Maryland: *Final* avg. 2024 #ACA rate changes: +4.7%

via the Maryland Insurance Dept:

Maryland Insurance Administration Approves 2024 Affordable Care Act Premium Rates

- Reinsurance Program Continues Positive Impact on Individual Rates

BALTIMORE – Maryland Insurance Commissioner Kathleen A. Birrane today announced the premium rates approved by the Maryland Insurance Administration for individual and small group health insurance plans offered in the state for coverage beginning Jan. 1, 2024.

Rate Changes for the Individual Market

The rates for individual health insurance plans subject to the Affordable Care Act (ACA) will change/increase by an average of 4.7% for 2024. Approximately 229,000 Marylanders are impacted by the approved rates. However, the actual percentage by which the rates for a specific plan will change depends on the carrier and plan.

The approved rates are 1% lower on average than insurance carriers originally requested, and are 1.6% lower than the revised increases that carriers requested after the parameters of the reinsurance program were adjusted in July. This difference represents a total annual premium savings of almost $19 million for Maryland consumers. In addition, the rate increase in the individual market for 2024 is significantly lower than the 2023 increase of 6.6%.

“The cost of individual health insurance plans in Maryland continues to be among the lowest in the nation, even before consideration of the premium subsidies available through the Maryland Health Benefit Exchange. I attribute our State’s continued ability to keep rate changes below claim trends to Maryland’s innovative reinsurance program,” said Commissioner Birrane.

Maryland was one of the first states in the nation to utilize the federal 1332 State Innovation Waiver process to establish a reinsurance pool to reduce and stabilize rates in the individual health insurance market. After the state experienced several years of high double-digit rate increases in the individual market, the reinsurance program was designed to reduce rates by 30% in three years and, thereafter, to align future rate increases with increases in claim and cost trends. The program was established through bipartisan legislation passed by the Maryland General Assembly in 2018. The waiver authorized by that legislation was approved by the U.S. Centers for Medicare and Medicaid Services (CMS) in August 2018, clearing the way for the implementation of the reinsurance program in 2019. Individual market rates fell more than 30% over the three years following its implementation and, since then, increases have been consistently below the claim trends. In June 2023, the waiver was extended by CMS for an additional five years.

In addition to the rate change requests from Individual carriers already selling in the market, the Maryland Insurance Administration also approved a new rate filing from Aetna Health Inc. Aetna has been approved to sell nine individual health plans. Those plans are available for purchase both on and off the Maryland Health Benefit Exchange (Maryland Health Connection) and in all Maryland counties. With this approval, all Marylanders will be able to choose from between at least three insurance carriers; a large improvement from 2018 prior to the Waiver when the majority of counties had only a single carrier.

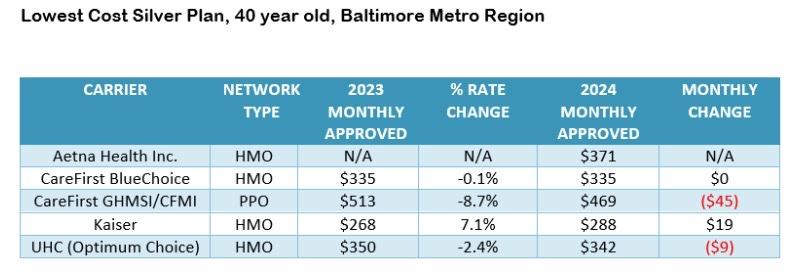

Commissioner Birrane emphasized that the rate change for an individual will depend on their carrier and their chosen health plan, noting that the rates for some plans are decreasing. As an example, for a 40-year-old living in the Baltimore metro region, rate changes for the lowest cost off-exchange silver plans range from -8.7% to 7.1%, with average monthly differences ranging from -$45 per month to $19 per month.

Individual Non-Medigap Market

Rate changes for the lowest cost gold plan for that same 40-year-old in that same region range from -1.5% to 10.1%, with average monthly differences ranging from -$8 per month to $32 per month:

Commissioner Birrane urged Marylanders to work closely with health insurance agents and advisors, and to explore plans available through Maryland Health Connection. Individuals who purchase individual insurance through the Exchange may be eligible to receive federal premium subsidies or federal Advanced Premium Tax Credit (APTC). Currently, approximately 80% of people who purchase their individual market policy on the Exchange receive some reduction in premium. The Inflation Reduction Act has extended enhanced APTCs through 2025, with no upper income limit on subsidy eligibility. In addition, people who are 18-35 years of age and are under 400% FPL remain eligible to receive a state premium subsidy to bring their subsidized premiums even lower.

“It is very important for you to work with Maryland Health Connection,” Commissioner Birrane advised. “Subsidies may offset some or all of any rate increase applicable to you. Review your renewal notice and work with Maryland Health Connection or another trusted advisor to see which plan is best for you. That is particularly important this year, with new offerings from Aetna.”

Stand-Alone Dental Market

The Maryland Insurance Administration also approved an average rate decrease of - 1.3% for dental rates in the individual market, which is the same average rate decrease initially submitted by carriers. These rates effect approximately 96,000 Marylanders.

Small Group Market

The rates for small group health insurance plans under the ACA will increase by an average of 6.9% in 2024. This is a reduction of 0.6% from the originally requested 7.5% average, reducing the market’s total annual premium by more than $15 million.

About 240,000 Marylanders are impacted by the approved small group rates. As is the case with the individual market plans, the actual percentage by which the rates for a specific plan will change depends on the specific carrier and plan. There are more than 220 plans offered this year in the Maryland small group market and plan sponsors are urged to shop carefully.

As an example, for a 40-year-old living in the Baltimore metro region, rate changes for the lowest cost off-exchange silver plans range from -3% to 16%, with average monthly differences ranging from -$12 per month to $56 per month.

Rate changes for the lowest cost gold plan for that same 40-year-old in that same region range from -3% to 14%, with average monthly differences ranging from -$13 per month to $56 per month.

It is important to note that more than 90% of Marylanders are covered by health insurance plans offered through large employers or employers who self-insure, or participate in “grandfathered” plans purchased before March 2010 or in federal plans (such as Medicare, Tricare, or federal employee plans). For these Marylanders, today’s announcement will not affect their rates. The attached exhibits provide additional detail and context to the outcome of 2024 ACA premiums. As always, the approved rate increases vary by carrier and plan, with some carriers decreasing rates and other carriers increasing rates more than the average. A member’s annual premium rate will depend on the approved rate increase for their plan, the year-over-year increase in age factor, and, when applicable, the change in subsidy.

Summaries of each premium decision are available on the MIA’s premium review website. Sample approved 2024 premiums for all companies by geographic region also are available online. The sample premiums do not reflect any employer contribution, any financial assistance a consumer may receive to reduce premiums or costsharing for plans purchased through the state’s health insurance marketplace, MarylandHealthConnection.