Delaware: *Final* avg. unsubsidized 2025 #ACA rate changes: +8.5% (updated)

Originally posted 8/13/24

The Delaware Dept. of Insurance has posted the preliminary 2025 individual & small group market rate filings from insurance carriers participating in those markets.

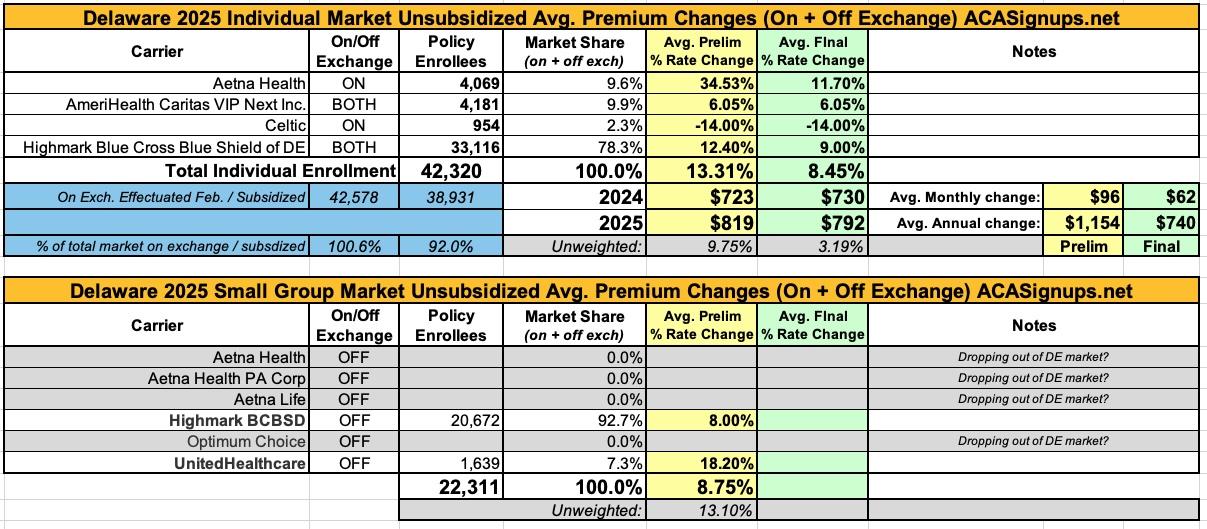

The big news on the individual market is that Aetna is seeking massive rate hikes of over 34% next year, though the weighted average across the board being requested is "only" a still ugly 13.3% increase.

On the small group market, average increases are the lower but still-not-great 8.8%. More significantly here is that Aetna and Optimum Choice are pulling out of the Delaware small group market entirely, reducing the number of carriers from six to just two, since Aetna had three divisions operating there.

UPDATE 9/19/24: The Delaware Insurance Dept. has published the final/approved 2025 rate changes for the individual market (small group plans will be finalized in October). Overall, 2025 rate increases have been reduced from 13.3% to 8.5%:

Filings and affordability standard reporting reviewed by Department, consumers continue to benefit from increased competition, Inflation Reduction Act, and 1332 Reinsurance Waiver

After welcoming new entrants for two consecutive years, the Delaware Health Insurance Marketplace is experiencing stability in carriers, plans, and rates for the 2025 plan year. Consumers will choose from 45 plans offered by four carriers when the Marketplace opens on November 1. This enrollment period will also offer persons with Deferred Action for Childhood Arrivals (DACA) status the ability to enroll in the comprehensive Affordable Care Act coverage offered.

“Increasing competition, emphasizing primary care, and addressing high-costs claims has helped us create a thriving Delaware Health Insurance Marketplace. Enrollment has increased 77% since 2021, and we continue to benefit from programs that lower consumer premiums” said Insurance Commissioner Trinidad Navarro. “We continue to ensure that 80% or more of premium is paid toward health care costs, and hold our carriers to important affordability standards. And, we’re proud to support efforts to address the impact a lack of providers and competition has on premiums here in Delaware.”

During the 2024 plan year, Delaware’s Health Insurance Marketplace is serving roughly 45,000 residents, a 29% year-over-year increase from 2023 plans. After Advance Premium Tax Credits, premiums average $147, a decrease of $50 per month from the prior plan year. 7,971 Delaware enrollees had a premium at or below $10/month. Commissioner Navarro and staff visited D.C. earlier this year to encourage Congress to continue the enhanced premium tax benefits of the Inflation Reduction Act, which saves Delawareans in Marketplace plans an average of $527 per month.

Delaware’s rate review process coincides with another critical aspect of health care reform, shared Commissioner Navarro: “As insurers go through the rate review process, they also engage with our Office of Value-Based Health Care Delivery to track compliance with our affordability standards and primary care initiatives. This work contributed an estimated $42 million to Delaware’s primary care providers last year alone, a critical infusion of dollars into an industry struggling with shortages.”

The state also renewed its 1332 State Innovation Waiver with the U.S. Department of Health and Human Services and the U.S. Department of the Treasury. This state-based reinsurance program, now authorized through 2029, projects it will result in the lowering of statewide average premiums by 15.9%.

Commissioner Navarro urges residents to be informed consumers and shop for the best plan for both their needs and their budget. Local navigators are available to assist in choosing the right plan, and consumers can also use certified agents/brokers to obtain coverage. Open Enrollment takes place November 1-January 15, but Special Enrollment Periods exist for loss of coverage (including under Medicaid/CHIP), changes in household or residence, incarceration reentry, income qualification, or for other qualifying reasons. Find out if you qualify for Special Enrollment.

Be aware of non-compliant alternative health plans.

Information on Federal Final Rule regarding DACA recipients

Individual Affordable Care Act (ACA) Marketplace Rates Announced

Following in-depth reviews by staff, independent actuaries, and the Office of Value-Based Health Care Delivery, rates for 45 regulated 2025 Marketplace plans have been finalized.Aetna Health’s final average rate increase of about 11.7% is 22.79% lower than their initially filed rate increase request of 34.53%. Their two plans are marketed as offering $0 MinuteClinic and CVS Health Virtual Primary Care.

AmeriHealth Caritas’ request to increase rates by 6.05% on average was approved. Their eight Marketplace are promoted as not requiring referrals.

For Celtic Ambetter Health of Delaware’s second year on the Marketplace, they requested a rate decrease of 14%, which was approved. Their 17 Marketplace plans include marketed offerings with connected health savings accounts (HSAs), vision, and dental.

Highmark requested a rate increase of 12.4%, and an average increase of 9% was approved. They will market 17 comprehensive plans and one catastrophic plan which includes three primary care visits. Comprehensive plans include HSA offerings, as well as connected vision and adult dental coverage.

All ACA-compliant health plans offer essential health benefits, including coverage of pre-existing conditions, prescriptions, emergency services and hospitalization, mental and behavioral health coverage, outpatient care, telehealth, lab services, and more. Plans on the Marketplace are spread among metal-level categories – bronze, silver, gold, platinum and catastrophic – and are based on how enrollees choose to split the costs of care with their insurer.

Other ACA and ACA-Compliant Rates

Off-market individual offerings include one plan from AmeriHealth Caritas, increasing the requested average of 6.05%. Two off-market plans from Highmark are increasing an average 9% after a 12.4% request.Delta Dental will increase rates by an average of 6% for two offered marketplace family plans and one off-market pediatric plan. Dominion Dental requested no change to their ACA premiums on their 10 plans, which include pediatric plans.

Off-market small group plan options for the coming plan year will finalize in October. Rate submissions show 58 plan options offered by Highmark and United HealthCare. In initial filings, Highmark has requested an 8% average increase, while United HealthCare has requested an increase of 18.2%. Aetna Health, Aetna (as a PA Corp), Aetna Life, and Optimum Choice have not filed off-market small group plans for the coming year.

The spreadsheet has been updated with the final rate changes, and has also had the on exchange effectuated enrollment numbers as of February 2024 added. Note that according to the official data, more than 100% of Delaware's total individual market is on exchange, which is of course not possible, so I presume there's at least a few hundred enrollees missing from the carrier filings (possibly dropped policies?)