California: 1.29M QHPs thru 11/30 w/auto-renewals (over 90.5K *new* enrollees); down 0.9% year over year

This just in...

Covered California’s Open Enrollment Is off to a Solid Start as the First Key Deadline Approaches

- More than 90,500 new consumers selected a plan through Nov. 30.

- While plan selections are ahead of the pace set in 2016, when Covered California also delayed its marketing until after Election Day, they are slightly behind the pace set during 2017.

- Roughly 1.2 million Covered California enrollees have been renewed for 2019, similar to last year’s totals.

- An estimated 1.1 million uninsured Californians are eligible to enroll in Covered California or Medi-Cal. New research shows that 82 percent of uninsured consumers surveyed, who are eligible for financial assistance, do not know that they qualify.

- Consumers must sign up by Dec. 15 in order to have their health insurance start on Jan. 1, 2019. Open enrollment in California continues through Jan. 15.

It's important to keep in mind that CoveredCA technically launched their 2019 Open Enrollment Period way back on October 15th, but as they note, they didn't start marketing/advertising until November 7th (after the midterm election was over).

Covered California announced today that more than 90,500 new consumers signed up for coverage through Nov. 30. The number of plan selections is well ahead of the pace set in 2016, which marked the last time Covered California delayed its marketing push until after Election Day, when 80,000 consumers signed up through November.

“Covered California is off to a solid start, signing up tens of thousands of people who understand the importance of having quality health care coverage, but it’s just a start,” said Covered California Executive Director Peter V. Lee. “For most of the nation, the open-enrollment period is done in two weeks, but that’s not the case in California.”

Covered California’s enrollment period began on Oct. 15 and continues through Jan. 15, 2019. Unlike the federal open-enrollment period, which ends Dec. 15, California continues to have a three-month enrollment period. Consumers who want their coverage to begin on Jan. 1 will need to sign up by Dec. 15.

“We know that deadlines matter to people, and for Covered California the two key deadlines coming up are Dec. 15 and Jan. 15,” Lee said. “Sign up by Dec. 15 and you can be covered on New Year’s Day, and if you miss that deadline you will still have until Jan. 15 to sign up for quality health care coverage that meets the needs of you and your family.”

While the number of plan selections is ahead of the pace set during the last election year, it is slightly behind the pace set last year when 102,000 consumers signed up through November. Lee notes that while it is too early to draw conclusions, there could be several possible explanations for why enrollment is behind last year’s pace. In addition to delaying marketing until after the election, there is less media attention on open enrollment as the debate over “repeal and replace” has faded, and consumers may not sign up because of the removal of the individual mandate penalty.

If you only count new enrollees, CoveredCA is running 11.3% behind last year. When you include auto-renewals of current enrollees, however, it's only down 0.9%. This is well behind other state-based exchanges so far (the other 6 which have released data so far are ahead of 2018 by 3-13%)...but well ahead of HealthCare.Gov, which is running 11% behind last year at the moment).

And yes, the mandate repeal is indeed having a negative impact on enrollment, as predicted:

Covered California projected the removal of the mandate penalty would result in a drop in enrollment in 2019 that ranges from 7 to 18 percent, with a base projection of 12 percent.

“While we know that the financial help offered through Covered California is the big motivator for many people to enroll, with the penalty removed we do expect some consumers to roll the dice and go without health coverage,” Lee said. “We also know that life can change in an instant, and it’s important to have health coverage when it does.”

Covered California data shows that more than 50,000 of its members were either diagnosed with or treated for cancer in 2017. Another 22,000 members fractured, dislocated or sprained their arm or shoulder.

“Being covered means you are protected from medical bills that can range from tens of thousands of dollars into the millions,” Lee said. “That’s why it is so important for Californians to take a look at their options and find out if they are eligible for financial assistance to help bring that coverage within reach.”

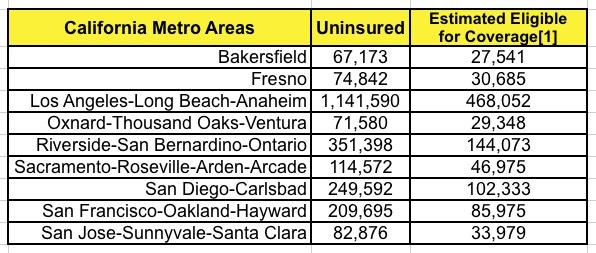

Roughly 1.1 million uninsured Californians are currently eligible for coverage in Covered California or Medi-Cal (see Table 1: Remaining Uninsured by Metro Area in 2017).

New research shows that four out of five of the uninsured consumers surveyed by Covered California, who are eligible for financial help, either do not know or do not think they qualify. Consumers can find out if they are eligible for financial help, and what plans are available in their area by using Covered California’s Shop and Compare Tool. Nearly nine out of every 10 Covered California consumers receive some level of financial help, which pays an average of 80 percent of their monthly premium.

The average Covered California enrollee pays about $5 per day for coverage, but many consumers pay far less. One out of every three Covered California consumers who receives financial help can purchase a Silver plan — which provides the best overall value — for $50 or less per month. Nearly three out of five of these consumers can get a Silver plan for $100 or less per month.

Table 1: Remaining Uninsured by Metro Area in 2017

Source: U.S. Census Bureau, American Community Survey, 2017

Those interested in learning more about their coverage options should go to www.CoveredCA.com, where they can get help to enroll. They can explore their options and find out if they qualify for financial help by using the Shop and Compare Tool. They can also get free and confidential enrollment assistance by visiting www.coveredca.com/find-help/and searching among 700 storefronts statewide or 16,000 certified enrollers who can assist consumers in understanding their choices and enrolling, including individuals who can assist in other languages. In addition, consumers can reach the Covered California service center by calling (800) 300-1506.