Arkansas: Preliminary avg. 2022 #ACA premium rate changes: +6.5% indy market; +4.1% sm. group

via the Arkansas Insurance Dept:

Health Insurance Rate Changes for 2022

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Arkansas Insurance Department for review and approval before plans can be sold to consumers.

The Department reviews rates to ensure that the plans are priced appropriately. Under Arkansas Law (Ark. Code Ann. § 23-79-110), the Commissioner shall disapprove a rate filing if he/she finds that the rate is not actuarially sound, is excessive, is inadequate, or is unfairly discriminatory.

The Department relies on outside actuarial analysis by a member of the American Academy of Actuaries to help determine whether a rate filing is sound.

Below, you can review information on the proposed rate filings for Plan Year 2022 individual and small group products that comply with the reforms of the Affordable Care Act.

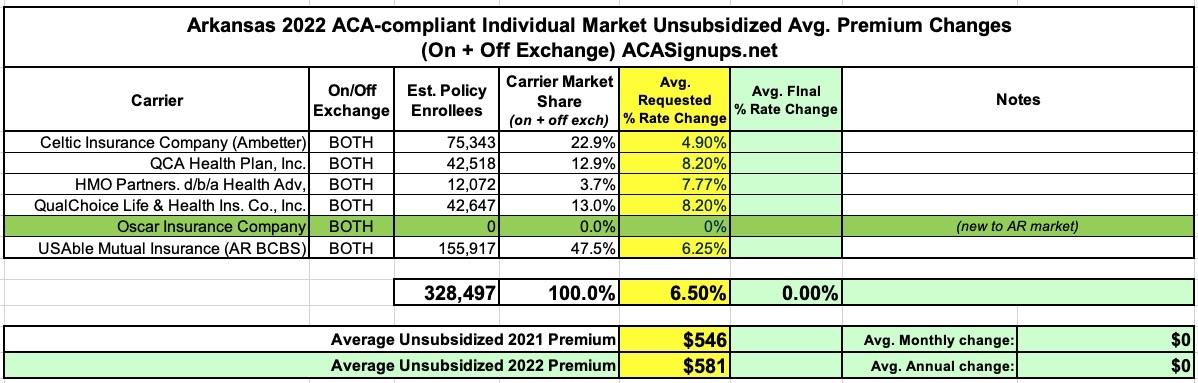

Here's the breakout. Oscar Insurance Co. is kind of interesting; the filing says that they're new to the Arkansas market, but they actually tried to enter it in 2021 and were apparently disapproved by the state regulators. Huh. I guess they made it through this year.

Arkansas' 328.5K ACA enrollee total is also noteworthy because the state supposedly had around 317,000 residents enrolled in the state's "Medicaid Private Option" plans in March 2021; these are actually ACA individual market plans with nearly all costs covered by a combination of federal & state Medicaid funds plus some wraparound state funding. If you subtract that total out it only leaves around 11.5K actual on-exchange QHP enrollees...except Arkansas actually had over 60,000 enrolled in exchange QHPs in February, so there's a ~48.7K discrepancy. Not sure what that's about.

Arkansas' ACA-compliant small group market, meanwhile, looks pretty quiet. At first I was greatly confused because the press release makes it look like there's only around 4,000 Arkansans enrolled in the state's small group market, which makes no sense at all.

However, when you click through to the actual rate filings, you see that the "affected lives" number for each carrier actually only refers to the number of companies (groups) which have policies with them--the actual number of covered lives is much larger of course, and the total small group market is over 52,000 people this year: