Indiana: Approved 2016 weighted avg. rates confirmed as only 0.7%

A couple of weeks ago, my post on Indiana's average 2016 rate increases on the individual market would likely be very close to flat, based on partial enrollment data (i.e., they provided the rate data for every insurance company, but enrollment data for only one of them). The one company they provided enrollment information for, Physicians Health Plan, also happens to have the highest average rate hike, 13.5%.

However, I noted that since a) Physicians only holds around 4% of Indiana's market, and b) several of the other companies were approved for rate decreases (up to -19% for Mdwise Marketplace), it's entirely possible that the state could be looking at an overall rate decrease, or a very low increase at worst. I decided to split the difference and go with a flat zero percent change until further notice.

Today, Louise Norris has come through again:

On September 1, the Indiana Department of Insurance posted a complete listof their individual and small group market carriers and their approved rate changes for 2016. The only thing missing from the list was market share data, which made it hard to calculate a weighted average rate change. So I contacted the Department of Insurance to see if I could obtain more information about market share. Here’s what they told me:

- Roughly 85 percent of Indiana’s ACA-compliant individual plans have been sold through the exchange.

- Anthem Blue Cross Blue Shield, which will have an average rate increase of 3.8 percent, has about 65 percent of the on-exchange market share.

- Humana is exiting the individual market in Indiana (their rate filing had been withdrawn, but it wasn’t entirely clear what their status was). Humana didn’t participate in the exchange previously, so it’s only the off-exchange market that they’re exiting.

- Across the 8 carriers that are continuing to offer plans in the exchange in Indiana, the Department of Insurance calculated an approved weighted average rate increase of 0.7 percent for 2016. They did that by utilizing SERFF data to obtain market share data. SERFF data is available to the public but can be quite time consuming to sort through.

In addition to Humana, Time/Assurance is exiting the market (nationwide). Unlike Humana, Time did offer plans in the exchange in 2015.

The only Indiana carrier that will be offering individual plans only outside the exchange in 2016 is UnitedHealthcare (although United’s subsidiary, All Savers, does offer on-exchange plans).

So:

- The approved weighted average increase is just 0.7% for 85% of the market.

- If 85% of the total ACA-compliant market is through the exchange this year, and the effectuated enrollment in exchange plans in Indiana stands at 167,261, that means the total ACA-compliant market is only 197,000 people.

- For reference, the Kaiser Family Foundation estimates that Indiana's 2014 individual market was 231,000...except that also included "grandfathered" and "transitional" policies.

- If the total ACA-compliant market is 197,000, and 85% of that has been accounted for, that leaves just 30,000 remaining.

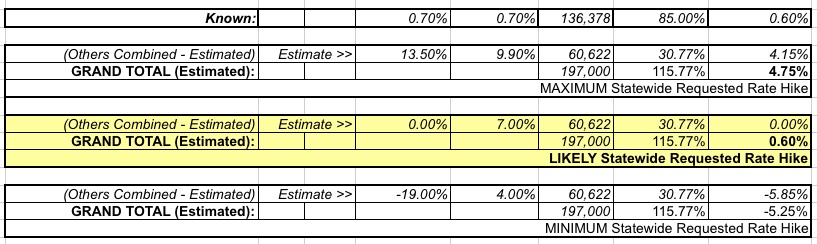

- There's no way of knowing what the breakout is for the other 30,000, we do know the maximum and minimum theoretical averages:

As you can see, the worst-case scenario assumes that all 30,000 off-exchange enrollments are through Physicians Health Plan (13.5% hike), with 0 going to anyone else. This is extremely unlikely, of course.

The best-case scenario assumes that all 30,000 off-exchange enrollments are through Mdwise Marketplace (19.0% rate drop), which is equally unlikely.

If you assume these average out to 0%, that nudges the overall average hike down a smidge, from 0.7% to 0.6%, but I can live with 0.7% as well.