Update: CMS still won't launch HC.gov #COVID19 SEP, but they aren't requiring documentation for SEP enrollees!

For over a month now, I (and many, many others) have been pleading with HHS Secretary Alex Azar, CMS Administrator Seema Verma and CMS itself to launch a formal, "open" COVID-19 specific Special Enrollment Period for the millions of people living in the 38 states hosted by HealthCare.Gov who are uninsured but who don't qualify for Medicaid, CHIP or other "year-round enrollment" programs such as the Essential Plan in New York, MinnesotaCare in Minnesota or ConnectorCare in Massachusetts. Even the insurance industry--which normally hates letting people enroll at any time outside of the official Open Enrollment Period--has been calling for them to do so.

Twelve of the thirteen state-based ACA exchanges have already done this, and there's really no logical reason for CMS not to do so as well. The excuse given until now for not doing so is that the bulk of the 22 million people who've lost their jobs so far (and with it, their employer-sponsored healthcare coverage in most cases) are already eligible for a traditional 60-day Special Enrollment Period via the "lost my coverage" Qualifying Life Event.

However, as I explained in painful detail a few weeks ago, this still presents a major logistical problem even if you want to limit SEPs to those who've lost their existing coverage: The documentation/verification requirements imposed by the Trump Administration for those enrolling via SEPs is painful, confusing and cludgy even under normal circumstances. Ramping this up by a good 15x the normal application load is bound to make things...worse, to put it mildly.

I noted that twelve of the state-based exchanges have launched COVID-19 SEPs to anyone uninsured (in fact, Connecticut's just ended a few days ago, and Minnesota's deadline is tonight). The thirteenth SBE, Your Health Idaho, has decided (after weeks of pressure) to sort of split the difference:

Impacts from COVID-19 (coronavirus) continue to spread throughout our communities and around the world. As we grapple with this new reality, Your Health Idaho remains committed to serving Idahoans by providing a path to health insurance coverage when the need is greatest.

At a time when the overall health and well-being of our collective population is the top priority, Your Health Idaho is working hard to help Idahoans who have been impacted by COVID-19, specifically those who now find themselves out of a job and without health benefits.

In partnership with the Idaho Department of Insurance and Idaho insurance providers, and in alignment with Governor Little’s initiative to reduce regulations, Your Health Idaho is working to relax the requirements for eligible Idahoans to enroll in coverage.

...Idahoans who have lost employer-sponsored health insurance as a result of termination, layoff, or furlough due to COVID-19 are eligible for a Special Enrollment Period. Previously this process would require several steps of documentation and validation. Under the newly relaxed policy, in lieu of documentation and proof of termination, Idahoans can now submit a written statement explaining their loss of employer health benefits. This new process removes time-consuming barriers and ensures an expedited path to coverage.

In other words, Idaho is not launching an "open" SEP for any uninsured Idahoan, but they are at least waiving the normal documentation/verification process. This basically amounts to relying on the honor system for those claiming to have lost their employer coverage...they just have to jot down a simple written statement and that will suffice.

This still isn't nearly as good as an open SEP given the circumstances, but it's a a lot better than forcing everyone to jump through the normal documentation hoops.

Well, yesterday Amy Lotven of Inside Health Policy reported that in response to the growing heat and criticism, CMS is apparently at least following Idaho's lead over at HealthCare.Gov:

CMS Won't Do SEP Outreach, But Will Grant Flexibility

CMS tells Inside Health Policy that, while it has no plans to proactively reach out to consumers about existing special enrollment periods, it has updated heathcare.gov with a new webpage on available options and will offer consumers who visit the site enrollment flexibility on document verification during the pandemic.

CMS is providing flexibility around submission of certain documents, such as a document confirming loss of coverage from one’s employer, during the pandemic emergency, the agency says.

The new webpage includes information on the existing SEPs, including one available for anyone who lost employer-sponsored or any other type of minimum essential coverage, or for marketplace enrollees who lost hours and may be newly eligible for financial assistance.

The marketplace also assesses whether someone may be eligible for Medicaid or the Children’s Health Insurance Program, another reason CMS says it is important for people who lost their jobs or income to visit the site.

Kids who have been sent home from college due to the virus can generally qualify for a SEP if they were enrolled in a student health plan, but the benefits don’t extend to the new geographic area. Parents can also enroll children under age 26 in their employer-sponsored plan. Further, anyone who may have been eligible for a special enrollment period, but was unable to enroll in time due to the federal emergency, may be eligible to enroll and should contact the marketplace, CMS says.

Healthcare.gov further affirms that the $1,200 payments from IRS will not be considered income for eligibility for Medicaid or for Affordable Care Act subsidies.

Here's the page referred to in the article, which I mentioned briefly a few days ago but hadn't really check into yet:

Marketplace coverage & Coronavirus

If you already have coverage through the Marketplace, the rules in your Marketplace health plan for treatment for the coronavirus emergency (officially called 2019 Novel Coronavirus or COVID-19) remain the same as any other viral infection.

- See what Marketplace plans cover.

- You can also check with your health insurance company for their specific benefits and coverage policy.

All Marketplace plans cover treatment for pre-existing medical conditions and can’t terminate coverage due to a change in health status, including diagnosis or treatment of COVID-19. While your coverage benefits will remain the same, you should log in to update your Marketplace application if COVID-19 impacts your income or household. You may be able to change your plan if certain situations apply.

If I lost my job or experienced a reduction in hours due to COVID-19

- If you lost your job-based health plan: You may qualify for a Special Enrollment Period if you lost health coverage through your employer or the employer of a family member in the past 60 days OR you expect to lose coverage in the next 60 days, including if you lose health coverage through a parent or guardian because you're no longer a dependent. Note: Losing coverage you have as a dependent doesn't qualify you for a Special Enrollment Period if you voluntarily drop the coverage. You also don't qualify if you or your family member loses coverage because you don't pay your premium.

- If your employer reduced the hours you work and you’re enrolled in a Marketplace plan: Update your application immediately within 30 days to report any household income changes. You may qualify for more savings than you’re getting now. Learn how to report changes.

- If you were furloughed: In some situations depending on the status of your health coverage from your employer, you may qualify for a Special Enrollment Period. You may be eligible for a premium tax credit to help pay for Marketplace coverage too. Create an account or log in to start your Marketplace application to find out if you qualify.

- If you have COBRA continuation coverage:

- If you’re entitled to COBRA continuation coverage after you lost your job-based coverage, you may still qualify for a Special Enrollment Period due to loss of coverage. You have 60 days after your loss of pre-COBRA job-based coverage to enroll in Marketplace coverage. You may also qualify for premium tax credits if you end your COBRA continuation coverage.

- If you're enrolled in COBRA continuation coverage, you may qualify for a Special Enrollment Period if your COBRA continuation coverage costs change because your former employer stopped contributing, so you have to pay full cost. Learn more about COBRA continuation coverage and the Marketplace.

- If you lost your job, but didn’t also lose health coverage, because your former job didn’t offer coverage: You generally won't qualify for a Special Enrollment Period. By itself, a job loss (or a change in income) doesn't make you eligible for a Special Enrollment Period to enroll in Marketplace coverage. See if you qualify for a Special Enrollment Period another way.

Coverage start dates with a Special Enrollment Period due to loss in coverage

- If you’ve already lost coverage, your Marketplace coverage can start the first of the month after you apply and enroll.

- If you know you’ll lose coverage within the next 60 days, you can submit an application on HealthCare.gov before you actually lose your coverage to help make sure there’s no gap in coverage. For example, if you know you’ll lose coverage on April 30, and apply and enroll in a Marketplace plan April 10, your new coverage will start May 1.

If I can’t pay my premiums because of a hardship due to COVID-19

- Check with your insurance company about extending your premium payment deadline or ask if they will delay terminating your coverage if you can’t pay your premiums.

- Most of the time, if you aren’t receiving financial assistance with your premiums, you have a grace period determined by state law (often one month). If you’re getting financial assistance, you have a three-month grace period during which your coverage can’t be terminated for not paying your premiums.

- If your household income has changed, update your application immediately. You could qualify for more savings than you're getting now.

If I’m enrolled in a Marketplace plan and my income has changed

- If you’re enrolled in a Marketplace plan and your household income has changed, update your application immediately. If your income goes down or you gain a household member:

- You could qualify for more savings than you’re getting now. This could lower what you pay in monthly premiums.

- You could qualify for free or low-cost coverage through Medicaid or the Children’s Health Insurance Program (CHIP).

If I previously qualified for a Special Enrollment Period, but missed the deadline because I was impacted by the COVID-19 national emergency

If you qualified for a Special Enrollment Period but missed the deadline due to COVID-19 (like if you were sick with COVID-19 or were caring for someone who was sick with COVID-19), you may be eligible for another Special Enrollment Period. Visit FEMA.gov for information about emergencies in your state.

To see if you’re eligible for this Special Enrollment Period, contact the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325).

If I want to change my current Marketplace plan or enroll for the first time

- If you’ve had qualifying life changes, like if you move, have a baby, or lose other health coverage, you may be able to enroll in Marketplace coverage for the first time or change your current plan through a Special Enrollment Period.

- Answer a few questions to find out if you can enroll in or change your coverage.

If my child is now living with me after their college sent them home early

- Your child can generally qualify for a Special Enrollment Period due to change in residence if they’re:

- Still enrolled in a student health plan that counts as qualifying health coverage, but the coverage and benefits don’t extend to your area.

- Had qualifying health coverage or lived in a foreign country or a U.S. territory for at least one of the 60 days before the date of their move. Note: This requirement doesn’t apply to members of a federally recognized tribe or Shareholders of Alaska Native Corporations.

- If your child is under 26 and you’re already enrolled in Marketplace coverage, you may be able to add your child to your plan.

- If you have Marketplace coverage with savings and don’t plan to claim your child as a tax dependent on your federal tax return, your child should set up their own Marketplace account and submit a separate application.

- If you plan to claim your child as a tax dependent on your federal tax return, and you currently have Marketplace savings with your coverage, you can update your Marketplace application and add your child.

- If you have Marketplace coverage without requesting savings, you can put everyone on one application.

If I get a direct deposit or check from the IRS that is called an economic impact payment

The Coronavirus Aid, Relief, and Economic Security (CARES) Act calls for the IRS to make economic impact payments of up to $1,200 per taxpayer and $500 for each qualifying child. If you get one of these payments, you don't need to include it in the income you report on your HealthCare.gov application. These payments don't impact your eligibility for financial assistance for health care coverage through the Marketplace, or your eligibility for Medicaid or the Children’s Health Insurance Program (CHIP). For more information, visit IRS Coronavirus Tax Relief information.

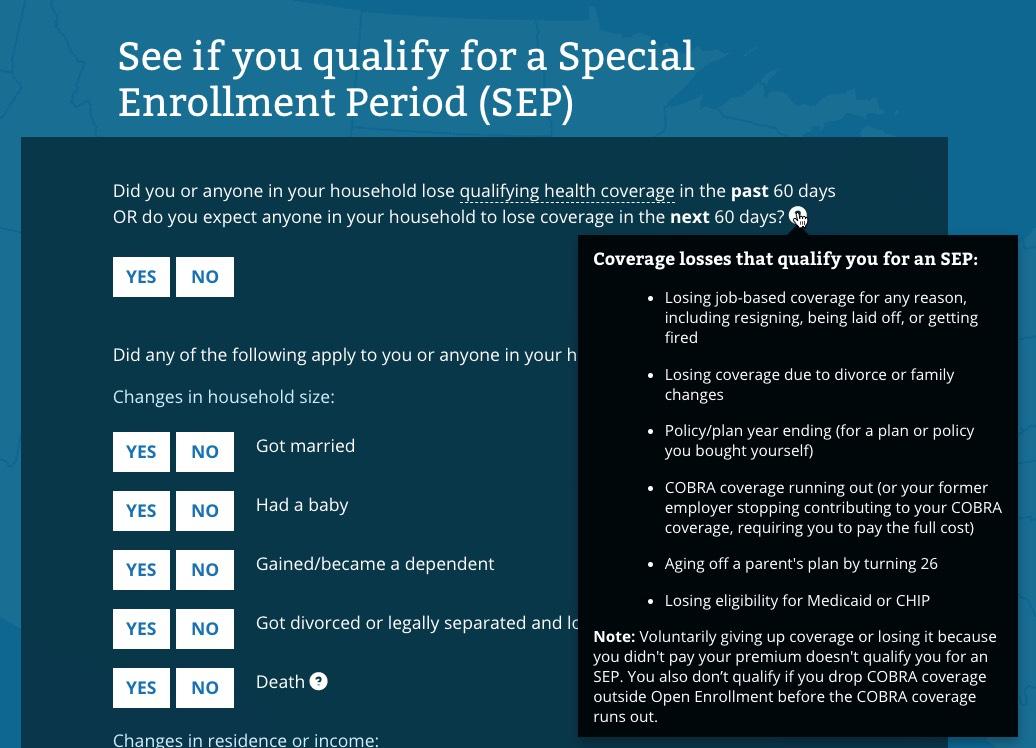

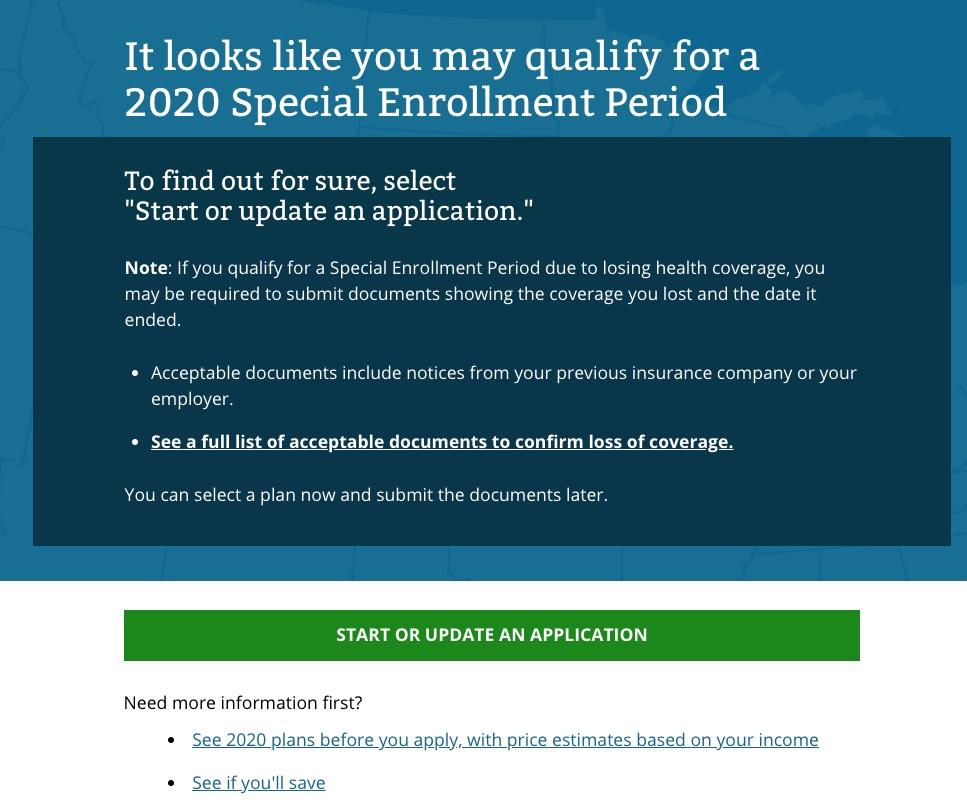

I don't actually see anything in the text above which clarifies anything regarding "flexibility on documentation". I'm not entirely sure what it means...does it mean a simple written explanation like Idaho is allowing? Here's the screens you'll see when you check to see whether you qualify for a Special Enrollment Period. The first three look mostly the same...

...but the fourth screen may have changed a bit:

I've never actually enrolled via a Special Enrollment Period, so I'm not sure whether the "acceptable documents" wording has changed or not, on either this page or the "full list" page:

What documents can I submit?

Documents must show that you lost qualifying health coverage in the past 60 days or will lose coverage in the next 60 days. These documents must include your name and the date of coverage loss. Documents you can submit:

- A letter from an insurance company, on official letterhead or stationery, including:

- A letter or premium bill from your former insurance company that shows you or your dependent’s cancellation/termination from health coverage.

- A decertification letter from your insurance company stating when coverage will no longer be offered.

- A letter from an employer, on official letterhead or stationery, that confirms one of these about you or your spouse or dependent family member:

- That your employer dropped or will drop your coverage or benefits.

- That your employer stopped or will stop contributing to your cost of coverage.

- That your employer changed or will change coverage or benefits, and your coverage will no longer be considered qualifying health coverage.

- A letter about COBRA coverage, like a letter from an employer or health insurance company that confirms these:

- Your employer’s offer of COBRA coverage along with the date this coverage would start.

- Your COBRA coverage ended or will end, or your employer stopped or will stop contributing to the cost of coverage and when.

- A health care program document, on official letterhead or stationery, including:

- A letter from a government health program, like TRICARE, Veterans Affairs (VA), Peace Corps, or Medicare, showing when coverage ended or will end.

- A letter from your state Medicaid or CHIP agency showing that your eligibility for Medicaid or CHIP was denied and when it was denied or that your Medicaid or CHIP coverage ended or will end.

- A dated copy of your military discharge document (DD214).

- A letter if you lost student health coverage, which shows when the coverage ended or will end. This should be on official letterhead or stationery.

You can also submit any of the documents in the list below. However, these documents may include only some of the information we need to confirm, so you’ll most likely need to submit more than one of these documents:

- Pay stubs, if you lost employer-sponsored coverage. You can submit:

- 2 pay stubs from the past 1-3 months, one that shows a deduction for health coverage and another which shows that the deduction ended in the past 60 days.

- If a reduction in work hours caused you to lose coverage, you can submit one previous pay stub that shows that you worked 30 or more hours and a deduction for health coverage, and a pay stub from the past 60 days that shows that you worked less than 30 hours and no deduction for health coverage.

- Document showing you lost coverage because of divorce, legal separation, custody agreements, or annulment within 60 days of submitting your application, including:

- Divorce or annulment papers that show the date responsibility ends for providing health coverage or proof that you stopped getting health coverage because of your relationship to your former spouse.

- Legal separation papers that show the date responsibility ends for providing health coverage.

- Other confirmation that you lost or will lose coverage because of divorce, legal separation, or annulment that shows the date that health coverage ends.

- Document showing you lost coverage due to death of a family member, including:

- A death certificate or public notice of death and proof that you were getting health coverage because of your relationship to the deceased person, like a letter from an insurance company or employer that shows the names of the people on the health plan.

- Other confirmation that shows you lost or will lose coverage because of the death of a spouse or other family member.

You can upload more than one document if you have multiple documents to confirm coverage loss. Select the green "UPLOAD DOCUMENTS" button on the upload screen in your application to submit each document.

UPDATE: Per Josh Schultz's suggestion, I ran the page through the Internet Archive Wayback Machine and came up with...identical wording on February 4th, 2020. If anything is different, I can't find it.

UPDATE: OK, via Andrew Sprung of Xpostfactoid, CMS is indeed doing the same thing for HealthCare.Gov that Idaho is doing for Your Health Idaho (waiving documentation and just requiring enrollees to attest that they lost their existing healthcare coverage)...but unlike Idaho, CMS doesn't appear to be going out of their way to advertise this fact either.

Here's the verbatim statement from CMS's official CCIIO (Center for Consumer Information & Insurance Oversight) representative during the training webinar that Sprung refers to while discussing Qualifying Life Events (QLEs) which make someone eligible for a Special Enrollment Period enrollment:

“I do want to point out that right now the Marketplace is not requiring consumers to upload supporting documentation to verify their eligibility to enroll in a Special Enrollment Period. So instead, consumers may attest to that information that they provide on the application while they are applying for a SEP.”

I don't know where exactly in the application process the attestation step is, but this is welcome news. As I noted above, it's still not nearly as good as a full "open" SEP given the circumstances, but it should help streamline the process for many enrollees.

Note that you still have to actually have experienced a QLE to be eligible; if you do get busted lying, it's still a violation of HealthCare.Gov's terms of service, so those living in the 38 HealthCare.Gov states should still only utilize a SEP if they actually did lose their employer coverage have one of the other QLEs.