Study: 1/3 of Medicaid enrollees don't even know they're enrolled

A month or so ago I noted that as ugly as the massive number of Americans who've had their Medicaid or CHIP coverage terminated is (nearly 22 million people as of last week, via KFF), there's some important mitigating factors to keep in mind (updated w/latest data):

- For starters, at least 3.9 million of those who had their Medicaid/CHIP coverage terminated transferred over to heavily-subsidized ACA exchange plans instead as of the end of January. This is likely several hundred thousand higher today.

- Another 290K living in Minnesota and New York shifted from Medicaid over to their respective Basic Health Plan programs.

- Another 527,000 were kicked off their Medicaid/CHIP plans...but then turned around, reapplied and were found to be eligible for Medicaid/CHIP regardless. I don't know how many actually re-enrolled, but I'm assuming the vast bulk of them have done so.

All told, that's at least 4.72 million of the 22 million who have found other comprehensive, extremely inexpensive healthcare coverage in one form or another...over 21%.

What about the other 17.3 million, though? Well, that's where things get interesting.

Around 4.1 million Americans turn 65 each year (roughly 1.2% of the total U.S. population).

I don't know the age distribution of the ~22 million who have been "unwound," but assuming it's fairly close to the nation as a whole, this suggests that perhaps 270,000 or so of them became eligible for Medicare instead over the past 12 months.

An unknown number have presumably gained employer coverage thanks in large part to the 2.8 million additional jobs which have been gained since March 2023.

The number of people enrolled in Medicaid soared over the pandemic due to federal restrictions on states removing members from the safety-net insurance program. However, many of those people may not have known their coverage had continued, a new study suggests.

Medicaid coverage as a share of the overall population jumped by 5.2 percentage points between 2019 and 2022, according to CMS statistics. However, the change in survey-reported Medicaid coverage was much smaller — an increase of 1.3 percentage points, according to the study published Friday in JAMA Health Forum.

As I noted at the time, consider that if you never receive any sort of notification (or assume it's spam and ignore it/throw it out) and are healthy all year, it may never occur to you.

For that matter, even if you do visit the doctor, if you don't know you're enrolled in Medicaid it will never occur to you to even check...you likely won't visit at all or will go but pay out of pocket whether you can afford it or not.

In addition, some enrollees have been double enrolled in both Medicaid and employer-sponsored coverage all this time without ever knowing it.

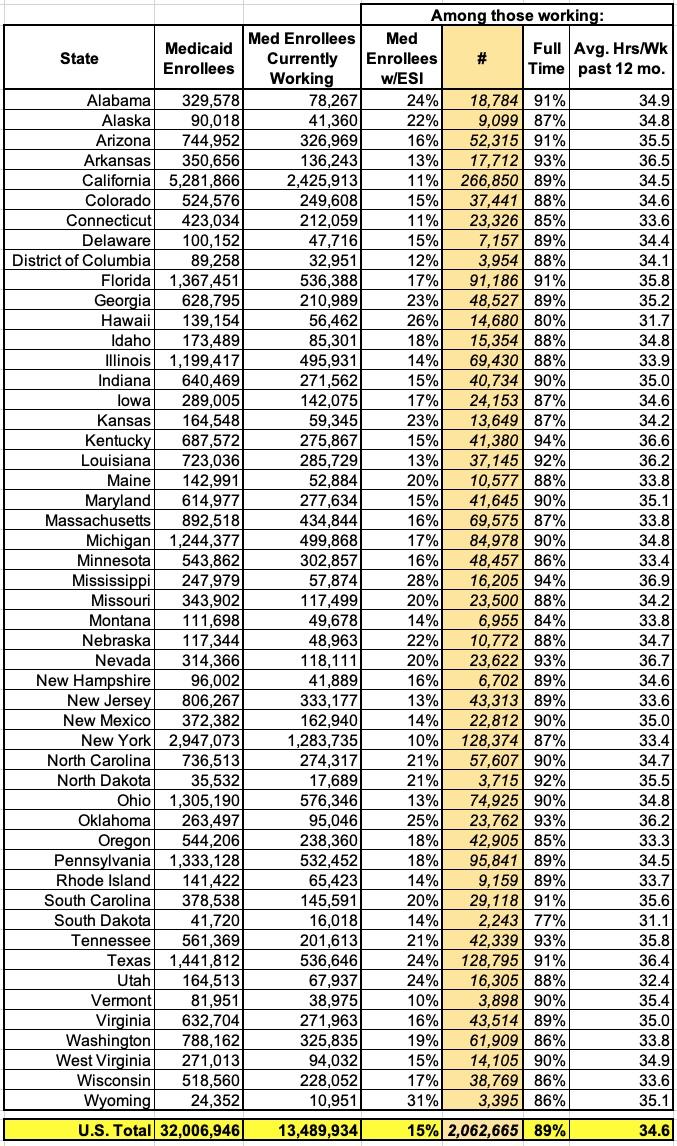

Many Medicaid enrollees are employed, and in 2021, 15 percent of working enrollees reported having both Medicaid and employer sponsored health coverage. The intersection between Medicaid and employment has implications for employers and others as the pandemic-related Medicaid continuous enrollment ends.

Approximately 2 million (15 percent) working Medicaid enrollees aged 19-64 report also having employer sponsored insurance (ESI) in 2021, and when accounting for spouses and dependent children of these individuals, over 4 million people could move to ESI after unwinding the Medicaid continuous enrollment provision. Medicaid is the payer of last resort; providers must first bill the enrollee’s ESI insurer and then bill Medicaid if any service is not fully covered by ESI

The study even includes a state-by-state breakout of how many Medicaid enrollees were employed as of a year ago and what percentage of them were estimated to also have employer-sponsored coverage at the time:

Appendix Table 1. Employment for Medicaid Enrollees Who Were Employed Ages 19-64 by State, 2021

All of this is relevant again today because of a new study by Harvard & New York University, published in Health Affairs, which confirms that nearly 1/3 of those enrolled in Medicaid in 2022 had no idea they were enrolled in Medicaid at the time:

Policy responses to the March 31, 2023, expiration of the Medicaid continuous coverage provision need to consider the difference between self-reported Medicaid participation on government surveys and administrative records of Medicaid enrollment. The difference between the two is known as the “Medicaid undercount.” The size of the undercount increased substantially after the continuous coverage provision took effect in March 2020.

Using longitudinal data from the Current Population Survey, we examined this change. We found that assuming that all beneficiaries who ever reported enrolling in Medicaid during the COVID-19 pandemic public health emergency remained enrolled through 2022 (as required by the continuous coverage provision) eliminated the worsening of the undercount.

We estimated that nearly half of the 5.9 million people who we projected were likely to become uninsured after the provision expired, or “unwound,” already reported that they were uninsured in the 2022 Current Population Survey.

This finding suggests that the impact of ending the continuous coverage provision on the estimated uninsurance rate, based on self-reported survey data, may have been smaller than anticipated. It also means that efforts to address Medicaid unwinding should include people who likely remain eligible for Medicaid but believe that they are already uninsured.

What does this all mean? Well, as reported by Phil Galewitz at KFF Health News:

Nearly 1 in 3 people enrolled in Medicaid in 2022 — or 26 million people — didn’t know it, according to a study by Harvard and New York University researchers published in Health Affairs this month.

The report estimated that of those who didn’t know they were on Medicaid, about 3 million thought they were uninsured.

They almost certainly had coverage, though, because the federal government from March 2020 to April 2023 prohibited states from dropping anyone from Medicaid rolls in exchange for billions of dollars in pandemic relief money.

There's a second problem here as well:

One group enjoys some upside from Americans’ ignorance about their insurance coverage: the companies that administer Medicaid for most states, including UnitedHealthcare and Centene.

States pay them a monthly fee for every person enrolled in their plans. But if people don’t know they’re insured, they’re less likely to seek health services — which means higher profits for the companies.

“Insurers reaped windfalls from this reality,” said Brian Blase, president of the Paragon Health Institute and a former health policy adviser to President Donald Trump. “People who are enrolled but don’t know they are enrolled receive no benefit from the program.”

Yep. MCOs get paid for each enrollee whether the enrollee ever sets foot inside a doctor's office or not.

Granted, the same is true of fully private insurance as well--you have to pay your monthly premium whether you ever get a checkup or not--but at least you know you'll be covered if you do.