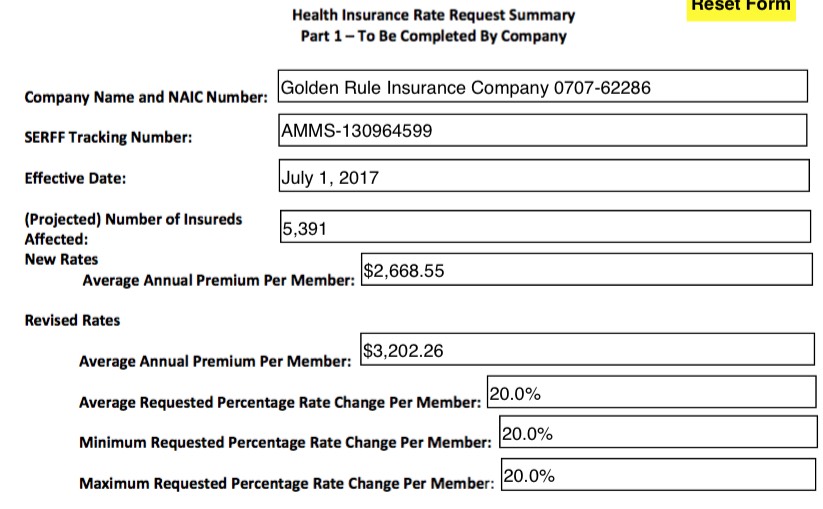

In any event, assuming all of the numbers below are accurate and that I'm not missing any major data points, it looks to me as though Virginia insurance carriers are initially requesting an unsubsidized, full-price, weighted average rate hike of roughly 30.6% on the individual market.

I've also compiled the small group market rate hike requests for Virginia. I can't seem to find either CareFirst Blue Choice or Kaiser Permanents, so the final weighted average may be different than that shown below, but this is what I've been able to put together so far. 10.5% is actually a bit higher than is typical for the small group market, although it's still obviously well below the individual market requests.