Presenting the Great Republican Party $21 Billion Middle Class Tax Hike

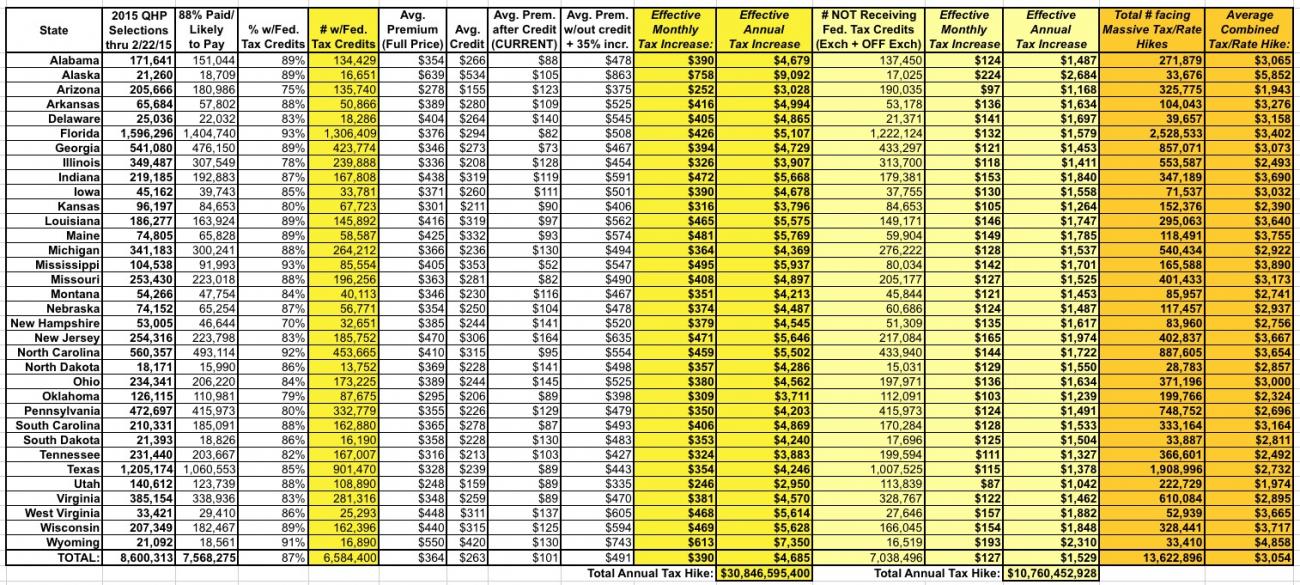

The Kaiser Family Foundation has posted a very handy table listing how many people in each state are receiving federal tax credits for ACA exchange-purchased healthcare policies this year, how much those policies would cost (on average) at full price, and what the average tax credit in each state is.

I'm using their data to take this info one step further: If the Supreme Court does tear away the tax credits in states operating on the federal marketplace, just how many people would be screwed by the ruling as a result, both on and off the exchanges? Remember, studies by both the Urban Institute and the RAND Corporation agree that average individual market premiums would rise by at least 35% in those states (and potentially as high as 45% in all states) as a result of such a ruling. The American Academy of Actuaries is taking these projections very, very seriously.

With that in mind, here's what I came up with. Some important caveats:

- I'm assuming that only 88% of the enrollees in each state actually pay up, which actually reduces the impact somewhat.

- I'm assuming that New Mexico, Oregon and Nevada (which are all set up as state-based exchanges legally even if they're still being run via HealthCare.Gov) are in the clear, so I'm only counting 34 states. If the SCOTUS were to rule that those 3 states aren't in the clear after all, you can increase the total numbers below by roughly another $1.2 billion / 377,000 people.

- I'm assuming that the off-exchange (direct) individual healthcare market is running at around 80% of the exchange-based enrollment.

- The reason the number shown in the 12th column (the first "manilla" one) is actually higher than the exchange-based number in most states is because it includes that 80% number plus the small percentage of exchange-based enrollees who aren't receiving tax credits (ie, Alabama = 120,800 off-exchange + 16,600 exchange-based w/out credits)

- I'm going with the lower, 35% rate hike from the Urban Institute rather than the higher 45% estimate from the RAND Corp. Again, if it were to play out with RAND's higher 45% figure, you can increase the dollar amounts by around another $6 billion total.

- Finally, to keep things simple, I'm also assuming that those who enroll off-exchange are choosing roughly the same types of plans in the same levels of metal levels, etc. as the exchange-based folks.

With that in mind, here's what it would look like (click below for higher-res version):

And there you have it: 6.6 million people would be looking at an average tax increase of $4,700 apiece, and another 7 million would be looking at an average of over $1,500 apiece annually.

Add it all up and you're talking about 13.6 million people having their effective tax rates increase by a collective $41.5 billion per year.

Of course, technically speaking, only about half of this ($20.8 billion) would be actual tax increases; the other half would be premium increases...and, to be truly fair, most of those rate increases would only be happening due to the 8-9 million or so of the above who wouldn't be able to afford the drastic spikes in the first place.

So, a more honest way of putting it would be to say that if the Supreme Court 1) rules for the plaintiffs, 2) tears away the tax credits for federal exchange states, 3) Congress doesn't fix the "problem" by adding 4 words to the sentence in question and 4) none of the 34 states in question move to a state-based exchange, the result would be:

- 8 million or more people would lose their healthcare coverage, and

- another 6 million would see their premiums jacked up by an average of $1,500 per year.

So, you know, take your pick: Would you rather see 14 million working-class/middle-class people have to shell out over $3,000 more per year apiece, or would you rather see 8 million of them lose their healthcare entirely while the other 6 million get stuck for $1,500 apiece?

See? The Republican Party is all about the freedom to make choices!