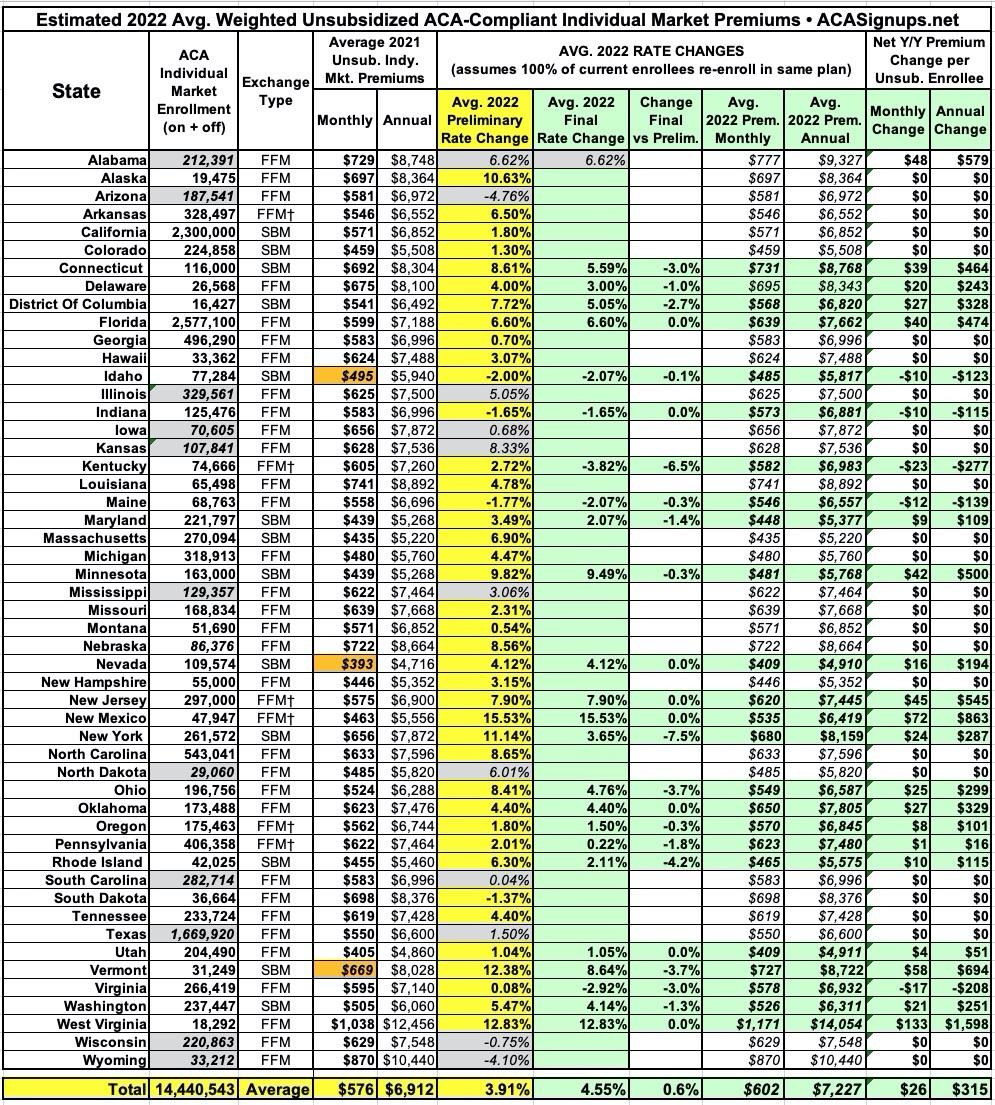

National 2022 #ACA Rate Changes: +3.9% on average, but the VAST majority will pay FAR less thanks to the #AmRescuePlan! (updated)

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have enrolled in ACA-compliant individual market policies;

- What their average projected premium rate increase (or decrease) is for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

Unfortunately, there are eleven states where, due to the carriers and/or the state insurance departments heavily redacting the rate filing documentation, I've been unable to fill in the actual number of people enrolled by some or all of the insurance carriers within that state's individual market. This means that the average premium rate changes listed (shown in grey) are unweighted averages, not weighted.

This can make a big difference in some cases: Let's say you have 2 carriers in a state, one raising rates by 10% and the other raising them by 1%. The unweighted average increase would be 5.5%. However, what if it turns out that the first carrier has 90% of the market share while the second only has 10%? That would mean a weighted average increase of 9.1%. The unweighted average is the best I can do for these states without knowing the market share breakout.

It's also important to note that for those same 11 states, I don't have a hard statewide ACA-compliant individual market enrollment number either. For these states, I've taken the effectuated on-exchange number from August 2021 via the CMS SEP effectuation report, and increased it by 18.7% to account for the likely off-exchange enrollees. The 18.7% figure is based on the average off-exchange portion of the other 39 states + DC compared against the August on-exchange enrollment for each. Again, without hard numbers, this is the best I can do for now.

As of this writing, I've plugged in the preliminary (requested) 2022 statewide average rate changes for all 50 states plus the District of Columbia, giving a national average increase of 3.9% overall. I've also entered the final (approved) averages for 19 states so far. For those states, the national weighted average increase is a bit higher, 4.8%. This will likely drop as more final averages are entered in the coming weeks, however; the odds are high that once every state is filled in, the final average increase will be slightly lower than the preliminary average.

UPDATE 10/19/21: I've filled in the final/approved averages for Oregon, Indiana, Delaware, Connecticut and Idaho, which collectively whittle the final national average down from 4.8% to...4.6%.

Again, I still have to fill in most of the final/approved statewide averages, but based on the requested/preliminary numbers, here's where things stand today. Keep in mind that all dollar amounts below assume UNSUBSIDIZED premiums. However, the vast majority of 2022 ACA exchange enrollees will be financially subsidized, bringing their net premiums down substantially; in fact, millions of them will pay no net premium at all, and none will have to pay any more than 8.5% of their household income for the benchmark Silver plan.

- Average unsubsidized 2021 premiums range from $393/mo (Nevada) to $1,038/mo (West Virginia)

- Average requested 2022 rate changes range from a 4.8% decrease (Arizona) to a 15.5% increase (New Mexico).

- Assuming all of the remaining requested rate changes are approved as is, Nevada would still have the lowest average premiums ($409/month), while West Virginia's would continue to be the highest in the country, at a jaw-dropping $1,171/month.

This last point is another reason why it's particularly disturbing that U.S. Senator Joe Manchin is jeopardizing President Biden's "Build Back Better" plan, which would make the expanded American Rescue Plan ACA subsidies permanent. West Virginia has the lowest median average income in the country (less than $47,000/year as of 2019), but even so, anyone earning more than 400% of the Federal Poverty Line (roughly $51,500 if single; $106,000 for a family of four) would see their premiums skyrocket starting in 2023 if that fails to happen.

NOTE: The permanent version of the table above will be available here.