ACA 2.0: Massachusetts (MA-02): How much would #HR1868 lower YOUR premiums?

Last March I wrote an analysis of H.R.1868, the House Democrats bill that comprises the core of the larger H.R.1884 "ACA 2.0" bill. H.R.1884 includes a suite of about a dozen provisions to protect, repair and strengthen the ACA, but the House Dems also broke the larger piece of legislation down into a dozen smaller bills as well.

Some of these "mini-ACA 2.0" bills only make minor improvements to the law, or make improvements in ways which are important but would take a few years to see obvious results. Others, however, make huge improvements and would be immediately obvious, and of those, the single most dramatic and important one is H.R.1868.

The official title is the "Health Care Affordability Act of 2019", but I just call both it and H.R.1884 (the "Protecting Pre-Existing Conditions and Making Health Care More Affordable Act of 2019") by the much simpler and more accurate moniker "ACA 2.0".

The official lead sponsor of H.R.1868 is Rep. Lauren Underwood (IL-14). While it currently only has 35 cosponsors, the larger H.R.1884 bill that includes H.R.1868 has 160 total sponsors to date, so there's strong support within the Democratic caucus.

H.R.1868 itself is a very short and simple bill which does just two things, both of which involve changes to the current formula for ACA individual market subsidies:

- First, it removes the current tax credit maximum income eligibility threshold of 400% of the Federal Poverty Line (around $50,000/year if you're single, or $100,000/year for a family of four).

- Second, it makes the underlying formula for the tax credits more generous: Instead of the maximum amount the enrollee has to pay for a benchmark Silver plan ranging from around 2.1% of their income up to around 9.8%, H.R.1868 would drop this down to between 0% - 8.5% of income at the outside.

This may not sound like much, but it would make a huge difference for millions of Americans. The main beneficiaries would be the middle class...people earning too much to qualify for subsidies today, but not enough to easily afford ACA-compliant policies (basically, between 400 - 800% FPL). However, many of those who are already receiving subsidies would also see additional savings.

It's important to keep in mind that there are three main trouble spots when it comes to the individual market under the ACA: Premiums (mostly for the unsubsidized); deductibles/co-pays (for those earning more than 200% FPL); and provider network width. H.R.1868 addresses the first of these three, and it does so very well.

There are other provisions in the larger "omnibus" ACA 2.0 bill (and especially in the Senate version, S.1213) which deal with the other two, but for this project I'm only looking at the first: High premiums.

When I ran the numbers for my March analysis of H.R.1868, I used the national average premiums for Silver plans, which cover around 70% of the average person's medical expenses per year. However, that premium can vary greatly from state to state, county to county, carrier to carrier and even by the specific Silver plan you're looking at.

The actual measure is to look at the benchmark plan for the specific geographic area that the enrollee(s) live in. Under the ACA, the benchmark plan is the second lowest-cost Silver plan available on the ACA exchange.

It's important to understand that in addition to where they live, the benchmark plan premium will also vary greatly depending on...

- The number of people living in the household; obviously it will be different for a single adult vs. a family of four.

- The age of the enrollees: Unless you live in New York or Vermont, a millennial will cost a lot less than a baby boomer.

- In some states, children under 18 are eligible for CHIP or Medicaid at lower income levels even if the parents aren't.

- In states which have refused to expand Medicaid, those who earn 100-138% FPL are also eligible for extremely generous private plan subsidies.

- In Alaska and Hawaii, the FPL threshold is higher than in the rest of the country.

Therefore, I've decided to launch a new project: I'm going to run the numbers for H.R.1868 for all 435 Congressional Districts.

In terms of methodology, the first challenge is the geography. Most states have multiple premium rating areas (that is, carriers can charge different rates for the same plan in one vs. another within the state); not every carrier offers plans in every part of the state; and of course there's no connection between the insurance rating areas and Congressional District boundaries (especially with some gerrymandered districts winding their way from one end of the state to the other).

My solution to this is to simply pick the zip code of each Representative's home town (there are nearly 42,000 zip codes nationally).

Second: I have to account for the wide variance of household makeups. There's an endless array of possibilities, but I settled on four specific households. Collectively, I think these are about as representative as I could reasonably be.

This is, needless to say, an extremely ambitious and time-consuming project. It'll take months for me to get to every district, assuming I even do get to all of them.

Today, I'm looking at Massachusetts' 2nd Congressional District. MA-02 is represented by Democrat Jim McGovern, who lives in Worcester:

Important: The tables and graphs for examples in Massachusetts look a different from most states for two reasons:

First, MA has a different Age Band rule for health insurance premiums. In most states, the ACA allows premiums for older enrollees to cost up to 3x as much as they do for younger enrollees. As a result, the unsubsidized price for a 64-year old will generally be 3x higher than for a 21-year old enrollee. In Massachusetts, however, this range is limited to a 2:1 ratio,

In addition, Massachusetts already has their own, unique state-based supplemental subsidy program in place for ACA enrollees earning less than 300% FPL. Unlike California, which simply shaves a point or two off the premiums for those earning 200-400% FPL, Massachusetts' program actually enrolls people earning 138 - 300% FPL into special, separate ACA-compliant policies called "ConnectorCare".

ConnectorCare policies are very generous, with no deductibles or coinsurance, reasonable co-pays and very low premiums. They remind me very much of New York and Minnesota's Basic Health Plan programs, which are allowed by and funded by the Affordable Care Act. The biggest differences are:

- BHP plans are only available for those earning up to 200% FPL; ConnectorCare is available up to 300% FPL

- BHP plans aren't included as part of the ACA market risk pool for purposes of rate setting, nor do the count as part of the official CMS ACA enrollment reports, while ConnectorCare is counted within the same risk pool as other ACA plans and are included in official enrollment reports

It's worth noting that Massachusetts has had the lowest unsubsidized (full-price) individual market premiums in the country for seven years running, so perhaps other states should take a look at how they have things set up?

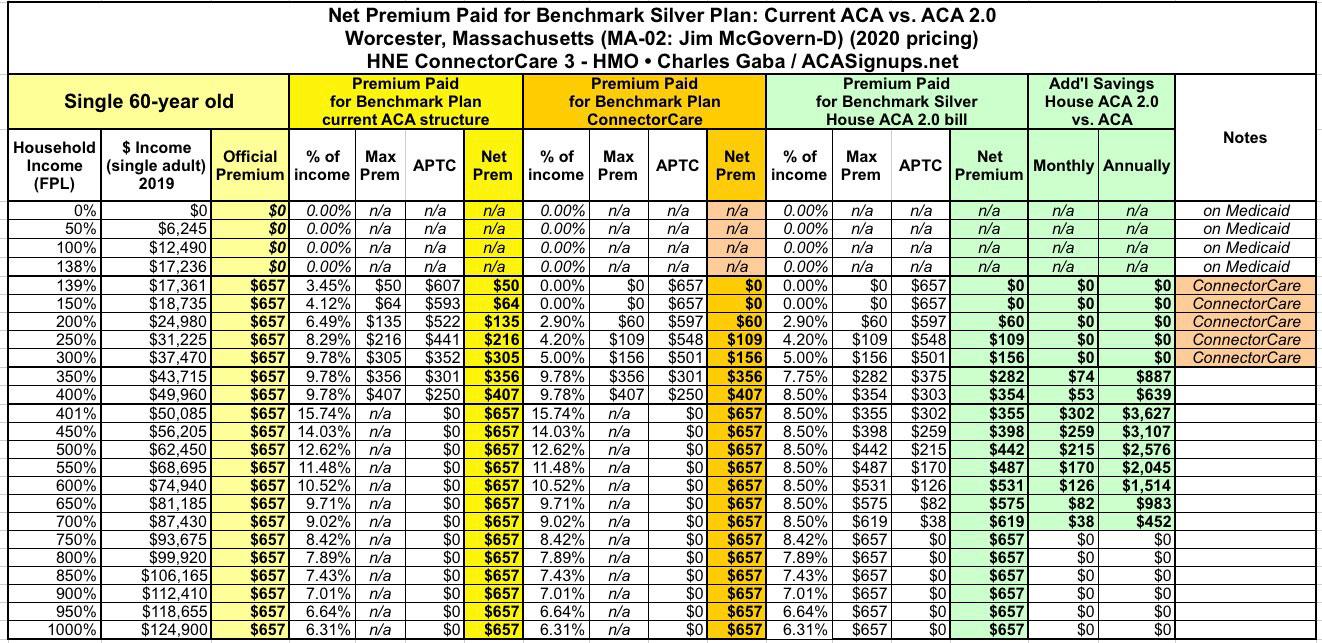

With all this in mind, here's the case studies, with extra columns added to account for MA's unique ConnectorCare arrangement:

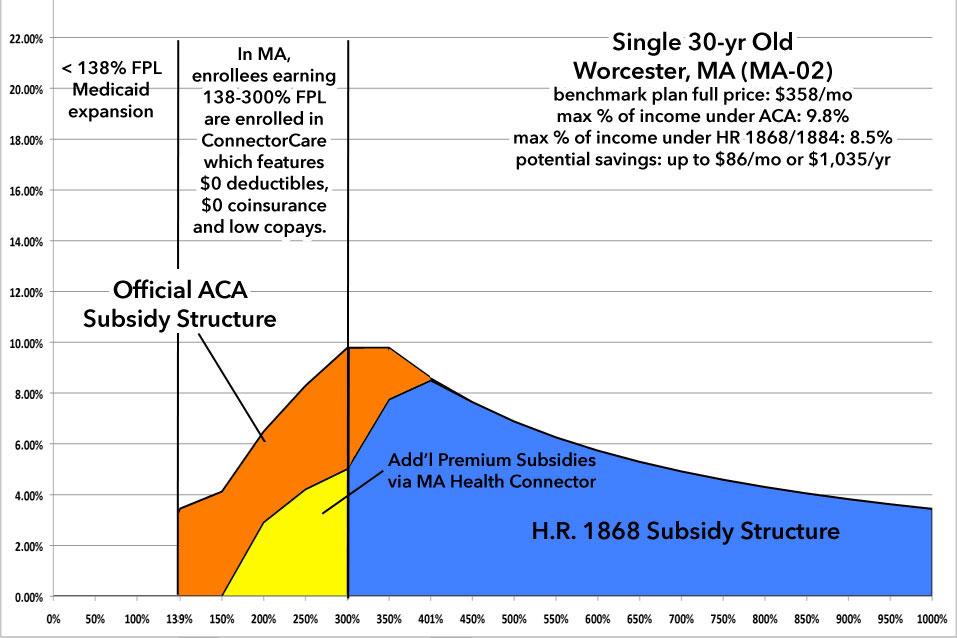

First up: A single 30-year old:

Without any subsidies, this young adult would be paying $358/month regardless of his or her income. Under the current ACA subsidy formula, they qualify for Medicaid up to an income of $17,300/year. In Massachusetts, between $17,300 - $37,500 they qualify for ConnectorCare policies, which don't cost anything until they break 200% FPL, and then range from $60 - $156/month up to 300% FPL. From 300-400% FPL they pay no more than 9.8% of their income.

Since they're younger, the full-price premium never actually hits the ACA's subsidy cliff at 400% FPL anyway; between that and the ConnectorCare program, H.R. 1868 would only be relevant to those earning between 300 - 400% FPL...but it'd still save them up to $1,000/year, which isn't bad.

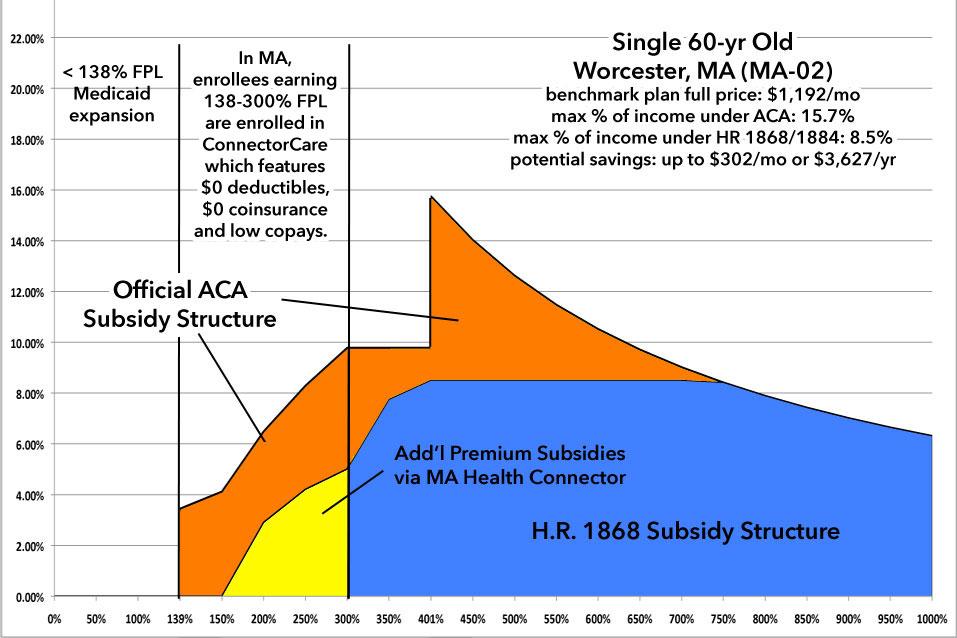

Next: A single 60-year old:

At 60 years old, the single adult's full-price premium is nearly twice as much as the 30-year old. This means that the ACA's subsidy cliff is now quite apparent. Again, up to 300% FPL they'd be enrolled in either Medicaid or a low-premium/$0 deductible ConnectorCare policy, but over 300% FPL, under H.R. 1868 they'd save as much as $300/month or over $3,600/year:

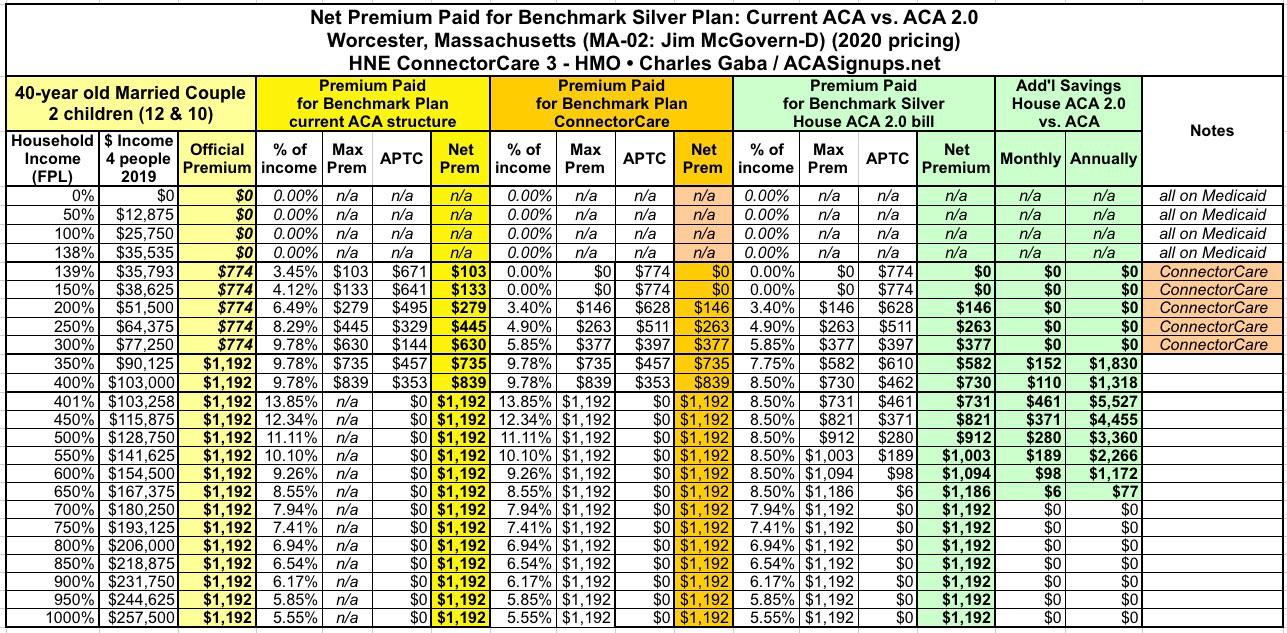

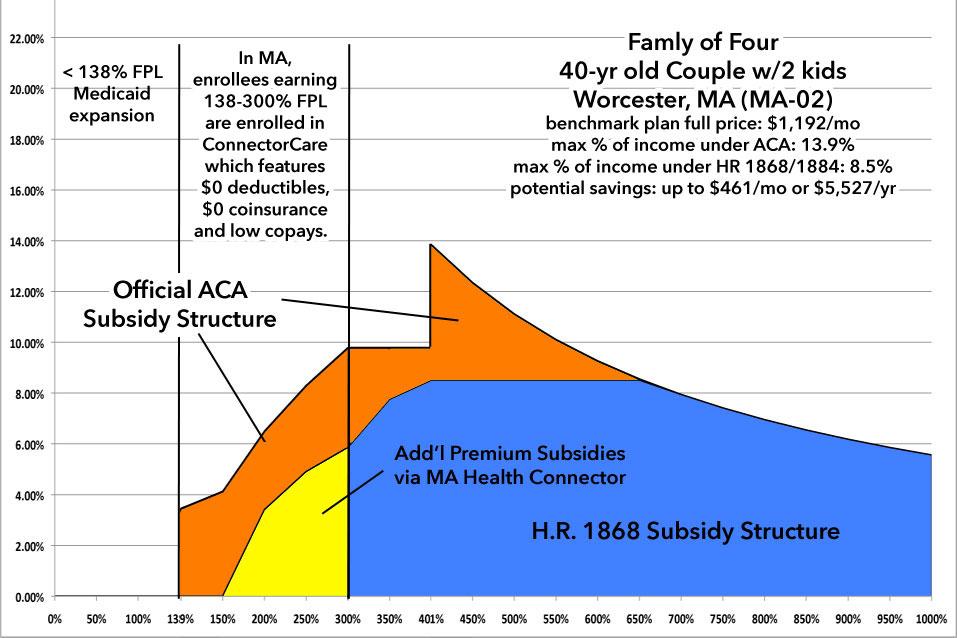

Nuclear Family: A 40-year old married couple with two children aged 12 & 10:

At full price, this family would be looking at spending nearly $1,200/month in premiums. Thanks to the ACA, of course, they'd all be on either Medicaid or a ConnectorCare plan up until they hit around 300% FPL ($77,000/year), paying nothing in premiums up to 150% and paying no more than 5.9% above that. From 300-400% FPL, they're limited to 9.8% of income.

The moment they break the 400% FPL threshold, however ($103,000/year), they have to start paying full price, which amounts to as much as 13.9% of their income.

Under H.R.1868/1884, this would drop to 8.5%, saving them as much as $461/mo or $5,527/year...and they'd still save up to $1,800 more per year even if they already receive assistance.

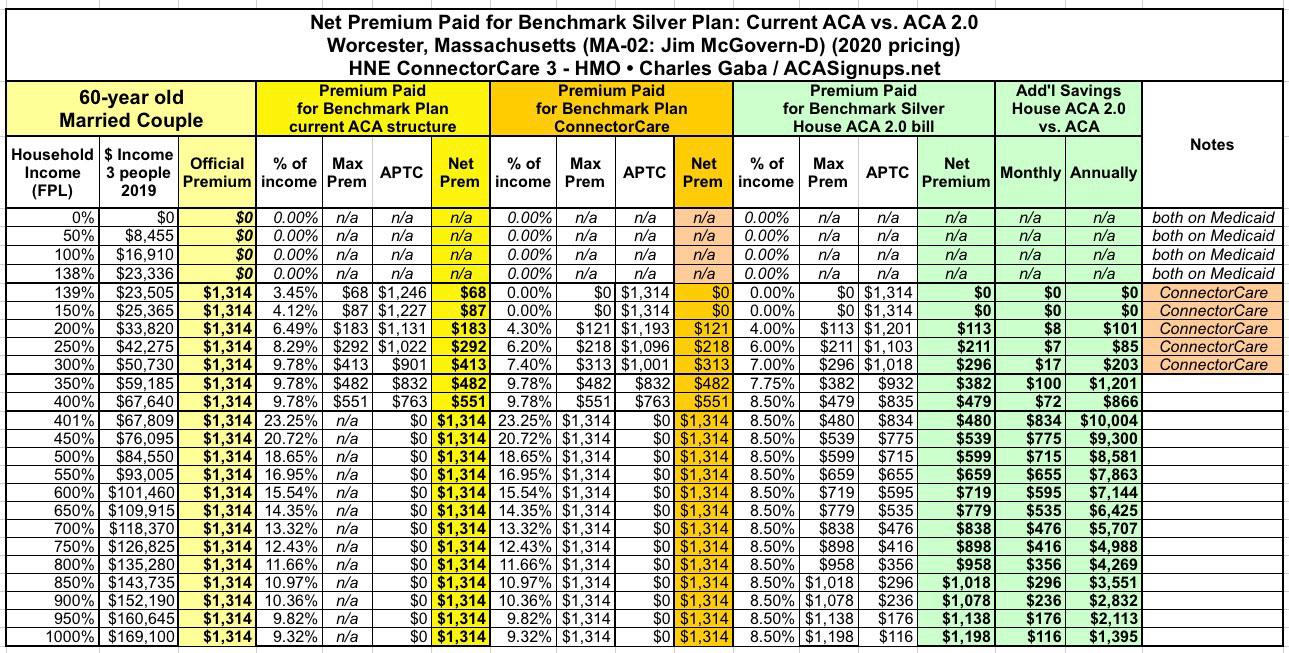

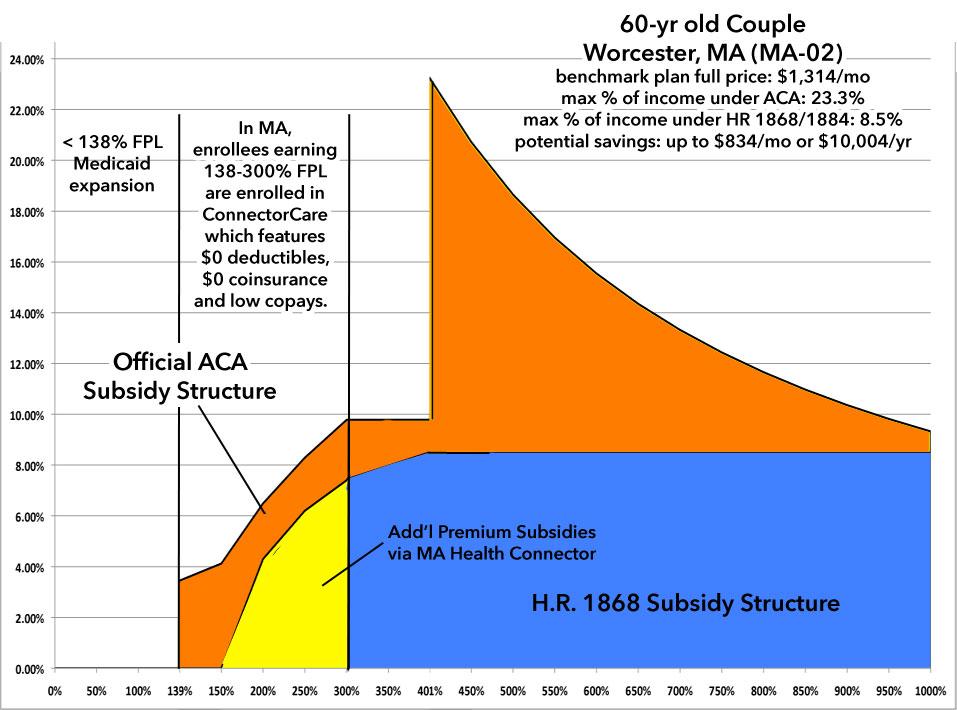

Finally, a 60-year old married couple:

Under the current ACA formula, once this older couple hits around $68,000/year in income, at full price they have to pay as much as 23.3% of their income in premiums.

Under H.R. 1868 / 1884, again, they'd pay no more than 8.5% in premiums, reducing their net premiums from $1,314/month down to as little as $480/month, a reduction of a whopping $834/month or over $10,000/year.