Illinois: RATE-HIKE-A-PALOOZA! Six more states added at once!

Protect Our Care is a healthcare advocacy coalition created last December to help fight back against the GOP's attempts to repeal, sabotage and otherwise undermine the Affordable Care Act. This morning they released a report which compiled the approved 2018 individual market rate increases across over two dozen states.

Needless to say, they found that the vast majority of the state insurance regulators and/or carriers themselves are pinning a large chunk (and in some cases, nearly all) of the rate hikes for next year specifically on Trump administration sabotage efforts...primarily uncertainty over CSR payment reimbursements and, to a lesser extent, uncertainty over enforcement of the individual mandate penalty.

Anyone who follows this site knows that this is hardly shocking news; I've been laser-focused on this issue for the past five months or so. I've already compiled and broken out the average rate increases for 22 of the 28 states covered by the Protect Our Care report. The average increases in my spreadsheets differ from some of the numbers in the POC report because I also include the off-exchange ACA-compliant market (which isn't always included in the sources cited by POC's report), and because I make sure to weight the averages by relative carrier enrollment share of the market. For these reasons, the Protect Our Care report normally wouldn't have caught my eye, though obviously it's a good thing for the sabotage issue to get more exposure.

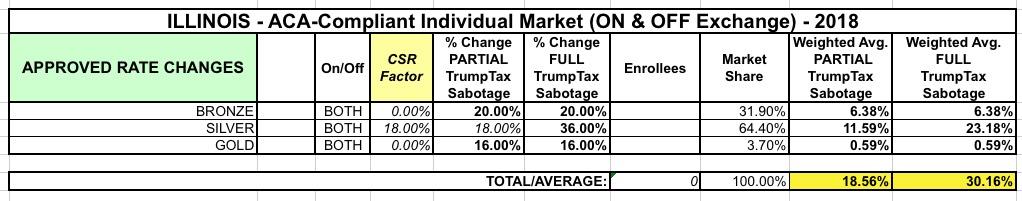

However, POC has also tracked down the approved rate increases for six additional states which I hadn't yet compiled...which makes this exciting to a healthcare data nerd like myself! They've helped me fill in the blanks for Illinois, Indiana, Nevada, Ohio, South Dakota and Utah. So without further ado, here's Illinois:

Illinois Department of Insurance:

'DOI is committed to ensuring that consumers are prevented from incurring higher health insurance costs due to uncertainty in Washington,’ said DOI Director Jennifer Hammer. ‘Insurers have been advised to apply the CSR uncertainty cost, solely to silver plans.’ This change makes it important that consumers diligently shop for a plan this year. DOI reminds consumers that cost alone may not be the only factor to consider when selecting a plan. For example, consumers may want to also consider a plan’s provider network.

The Illinois DOI doesn't appear to have posted approved average rate hikes or enrollment numbers for the individual carriers, but they've done something almost as good (and in some ways more useful): Their rate/plan analysis PDF lists the average rate increases for all individual market policies by metal level. Since I already know what portion of the indy market is enrolled in Bronze, Silver and Gold (there aren't any Platinum plans available in IL), this allows me to not only put together the overall average increase, but also clearly shows the impact of loading CSRs onto Silver plans only (around 18 points, or exactly half of the overall Silver increase). This gives a weighted statewide average increase of 30.2% assuming CSRs won't be paid...which would only be about 18.6% if the plans had been priced to assume they will be paid: