New Mexico: Preliminary 2019 ACA rate hike request:10%; est. ~6% due specifically to ACA sabotage

As usual, Louise Norris has the skinny:

Rate filings were due in New Mexico by June 10, 2018, for insurers that wish to offer individual market plans in 2019. Insurers that offer on-exchange coverage have been instructed by the New Mexico Office of the Superintendent of Insurance (NMOSI) to add the cost of cost-sharing reductions (CSR) only to on-exchange silver plans and the identical versions of those plans offered off-exchange (different silver plans offered only off-exchange will not have the cost of CSR added to their premiums).

Last fall, my colleagues (Norris, Dave Anderson, Andrew Sprung) and I were never quite sure what the CSR loading situation was in New Mexico; as far as we could tell, NM Health Connections and Christus were both Silver Loading while Molina went the full Silver Switcharoo route, and I don't think we ever had a clear answer on Blue Cross Blue Shield of NM. That confusion was compounded by Christus missing a deadline for refiling their 2018 rates, which meant that their policies were left off the ACA exchange for a couple of weeks, causing a change in which Silver policy was used as the "benchmark" from which tax credit subsidies were calculated.

For 2019, however, it appears that New Mexico is shifting to full #SilverSwitcharoo status across the board, which is a Good Thing®.

All four insurers that currently offer exchange plans in New Mexico have filed rates and forms for continued on-exchange plans in 2019. In addition, Presbyterian Health Plan, which exited the New Mexico exchange after the end of 2016 (details below), has filed rates for on-exchange plans in 2019. Presbyterian plans were only available off-exchange in New Mexico in 2017 and 2018, but the insurer anticipates having both on- and off-exchange plans available in 2019.

That's good news for New Mexico residents, especially those currently on Presbyterian policies who qualify for ACA tax credits; they should be able to shift to an on-exchange equivalent of the plan they're currently on and save big bucks.

On the other hand...

As noted below, Molina has threatened a possible exit of the individual market in New Mexico due to the impending loss of their Medicaid managed care contract. I spoke with the NMOSI about this issue, but they didn’t have any details in terms of the current status of the situation (Molina has protested their loss in the Medicaid bidding process, but the state has rejected that protest). Molina has filed on- and off-exchange plans — with a proposed reduction in rates — for 2019. But that does not bind them to participate in the individual market next year, as they could opt to withdraw those filings later in the summer.

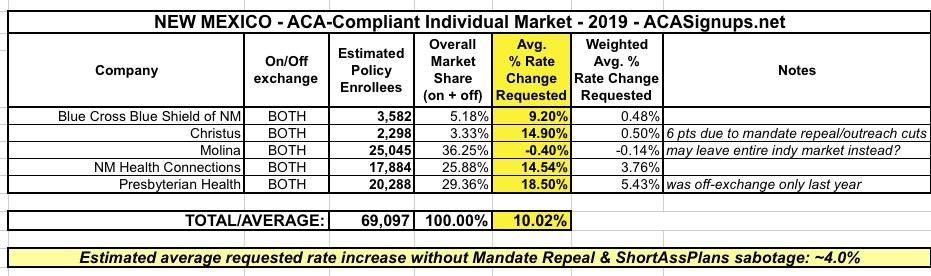

Insurers have filed the following proposed average rate changes, which are now being reviewed by the New Mexico Office of the Superintendent of Insurance:

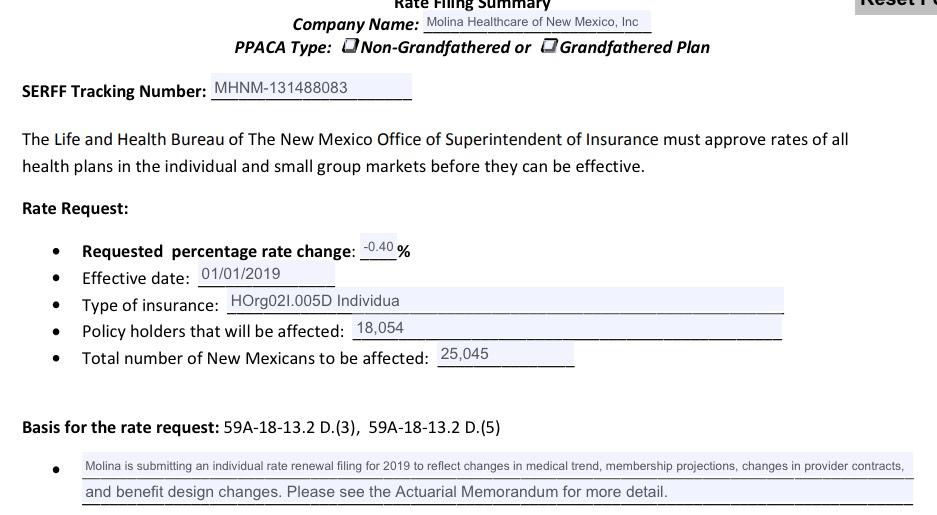

- Molina: decrease of 0.4 percent (25,045 members)

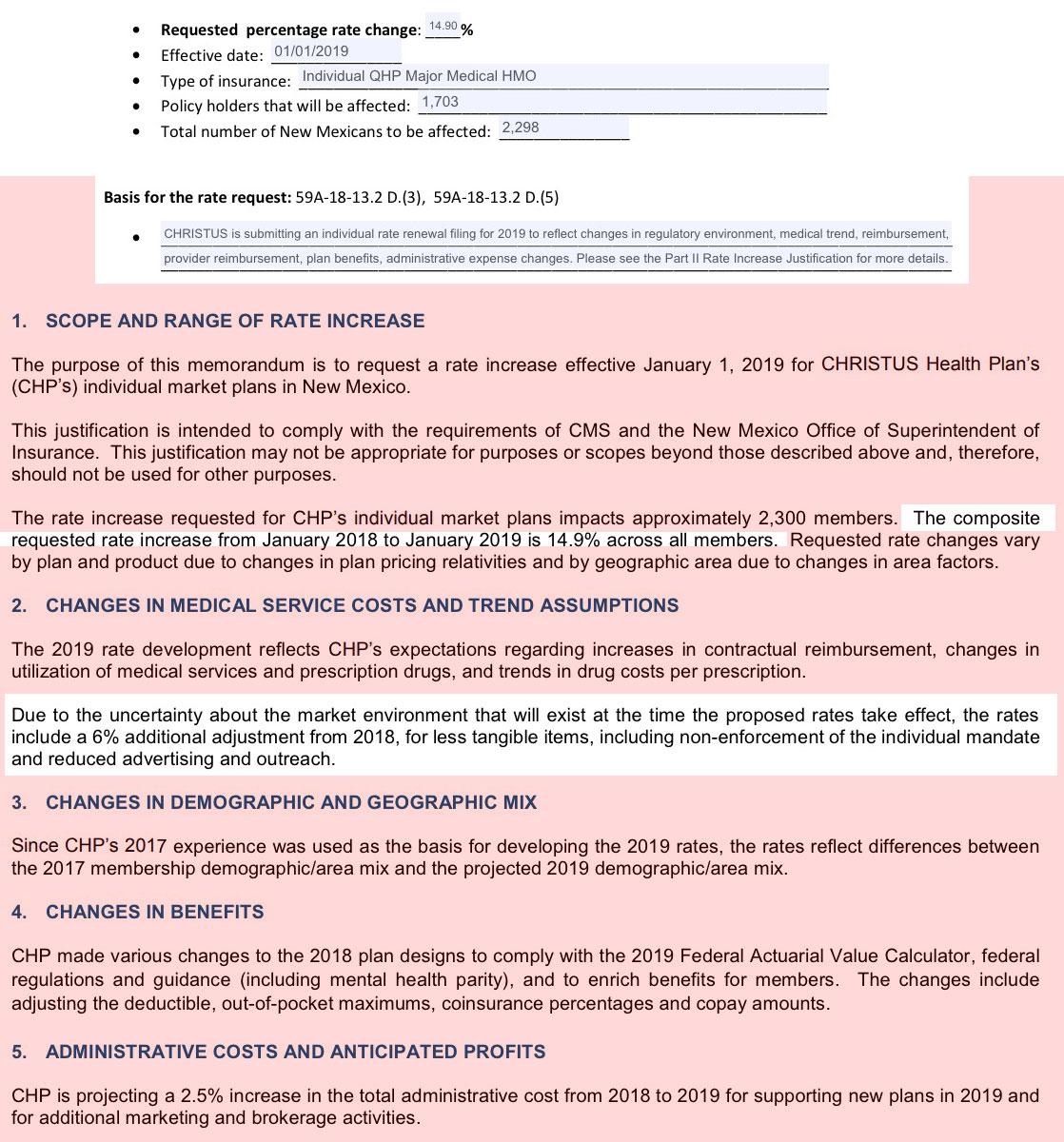

- Christus: 14.9 percent (2,298 members). Of that rate increase, 6 percentage points are due to “less tangible items, including non-enforcement of the individual mandate and reduced advertising and outreach.” In other words, the rate increase proposal would be single-digit if the individual mandate penalty weren’t going away, and if the Trump Administration hadn’t sharply reduced funding for exchange outreach and marketing.

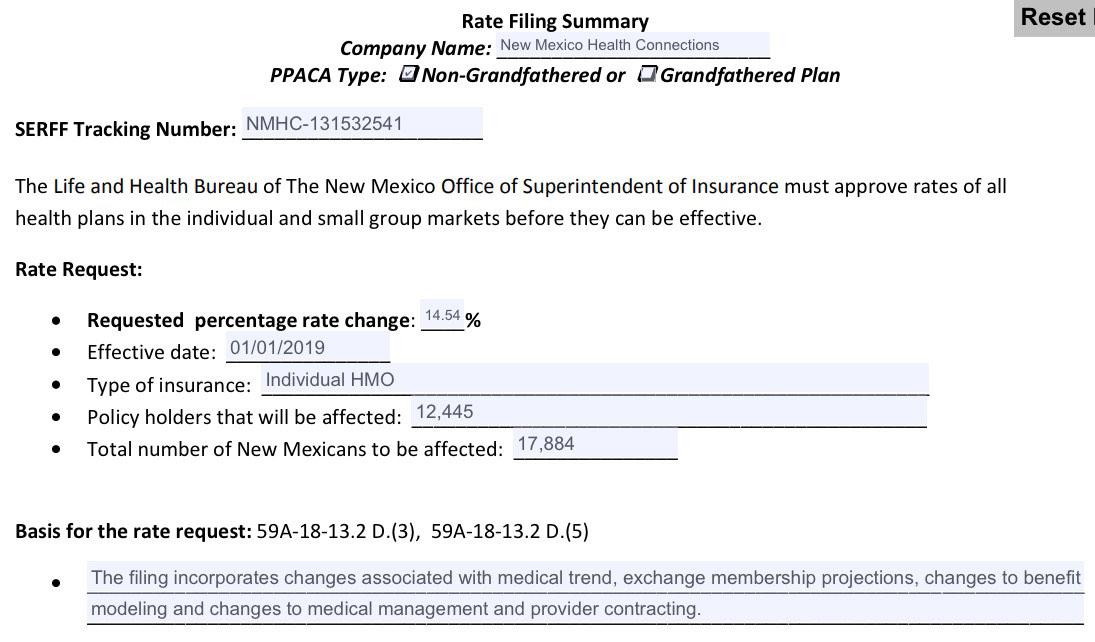

- New Mexico Health Connections: 14.54 percent (17,884 members)

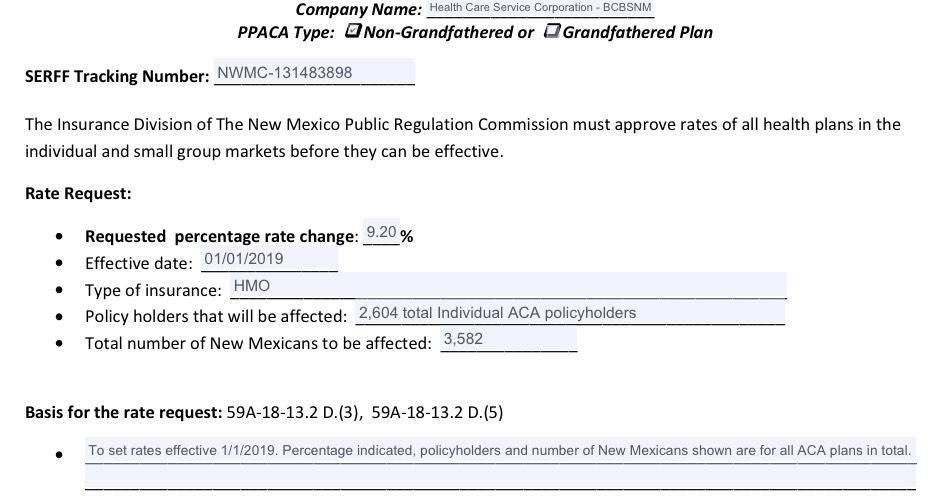

- Blue Cross Blue Shield of New Mexico (part of Illinois-based non-profit Health Care Service Corporation): 9.2 percent (3,582 members)

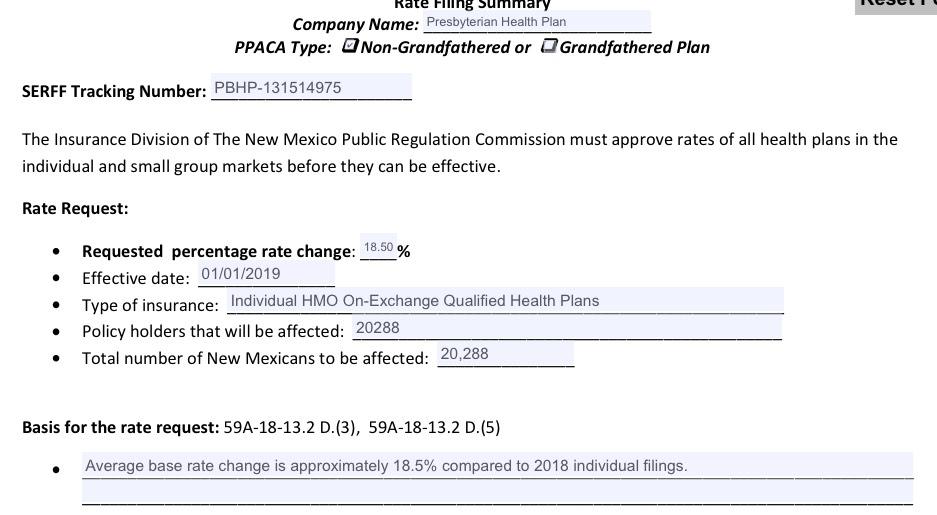

- Presbyterian Health Plan: 18.5 percent (20,288 members, all off-exchange in 2018). Presbyterian’s rate filing notes that part of the proposed rate increase is an adjustment to account for the fact that they’ll be “serving a significantly different population” in 2019 (ie, on-exchange) in addition to their current off-exchange members. When Presbyterian pulled out of the exchange at the end of 2016, they noted that their on-exchange enrollees had been incurring claims costs that were 30 percent higher than their off-exchange members.

Here's what it looks like when you put them all together. Christus is the only carrier which specifically called out the repeal of the ACA individual mandate and other sabotage factors (6 points out of their 14.9% total increase request), but the Urban Institute estimated that overall, sabotage factors will likely be responsible for around a 9.1 point increase. As I noted last week, in the interest of caution, I'm taking 2/3 of that and pegging about 6 points of the total 2019 increase on mandate/#ShortAssPlans sabotage: