Arkansas: *Approved* avg. 2017 rates: 9.4% (down from 15.1% requested)

There are a few states which have technically expanded Medicaid under the ACA, but have done so using an approved waiver which allows them to actually enroll expansion-eligible residents in private Qualified Health Policies (QHPs)...using public Medicaid funding to do so. To be honest, this has always struck me as being essentially no different than someone simply receiving 99.9% APTC/CSR subsidies for enrolling in an exchange policy anyway; it's just a question of which pool of federal funds the subsidies come from. The two states which I know for a fact do it this way are Arkansas and New Hampshire, with Arkansas calling their "Private Medicaid Option" program the "Health Care Independence Program".

In any event, AR "Private Option" enrollees may be categorized as "Medicaid expansion" in the official reports, but for purposes of estimating the risk pool, they're included in with every other ACA-compliant private individual policies, whether on or off the ACA exchange.

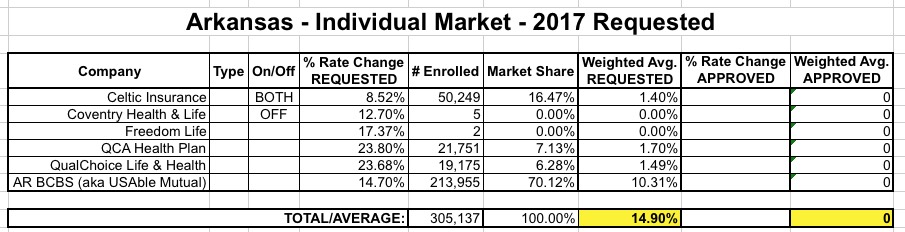

When I first crunched the numbers for Arkansas in early June, I estimated the average requested rate hike on the indy market at around 14.9%:

Yesterday, according to the Arkansas Democrat Gazette, the state insurance commissioner has made final decisions on the approved rate increases...and while it looks like the carriers have accepted the reductions, Blue Cross, at least, doesn't appear to be too happy about it:

The three companies offering plans on the state's health insurance exchange have lowered their proposed rate increases for next year, an Arkansas Insurance Department spokesman said Friday.

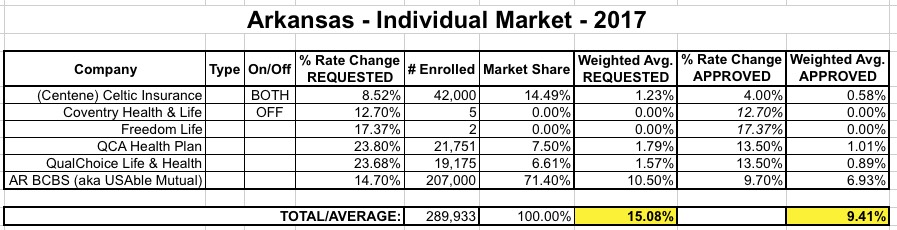

A letter from the chief legal officer of the state's largest health insurer, Arkansas Blue Cross and Blue Shield, indicates that the company lowered its requested increase from 14.7 percent to 9.7 percent after Insurance Commissioner Allen Kerr said he would recommend the lower rate to the federal Centers for Medicare and Medicaid Services, which must approve the rates.

In his letter Friday to the commissioner, Lee Douglass called Kerr's rejection of the company's 14.7 percent rate increase "arbitrary," noting that actuaries hired by the Insurance Department had found the request to be justified.

Blue Cross and Blue Shield plans cover about 207,000 Arkansans, including about 130,000 whose premiums are paid by Medicaid under the so-called private option, Insurance Department spokesman Ryan James said.

Little Rock-based QualChoice Insurance reduced its requested increase for plans covering about 41,000 people, most of them private-option participants, from more than 23 percent to about 13.5 percent.

Centene Corp. of St. Louis, which had plans covering about 42,000 Arkansans at the end of last year, will increase rates by 4 percent, instead of the 8.1 percent it initially proposed, James said.

...In the letter to Kerr Friday, Blue Cross' Douglass said the commissioner's rejection of the 14.7 percent rate increase appeared to be based on an "erroneous belief that we have recently received an 'influx' of $30.8 million into our surplus."

The rest of the article goes into the politics of the requested and approved rate changes, with Blue Cross basically accusing the AR DOI of slashing approved rates not because of accurate actuarial need but simply to keep a lid on the public backlash. I'm not in a position to comment on whether that's the case or not here, although there's been a lot of claims of this nationally the past few years.

I should also note that there appear to be around 30,000 private option enrollees unaccounted for in the above article; if you add 130K via Blue Cross, perhaps 40K via QualChoice (it just says "most") and the full 42K via Centene (no proportion listed), that only adds up to 210,000 people at most, yet it goes on to say:

More than 238,000 people were covered by private option plans as of March 15.

In any event, in addition to slightly updating the current enrollment numbers for each carrier (remember, the original filings included enrollment as of last March or so), the Gazette article clearly states the approved rates for 3 of the 6 carriers listed above...except it's really 4, since "QCA" is just a separate branding for "QualChoice". Their combined enrollment makes up the 41K in the article. In addition, "Centene" actually acquired Celtic recently, accounting fro the 42K (down from 50K) listed above.

That just leaves "Freedom LIfe", which is questionably-legit as an "individual market" carrier (and only has 2 people enrolled anyway) and Coventry, which is actually a subsidiary of Aetna...except that they only list 5 people enrolled state-wide, and Aetna didn't even bother listing Arkansas among the states they're currently participating in anyway.

Update the numbers, plug in the approved rates and here's what it looks like:

As you can see, the enrollment tweaks bump up the requested average slightly...but the approved rate increases average 9.4%, a good 5.7 points lower.

As noted in the article, this is good news for the enrollees this year...but if Blue Cross is correct about their higher request truly being justifiable, this also increases the odds of them bailing next year.

I now have the weighted average approved rate hikes for 7 states representing about 8.5% of the total population. These 7 states average 17% overall.