ACA 2.0 Hunger Games: Dems plan to go big on helping ALL income ranges over 100% FPL! (updated)

Back on January 14th, I noted that President Biden's proposed $1.9 trillion American Rescue Plan includes a couple of interesting ACA-specific provisions:

Roughly two to three million people lost employer sponsored health insurance between March and September, and even families who have maintained coverage may struggle to pay premiums and afford care. Further, going into this crisis, 30 million people were without coverage, limiting their access to the health care system in the middle of a pandemic. To ensure access to health coverage, President-elect Biden is calling on Congress to subsidize continuation health coverage (COBRA) through the end of September. He is also asking Congress to expand and increase the value of the Premium Tax Credit to lower or eliminate health insurance premiums and ensure enrollees - including those who never had coverage through their jobs - will not pay more than 8.5 percent of their income for coverage.

Together, these policies would reduce premiums for more than ten million people and reduce the ranks of the uninsured by millions more.

Depending on how you look at it, this is really three provisions:

- Temporary COBRA subsidies

- Killing the ACA's APTC 400% FPL Subsidy Cliff

- Beefing up the ACA's APTC Subsidy Formula below 400% FPL

The COBRA subsidies are important but would be temporary. The other two, however, would presumably be permanent, and are my main focus of course.

As I wrote in my previous "ACA 2.0 Hunger Games" post:

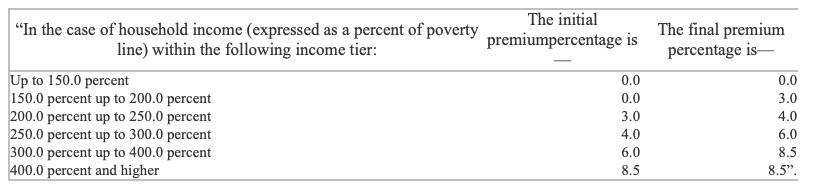

...he wants to include H.R. 1868, the Health Care Affordability Act, which would remove the current 400% FPL income subsidy eligibility ceiling on the ACA exchange while also beefing up the underlying subsidy formula. The table below shows the current formula (which cuts off all subsidies at 400% FPL), the formula under H.R. 1868 and the even more generous formula under H.R. 1425, which passed the House of Representatives last summer before becoming D.O.A. in the Senate.

I have no idea what the subsidy formula would look like under the #AmRescuePlan other than that it would top out at 8.5%. My guess is that it'll follow the H.R. 1868 formula, but who knows? I also don't know whether it would do anything for those caught in the Medicaid Gap (below the 100% FPL margin), since Biden's larger healthcare vision includes moving those folks onto a new Public Option plan at no cost.

The rest of the post went into a wonky look at the pros & cons of focusing more subsidy enhancement efforts on one population or the other. As my colleague Andrew Sprung put it, if forced to pare the proposal down, should they:

- a. Concentrate on the currently unsubsidized, for whom coverage is often truly unaffordable, capping premiums for a benchmark plan as a percentage of income (e.g., 8.5% as in the ACEA, but probably higher)?

- b. Concentrate on lower incomes, where takeup among the subsidy-eligible has been poor? (See the last post for the ACEA subsidy scale and how it compares to current law.)

- c. Spread whatever enhanced subsidy money they can muster across all income groups?

The problem with this sort of speculation is that, as I note in the table above, I didn't even know where Biden's starting offer is beyond the 8.5% ceiling. Perhaps he'd start out with the HR 1868 proposal. Perhaps he means to start with HR 1425. Perhaps some other formula.

Well, as of today I think I've answered this question...and the answer includes an important bonus discovery which I somehow completely missed last summer (but shouldn't have).

Take a look at this press release from Rep. Lauren Underwood's office a few days ago, announcing her re-introduction of H.R. 1868 for the new Congressional session:

UNDERWOOD INTRODUCES LEGISLATION TO LOWER HEALTH INSURANCE PREMIUMS

January 19, 2021

- President-elect Joe Biden’s American Rescue Plan includes this policy, first introduced in March 2019

WASHINGTON— Today, Congresswoman Lauren Underwood (IL-14) introduced the Health Care Affordability Act with Representatives Jimmy Gomez (CA-34) and Tom O’Halleran (AZ-01). The legislation would lower health insurance premiums and out-of-pocket costs by making tax credits for Health Insurance Marketplace plans more generous and available to more Americans. The legislation would lower premiums for more than ten million people and reduce the number of uninsured Americans by millions more. The Health Care Affordability Act of 2021 would expand eligibility for premium tax credits beyond 400 percent of the federal poverty line and increase the size of the tax credit for all income brackets.

The policy, originally introduced by Underwood in March 2019 to address skyrocketing health insurance costs and passed in the House in June 2020, was referenced in President-elect Biden’s American Rescue Plan. The plan calls for Congress to "expand and increase the value of the Premium Tax Credit to lower or eliminate health insurance premiums” and ensure Americans "will not pay more than 8.5 percent of their income for coverage."

"Originally introduced in March 2019" makes it sound like this would use the less-generous table...but "passed in the House in June 2020" makes it sound like it refers to the more-generous table included in H.R. 1425...and of course "referenced in Presdent-elect Biden's American Rescue Plan" simply clarifies that one version or the other is baked into the AmRescuePlan as well.

Unfortunately, the rest of the press release doesn't lend any more guidance:

The Health Care Affordability Act of 2021 would address the high cost of health insurance premiums in the United States by:

- increasing the generosity of premium tax credits across all income levels, reducing the portion of the premium costs for millions of Americans; and

- expanding eligibility for premium tax credits to people with incomes above 400% of the federal poverty level (FPL), guaranteeing that anyone who buys Marketplace insurance can purchase a plan for 8.5% of their income or less.

A one-pager of this legislation can be found here:

Even the "one-pager" doesn't help...because there's no link as of this writing. I don't mean that the link is broken, I mean it literally doesn't link to anything at all. So, I ran a search for the bill itself and found the new version: H.R. 369. Unfortunately...the actual legislative text isn't available yet.

Finally, I contacted Rep. Underwood's office and simply asked which APTC subsidy table the new version of the bill includes...and voila:

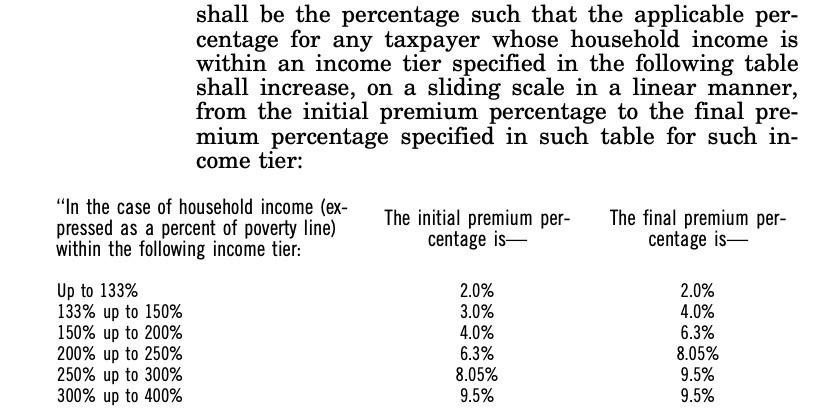

Thanks for the good question about the Health Care Affordability Act: we did update the table to reflect the premium percentages from HR 1425. I assume the bill text will be posted online soon, but when it is, you will see this table:

BOOM, THERE IT IS.

OK, I've confirmed that the 2021 version of Rep. Underwood's bill is indeed using the more generous formula used in H.R. 1425 last summer, hooray!

Now, this doesn't prove that the #AmRescuePlan will also use the same table, but it sure seems like it. HR 1425 passed last summer, the just-introduced HR 369 uses it, and the press release certainly seems to tie all three together at the hip, so unless I hear otherwise, I'm operating on the assumption that this is the formula which the Democrats plan on pushing for (whether they get this table or not is a different story, of course...that gets into the type of sausage-making which Sprung and I were discussing in the first place).

HOWEVER, there's also another small but critical detail included in the table above which escaped my attention last summer in H.R. 1425.

Take a look at the first line of Rep. Underwood's 2019 version (H.R 1868):

- Over 100.0 percent up to 133.0 percent

Now take a look at the first line under both H.R. 1425 and H.R. 369:

- Up to 150.0 percent

Notice the difference? I'm not talking about the "up to 150%" part. I'm talking about the removal of the "Over 100.0 percent" part.

If this were to pass the House & Senate and be signed into law by President Biden using this exact language, it would apparently eliminate the Medicaid Gap...albeit with a couple of major caveats.

As of this writing, around 2.2 million Americans are caught in the Medicaid Gap. These are people who earn less than 100% of the Federal Poverty Level, but who live in one of the twelve states which still hasn't expanded Medicaid under the Affordable Care Act.

Until now, advocates in non-expansion states have tried to close the Medicaid Gap by pushing individual states to pass ballot initiatives forcing them to do so...which quite a bit of success; in the past few years, Utah, Nebraska, Idaho, Missouri and Oklahoma have all done so after lengthy, hard-fought grassroots campaigns, while other states like Montana might have shut down their Medicaid expansion programs if not for hard work on the part of healthcare advocates to keep the funding in place.

However, there's still a dozen states which have refused to budge nearly a decade after the first Medicaid expansion programs ramped up: Alabama, Florida, Georgia, Kansas, Mississippi, North Caroina, South Carolina, South Dakota, Tennessee, Texas, Wisconsin (sort of) and Wyoming. Wisconsin is a special case because they refused to fully expand Medicaid up to 138% FPL but did expand the program up to 100% FPL via other funding, so they don't technically have anyone in the Gap.

There are important upsides and downsides to doing this, and I've struggled with whether to support it or not since 2017 (see #7 on my "If I Ran the Zoo" wish list back in 2017).

The upside is that this would instantly make at least somewhat affordable, comprehensive healthcare policies available for most of the 2.2 million folks caught in the Medicaid Gap. They would pay nothing in premiums...while their deductible would be limited to no a few hundred dollars thanks to generous Cost Sharing Reduction assistance and their maximum out of pocket cost (for all in-network expenses, including deductible, co-pays, etc.) would be limited to perhaps $1,000/year or so.

On the downside, of course, this still wouldn't be ideal by any means at this income level. Even with $0 premiums, the decuctible & co-pays (even vastly reduced) would still be hard to swing for most of these folks, especially those below, say, 75% FPL.

In addition, this would pretty much guarantee that none of the 12 states listed above would ever expand Medicaid in the future...and worse yet, some of the states which have expanded it would almost certainly allow their expansion programs to expire and not renew them. APTC and CSR assistance is paid for 100% via federal funding, while the states have to cover 10% of the cost of Medicaid expansion, so offloading their Medicaid expansion enrollees back onto subsidized ACA plans would effectively save the states hundreds of millions of dollars (or even a billion or two) per year on their state budgets.

This is precisely why I backtracked on recommending killing the lower-bound subsidy cliff 4 years ago, and I suspect it's why this hasn't been part of any ACA 2.0 plans until now...the hope was that we'd be able to continue the process of winning over non-expansion states one by one.

Even so...this would still be better than having no decent healthcare options available whatsoever. It'd be something, and would probably be taken up by those in the 75 - 100% range, at least.

It's a tough call, really. On the one hand, activists have managed to push expansion through five deep red states via ballot initiatives. On the other hand, doing so has required a ton of hard work by thousands of people, it's taken years to get some of these initiatives through, and there's no way of knowing how long it would take to get it through the remaining states. In the meantime, that's still millions of people trapped with no viable options for quality healthcare coverage.

There's one thing which makes me uncertain about whether H.R. 369 would address the Medicaid Gap aspect, however. As Stan Dorn of Families USA opinted out to me, there's a portion of Section 1401 of the ACA, unmentioned in Rep. Underwood's previous version of the bill, which might cause a snag:

‘‘(c) DEFINITION AND RULES RELATING TO APPLICABLE TAXPAYERS, COVERAGE MONTHS, AND QUALIFIED HEALTH PLAN.—For purposes of this section—

‘‘(1) APPLICABLE TAXPAYER.—

‘‘(A) IN GENERAL.—The term ‘applicable taxpayer’ means, with respect to any taxable year, a taxpayer whose household income for the taxable year exceeds 100 percent but does not exceed 400 percent of an amount equal to the poverty line for a family of the size involved.

‘‘(B) SPECIAL RULE FOR CERTAIN INDIVIDUALS LAWFULLY PRESENT IN THE UNITED STATES.—If—

‘‘(i) a taxpayer has a household income which is not greater than 100 percent of an amount equal to the poverty line for a family of the size involved, and

‘‘(ii) the taxpayer is an alien lawfully present in the United States, but is not eligible for the medicaid program under title XIX of the Social Security Act by reason of such alien status, the taxpayer shall, for purposes of the credit under this section, be treated as an applicable taxpayer with a household income which is equal to 100 percent of the poverty line for a family of the size involved.

As Stan explained to me, this section exists so that certain lawfully present immigrants who earn less than 100% FPL but aren't eligible for Medicaid for some paperwork reason or another are allowed to receive ACA subsidies as if they earned exactly 100% FPL.

The problem in this instance is that the first part of the section (A) appears to still limit ACA subsidies to those earning between 100 - 400% FPL regardless of what it says in the APTC table. If I'm correct about this, not only would H.R. 369 not have any impact on those caught in the Medicaid Gap...it also wouldn't result in the subsidy cliff being killed either, since only those earning 100 - 400% FPL would be defined as "applicable taxpayers".

In fact, there's actually several other references to the "400% FPL" cut-off point throughout the ACA...I don't know if any of these would have to have legislative language baked into H.R. 369 to allow the subsidy cliff to be killed as well:

- In the section on Reconciliation of Credit and Advance Credit:

‘‘(B) LIMITATION ON INCREASE WHERE INCOME LESS THAN 400 PERCENT OF POVERTY LINE.—

‘‘(i) IN GENERAL.—In the case of an applicable taxpayer whose household income is less than 400 percent of the poverty line for the size of the family involved for the taxable year, the amount of the increase under subparagraph (A) shall in no event exceed $400 ($250 in the case of a taxpayer whose tax is determined under section 1(c) for the taxable year).

- In section 1402 regarding Cost Sharing Reductions:

(b) ELIGIBLE INSURED.—In this section, the term ‘‘eligible insured’’ means an individual—

(1) who enrolls in a qualified health plan in the silver level of coverage in the individual market offered through an Exchange; and (2) whose household income exceeds 100 percent but does not exceed 400 percent of the poverty line for a family of the size involved.

(c) DETERMINATION OF REDUCTION IN COST-SHARING.—

(1) REDUCTION IN OUT-OF-POCKET LIMIT.—

(A) IN GENERAL.—The reduction in cost sharing under this subsection shall first be achieved by reducing the applicable out-of pocket limit under section 1302(c)(1) in the case of—

(i) an eligible insured whose household income is more than 100 percent but not more than 200 percent of the poverty line for a family of the size involved, by two thirds;

(ii) an eligible insured whose household income is more than 200 percent but not more than 300 percent of the poverty line for a family of the size involved, by one half; and

(iii) an eligible insured whose house9 hold income is more than 300 percent but not more than 400 percent of the poverty line for a family of the size involved, by one-third.

In this case, CSRs were weakened in the final version of the ACA as signed into law to only range from 100 - 250% FPL instead of 100 - 400% FPL...but this still raises the question of whether those earning less than 100% FPL would qualify for CSR assistance or not. If they didn't, then those in the Medicaid Gap would see $0 premiums...but still be hit with massive deductibles to the tune of $6,000 or more.

I should note that I could be wrong about some of this, of course. I've brought it to the attention of a healthcare policy advisor in Rep. Underwood's office and am waiting to hear back from them.

Stay tuned...

UPDATE: Nice catch by Louise Norris (of course). The language of the ACA as it stands now already includes the "Up to" wording for the subsidy table after all:

In other words, it's not the H.R. 1425 or H.R. 369 language which changes this; it's the other way around--H.R. 1868 / H.R. 1884 are the ones which added the 100% lower-bound subsidy cut-off, which was then corrected in H.R. 1425 / H.R. 369.

I had this issue completely backwards--if the 100% had been left in the table, that would have prevented otherwise eligible immigrants below that threshold from receiving subsidies, so 1425/369 fix that issue.

This means that no, 1425/369 would not address the Medicaid Gap after all.

As for the various references to the 400% FPL cliff, both H.R. 1425 and Rep. Underwood's previous version of her bill (H.R. 1868) both included this line:

(b) Conforming Amendment.—Section 36B(c)(1)(A) of the Internal Revenue Code of 1986 is amended by striking “but does not exceed 400 percent”.

...which I assume covers all of the other relevant "400% FPL" references throughout the ACA. Hopefully they didn't miss any, or we're back in King vs. Burwell territory, I'd imagine...