BREAKING: CMS announces over 1.24 million have enrolled via HC.gov SEP so far; #GetCovered thru 8/15!

2021 Marketplace Special Enrollment Period Report: February 15 – May 31, 2021

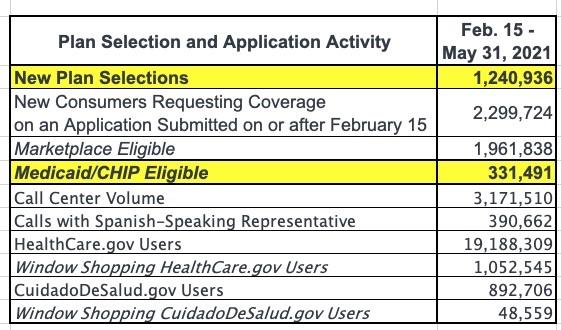

The Centers for Medicare & Medicaid Services (CMS) reports that over 1.2 million Americans have signed up for health insurance through HealthCare.gov since February 15, the start of the 2021 Marketplace Special Enrollment Period (SEP) opportunity, through May 31, with 376,000 consumers signing up for health insurance in the month of May.[1]

I projected at least 1.2 million SEP enrollees via HC.gov a week or so ago. On the other hand, I also noted that President Biden appeared to have let this number slip a week earlier anyway, so it wasn't that impressive of a projection:

All in all, I've confirmed that at least 1,090,631 more people have enrolled via the Special Enrollment Period nationally...and even then, most of that data only runs through the end of April. I strongly suspect that HealthCare.Gov SEP enrollment was over 1.2 million by the end of May (in fact, President Biden may have even let this slip in his Weekly Address video with President Obama over the weekend). On top of that, I suspect total SEP enrollment across the 15 state-based exchanges is more like 400,000, bringing the SEP total as of the end of May up to 1.6 million or so nationally.

That 1.6 million national estimate seems like it's on pretty safe ground.

The exact HC.gov number (see tables below) is 1,240,936 as of 5/31. If you subtract 376,000 for May specifically, you get 864,936 enrollees from before 5/01. This is noteworthy because the prior CMS HC.gov report (thru 4/30) put the total QHP (Qualified Health Plan) selections at 939,575.

That means 74,639 of those who selected plans prior to May 1st either never paid their first premium or dropped coverage after the first month or two; that's around 7.9%, which is actually pretty close to what you'd normally expect (the ARP's expanded subsidies likely reduced attrition somewhat, but the economy reopening also likely means a lot of people switching back to employer coverage instead).

CMS also cleaned up the prior 940K April number as well (with roughly 57,000 people being "culled" from the total) which should mean the actual number of people who have selected QHPs via the ACA exchanges during the SEP is actually more like 1.37 million, meaning a net attrition rate of 9.5%...which, again, is within normal expectations.

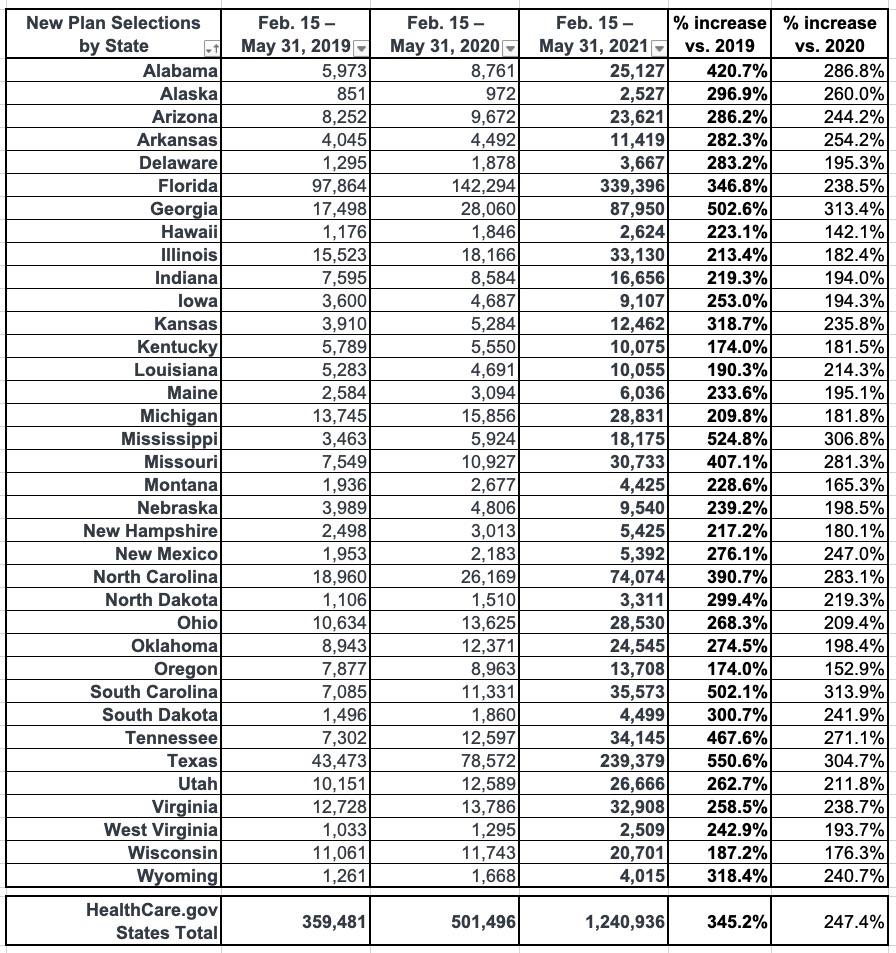

The number of new plan selections from the start of the SEP opportunity on February 15 through May 31 represents a substantial increase in enrollment from the same period in 2020 and 2019, when 501,000 and 359,000 consumers signed up for Marketplace coverage, respectively.[2] In previous years, SEPs were available primarily only for qualifying life events, whereas this year the Biden-Harris Administration opened a SEP to all Americans in response to the COVID-19 Public Health Emergency.

That's 3.5x higher than 2019 (pre-COVID) and 2.5x higher than 2020 (which of course included the first massive wave of COVID-induced layoffs/etc.).

Under the American Rescue Plan (ARP), most consumers are now eligible for more generous advance payments of premium tax credits (APTC), which further reduce monthly premiums. Since HealthCare.gov implemented the expanded APTC amounts on April 1, 2.3 million consumers have returned to the Marketplace and reduced their monthly premiums after APTC by over 40 percent, from $103 to $61, on average, and 30 percent (687,000) of returning consumers newly selected plans for $10 or less after APTC.

This is a Big Deal and will be the subject of a separate blog post this morning.

The ARP also makes it more affordable for new consumers to purchase and use Marketplace coverage. For new consumers selecting plans during the SEP, the average monthly premium after APTC fell by 26 percent, from $117 for those enrolling from February 15 through March 31 to $87 for those enrolling from April 1 through May 31, and 43 percent (347,000) of new consumers since April 1 selected plans for $10 or less after APTC. The ARP also helped to lower out of pocket costs for new consumers. The median deductible for new consumers during the SEP fell by 83 percent, from $450 prior to April 1 to $75 for new consumers enrolling from April 1 through May 31.

In this month’s report, CMS is also releasing data on the gender, race, and ethnicity of consumers enrolling during the SEP, as well as state-level data on the percentage of consumers newly selecting plans for $10 or less since the ARP implementation.

Fantastic!

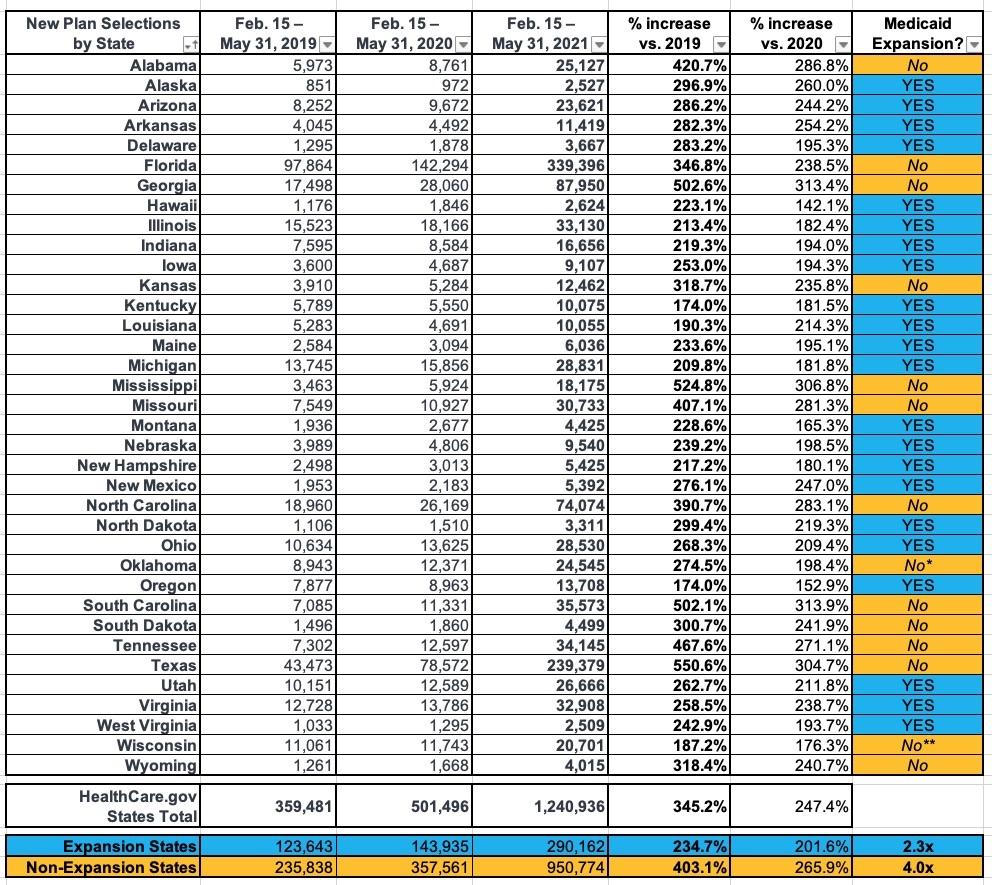

As Andrew Sprung and I have noted several times before, the biggest determining factor for how much SEP enrollment has increased this year over prior years is whether the state has expanded Medicaid under the ACA:

Of the 36 states hosted by HealthCare.Gov, 22 of them have ACA Medicaid expansion (Missouri and Oklahoma both passed expansion ballot proposals last year, but Missouri's GOP legislature is refusing to fund it and Oklahoma doesn't actually launch theirs until July, though they've started signing people up for it). The other 14 (12) haven't done so.

On average, states which have expanded Medicaid have seen SEP enrollment rates 2.3x higher than they were for the same time period in 2019, while non-expansion states are up more than 4x over 2019. The reason for this is the 100 - 138% FPL "overlap" population: In expansion states, those earning up to 138% FPL are shifted over to Medicaid instead, but in non-expansion states, those earning more than 100% FPL are eligible for $0 premium ACA exchange plans.