New York: *Final* avg. unsubsidized 2024 #ACA rate changes: +12.4% (down from +22.1%)

Back in June, the New York Department of Financial Services published the preliminary annual rate filings for both the individual and small group health insurance markets. At the time, the NY DFS put the weighted average rate increases on the ACA-compliant individual market at 20.9% statewide, although my own calculations based on the officially-reported market share enrollment came in slightly lower, at 20.7%.

Meanwhile, they put small group market, NY DFS put it at a 15.3% average increase (almost identical to my 15.4%).

However, I made sure to include an important caveat:

It's important to remember that these are not final rate increases--New York in particular has a tendency to slash the requested rate hikes down significantly before approving them.

Well, today NY DFS has published the final/approved rate changes for 2024...and lo & behold, my caveat proved completely on point:

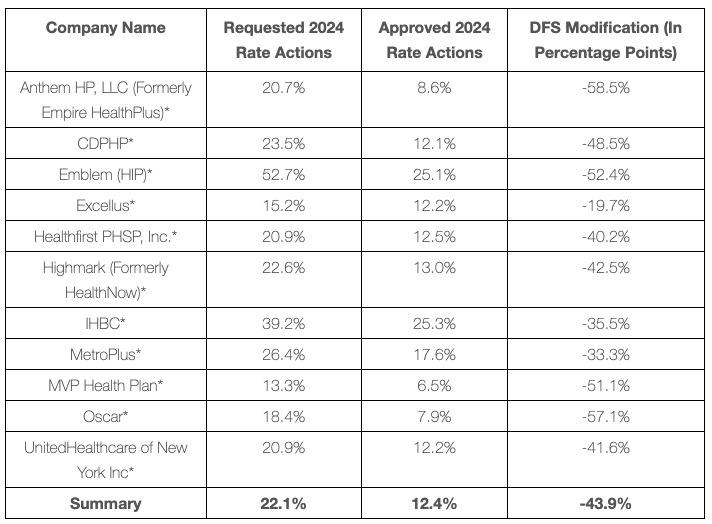

NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES 2024 INDIVIDUAL AND SMALL GROUP REQUESTED & APPROVED RATE ACTIONS

Individual Market

Insurers requested an average rate increase of 22.1% in the individual market, which DFS cut by 44% to 12.4% for 2024, saving consumers $126 Million. These rates will be further reduced for many consumers who are eligible for federal tax credits. Last year, over 60% of individuals who enrolled in a Qualified Health Plan through New York State of Health received the federal premium tax credits to lower the costs of premiums. Approximately 248,000 New Yorkers are currently enrolled in individual commercial plans. These rate decisions do not include the Essential Plan, available through NY State of Health, which as of June 1, 2021 charged no premium for lower-income New Yorkers who qualify. As of 2023, more than one million New Yorkers are enrolled in the Essential Plan.

It's important to note a couple of important things here: First, the preliminary weighted average increase somehow changed from 20.7% to 22.1%. I suppose that's possible if there were some clerical updates to the hard enrollment numbers. Second, they put total indy market enrollment at 248,000, versus the 237,469 I have tallied using DFS's own enrollment data; not sure what accounts for the ~10.5K enrollee discrepancy.

DFS INDIVIDUAL MARKET RATE ACTIONS

Fidelis filed a 2024 rate application that included a change in the company’s service area, specifically to withdraw from Kings County. The Departments of Financial Services and Health worked with Fidelis to reverse these changes and avoid significant disruption to policyholders and the market in Kings County. Fidelis is providing Kings County policyholders who did not receive a notice of their requested 2024 rate increase this required notice. Following a standard thirty-day period for consumers impacted to submit comments on the proposed rates, DFS will review the request and determine an approved 2024 rate.

In addition to Fidelis not being listed due to the withdraw/reinstatement of service in Kings County, there are two additional carriers (both of which only offer off-exchange policies, and neither of which has more than 100 enrollees) which aren't listed in the table above: Aetna Life Insurance Co. and UnitedHealthcare Insurance Co. of NY. Neither of those is more than a rounding error, however.

According to NY DFS, 2024 individual market rates will being increasing by 12.4% for unsubsidized enrollees, or 44% less than the initial 22.1% requested. Again, this is off somewhat from my own calculation of a 14.5% increase (see 3rd table below), but that missing 10.5K as well as the Fidelis question make this discrepancy plausible.

It's also important to note that the final 12.4% average increase would apparently have been up to 2 points higher due to the states pending expansion of their Basic Health Plan (BHP) Program had the state not modified their BHP expansion waiver to address the impact on premiums.

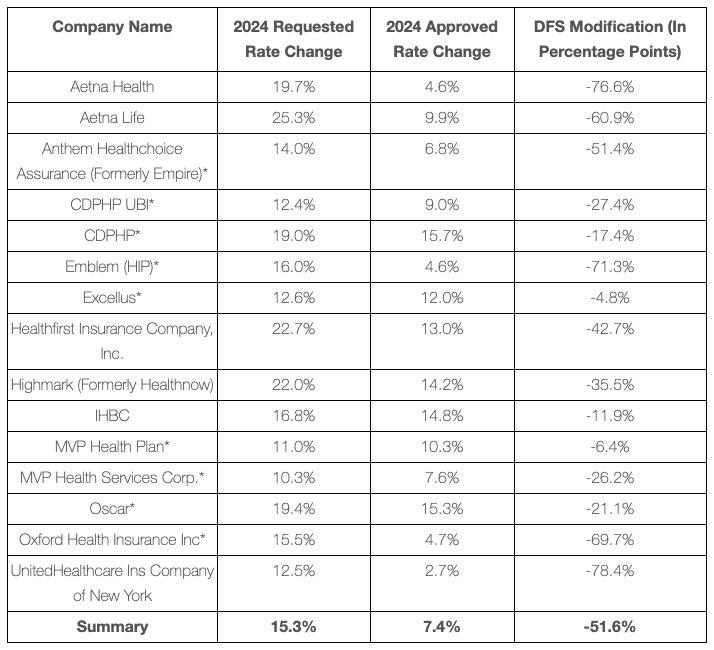

Small Group Market

Almost 800,000 New Yorkers are enrolled in small group plans, which cover employers with up to 100 employees. Insurers requested an average rate increase of 15.3% in the small group market, which DFS cut by 52% to 7.4% for 2024, saving small businesses $607 million. A number of small businesses also will be eligible for tax credits that may lower those premium costs even further, such as the Small Business Health Care Tax Credit.

DFS SMALL GROUP MARKET RATE ACTIONS

* Indicates the Company will offer products on the NY State of Health Marketplace in 2024.

For the small group market the gap between DFS and my calculations for the preliminary and final rates are smaller--the preliminary estimates are pretty much identical, while the final/approved rates only vary by 0.7 percentage points, again as noted in the table below. Also note the ~36,000 enrollment gap between my tally and DFS's press release:

Again, for the past three years straight New York has seen dramatically high requested rate increases followed by state regulators slashing them in an equally dramatic manner:

- 2023: 18.8% requested; 9.7% approved

- 2022: 11.1% requested; 3.7% approved

- 2021: 11.7% requested; 1.8% approved

Prior to 2021, the gap between the preliminary and final rates was much smaller, although 2018 and 2019 had some other weirdness going on which made it difficult to compare the two:

- 2020: 8.3% requested; 6.8% approved

- 2019: Special Case

- 2018: Special Case

- 2017: 17.3% requested; 16.6% approved

So what happened starting with the 2021 filings (which were submitted, reviewed and approved over the summer of 2020)? Well, that's difficult to say. Yes, the COVID-19 pandemic was raging that summer, but that was true in other states as well (even if New York was hit the hardest)...and it still wouldn't explain the huge gap continuing in the 2022, 2023 and 2024 filings.

I honestly can't say what's going on here. I suppose it's conceivable that there's some sort of nefarious arrangement between the carriers and state regulators to make NY DFS look good ("hard at work protecting John Q. Public from excessive price gouging!" etc etc), or it's possible that there's nothing unseemly going on. Regardless, the bottom line is that for the fourth year in a row, approved annual individual market rate increases will be dramatically less than what the insurance carriers initially asked for.

As long as I'm on the subject of New York annual rate filings and NY DFS press releases, there's a different phenomenon specific to New York which I documented a few years ago: The Mystery of NY DFS's "55% Lower" Obsession:

For six years straight, the New York DFS has claimed that even after the annual increases, average premiums for the upcoming year will be 50-55% lower than they were prior to the establishment of the New York State of Health exchange (aka, the state ACA exchange) starting in 2014. This sounds particularly curious given that premiums have obviously increased each of those years, by an average of 5.7% in 2015, 7.1% in 2016, 16.6% in 2017, 14.5% in 2018, 8.6% for 2019 and, as they just announced, 6.8% in 2020. That's a cumulative 75% average increase over six years.

So how could premiums in 2020 still be "less than 55%" of what they were prior to the ACA exchange launch (that is, as of 2013)?

I did some digging and played around with the numbers some more, but that "55% lower" claim never really made much sense no matter how much leeway I gave them. And in fact, it happened a seventh time in 2020, for the 2021 Open Enrollment Period:

Rates for individuals are more than 55% lower than prior to the establishment of the New York State of Health in 2014, adjusting for inflation but not counting federal financial assistance that the ACA makes available to many consumers purchasing insurance. Approximately 323,000 New Yorkers are currently enrolled in individual commercial plans.

And then, starting in 2021, that "55% lower" bullet point finally disappeared entirely (the press release actually came out on August 13, 2021). It didn't appear in the 2022 press release for 2023 or in this year's press release for 2024 either. Huh.

What caused NY DFS to finally stop using this clearly and increasingly ludicrous claim after seven years straight?

Well, I don't know for certain, but the date of that 2021 press release (August 13th) stuck in my head, and I remembered that there was another big news story out of New York State which happened just three days earlier:

NEW YORK (AP) — Gov. Andrew Cuomo announced his resignation Tuesday over a barrage of sexual harassment allegations in a fall from grace a year after he was widely hailed nationally for his detailed daily briefings and leadership during some of the darkest days of the COVID-19 pandemic.

Huh.