Minnesota: *Approved* 2016 avg. rate hikes are ugly, but some good news as well...

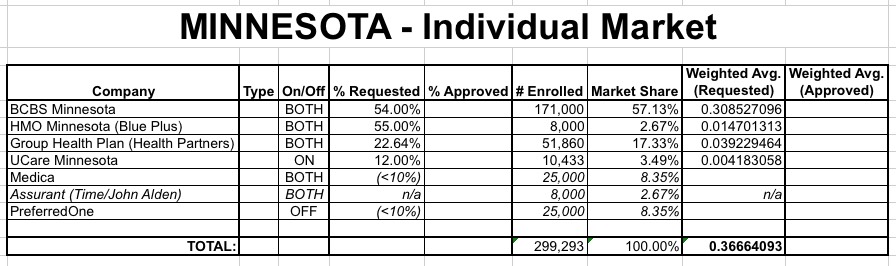

When I crunched the numbers for Minnesota's requested rate hikes, the results were pretty scary-looking; based on partial data, I estimated that the weighted average was something like a 37% overall requested increase:

Note that there were several crucial missing numbers: I didn't know the actual market share for several companies (I made a rough guess based on an estimate of the total missing enrollments), nor did I know what the requested increases were for Medica or PreferredOne, other than thinking that both were under 10%.

Just moments ago, however, the Minnesota Insurance Commissioner released the approved rate changes...and it's admittedly not pretty:

Individual Market

The individual market for health insurance is available for Minnesotans who do not have access to employer-based coverage and are not eligible for coverage through public programs like Medicare, Medicaid and MinnesotaCare. (When applying to purchase an insurance policy through MNsure, eligibility for Medicaid or MinnesotaCare is automatically determined.) About 5.5 percent of all Minnesotans purchase their health insurance on the individual market.

Note: Minnesota's total population is 5.457 million people, so their individual market is right around 300,000. Minnesota didn't allow "transitional" plans, so that just leaves "grandfathered" policies.

I don't know exactly how many "grandfathered" enrollees are left in Minnesota, but data from other states suggest that it's likely only around 5% of the individual market enrollees by now, which would be around 15,000. Subtract those and you're left with an ACA-compliant market of roughly 285,000 people (also about 15K fewer than I originally estimated above). This number will become important later.

Eight companies are approved to sell health insurance plans to Minnesotans in 2016 in the individual market.

- Blue Cross and Blue Shield of Minnesota

- Blue Plus

- Group Health, Inc.

- HealthPartners Insurance Company

- Medica Health Plans of Wisconsin

- Medica Insurance Company

- PreferredOne Insurance Company

- UCare

It's important to remember that not all 8 of these companies are participating in the ACA marketplace (ie, MNsure); most of them sell policies off-exchange as well, and PreferredOne, and possibly a couple of others, are only selling off-exchange this year.

Consumers will be able to purchase individual market insurance plans either through MNsure or directly from the insurance companies or insurance broker/agents.

The final rate increases for 2016 plans offered by companies in Minnesota’s individual market range from 14 percent to 49 percent. Each insurance company’s final average rate increase is listed in the table on page 7.

Many Minnesotans who purchase individual policies through MNsure will be eligible for federal tax credits that will lower their monthly premiums and help offset the impact of rate increases. Eligibility for the tax credits is automatically determined when applying to purchase a plan through MNsure.

The APTC (premium tax credits) and CSR (cost sharing reduction) factor is also an important point below.

Some key factors that insurance companies cite for their rate increases in Minnesota’s individual market include:

- A higher percentage of less healthy, more costly enrollees than expected entered the individual market.

- Insurers incurred significantly higher claims than expected for medical care and prescription drugs, especially high-cost specialty drugs.

- Minnesota has a relatively small individual market compared to other states, resulting in a smaller risk pool across which insurers can spread their costs.

In 2014 and so far in 2015, Minnesota insurers in the individual market have paid more in claims than they have received in income from premiums. Although insurance companies are not permitted to charge rates in 2016 to recover costs from previous years, their prior claims experience in the individual market informs their expectations of what costs they may incur in 2016.

This last bold-faced point is an important one to remember for all states and all exchanges: If an insurance carrier got hosed last year due to misjudging the market, they are not allowed to make up for it this year. In other words, if Blue Cross underpriced in 2014 and lost $50 million, they are (supposedly) not legally allowed to jack up their 2015 prices by an extra $50M to make up the difference. Rate hikes are only allowed when justified by actual increased operational and healthcare cost increases.

Obviously one can question whether this is what's actually happening in practice, but that's how it's supposed to work.

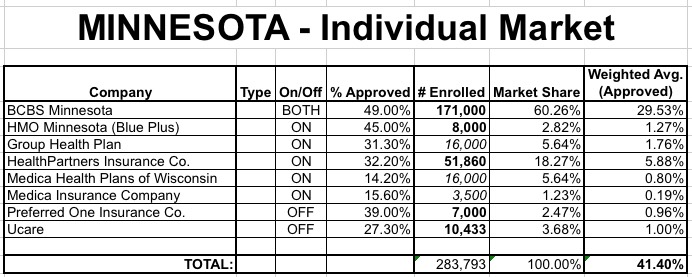

Anyway, that brings us to the actual rate hikes. Here's what the approved rate hikes look like, with some important notes after the table:

Ouch. While several companies did have their requested increases lowered (BCBS was cut from 54% to 49%, for instance), overall the weighted average is higher than the requested rates, for two reasons:

- First, it looks like both Group Health/HealthPartners as well as Medica had their requested hikes increased (from 22% to 32% and from <10% to 15% respectively)

- Second, I made a huge mistake with PreferredOne. I don't recall seeing them at HC.gov's Rate Review website, which meant that they had asked for an increase of less than 10%. In actuality, today they're there with substantial increase requests...and were approved for a whopping 39% hike. Ouch.

I'm still not certain about a couple of numbers, though. The actual enrollment numbers for Group Health Plan and both divisions of Medica are unknown to me (I'm a little confused, because I thought Group Health Plan and HealthPartners were the same company, but could be wrong). Since the total ACA-compliant market is around 285K, I've flled in the gaps as best as I could (16K, 16K and 3,500), but these numbers might be divided up differently.

However, that doesn't matter. The best-case scenario would involve all 35,500 of the missing enrollees being listed under Medica Health Plans of Wisconsin...but even that wold only reduce the overall rate hike by around 1% or so.

As a result, it looks like Minnesota's overall, weighted average rate increase for 2016 will be roughly 41.4%...assuming no one shops around this fall.

More Minnesotans than Ever Before will Qualify for Advanced Premium Tax Credits in 2016

2016 rate increases mean thousands more Minnesotans could receive tax credits when buying health insurance through MNsureST. PAUL, Minn.—Highlighting the importance of advanced premium tax credits for Minnesotans purchasing health insurance, MNsure interim CEO Allison O’Toole joined Minnesota Department of Commerce Commissioner Mike Rothman today as the final 2016 rates were released for the individual and small group health insurance markets.

MNsure, the state’s health insurance marketplace, is responsible for the administration of tax credits that help off-set premium increases and help make insurance more affordable and is the only place Minnesotans can take advantage of the cost-savings.

The rate announcement comes in advance of the MNsure open enrollment period, which begins November 1 and ends January 31, 2016, allowing time for Minnesotans to determine the insurance options that best fit their individual health and financial needs for the next year.

“The Affordable Care Act was passed and MNsure created in large part to promote market transparency and provide financial help – like advanced premium tax credits – to help make insurance coverage more affordable,” said MNsure Interim CEO Allison O’Toole. “Today’s rate release gives consumers needed time to evaluate their options ahead of the November 1 open enrollment period and shows how important tax credits, available only through MNsure, are to mitigating large premium increases.”

O’Toole highlighted several examples of how these tax credits, available only through MNsure, help lower, or in some cases completely eliminate, premium increases for Minnesotans. For example:

- A 40-year-old in southeast Minnesota purchasing a silver plan could see a rate increase from $282/month this year to $329/month in 2016. That same person would also see their advanced premium tax credit amount increase from $159/month this year to $209/month in 2016, meaning the overall cost to the consumer will be less in 2016.

- A 25-year-old in the Twin Cities could see her bronze plan rate increase from $110/month this year to $140/month in 2016. However, the tax credit amount through MNsure would also increase from $20/month this year to $59/month in 2016,meaning an overall savings of $9/month.

- A 60-year-old in Yellow Medicine County could see his tax credit increase from $360/month this year to $514/month in 2016, and could purchase a bronze plan for only $11 per month.

About 55 percent of current MNsure qualified health plan enrollees receive an advanced premium tax credit. That percentage is expected to increase next year as more Minnesotans become eligible for the financial help. In 2014 alone, Minnesotans saved more than $31 million through advanced premium tax credits.

“Large insurance premium increases are unfortunate, however, MNsure offers a real solution for Minnesotans to control or eliminate these premium increases,” said O’Toole. “I sincerely hope Minnesotans will not simply accept these premium increases and will instead shop and compare on MNsure to see what kind of financial help they may be able to get.”

In other words, when the benchmark Silver plan rates go up, so do the federal tax credits people receive...which means that not only do more people qualify for credits, those who do also qualify for higher credits, thus offsetting most (or even all) of the rate increase.

SHOP AROUND, SHOP AROUND, SHOP AROUND.