Surreal silver lining re. Medicaid unwinding? Some losing coverage may not have known they were covered to begin with

According to the latest estimates from KFF, over 20 million Americans have now had their Medicaid or CHIP healthcare coverage terminated since the post-public health emergency "unwinding" process began one year ago:

At least 20,104,000 Medicaid enrollees have been disenrolled as of April 11, 2024, based on the most current data from all 50 states and the District of Columbia. Overall, 31% of people with a completed renewal were disenrolled in reporting states while 69%, or 43.6 million enrollees, had their coverage renewed (one reporting state does not include data on renewed enrollees). Due to varying lags for when states report data, the data reported here undercount the actual number of disenrollments to date.

On the one hand, this is absolutely a crisis. On the other hand, while the numbers are still shockingly high (KFF themselves put their estimate at anywhere between 8 - 24 million who would lose coverage last April), it isn't quite as bad as the top line number suggests, for several reasons.

- For starters, at least 3.42 million of those who had their Medicaid/CHIP coverage terminated transferred over to heavily-subsidized ACA exchange plans instead as of the end of December. This is likely several hundred thousand higher today.

- Another 257,000 or more living in Minnesota and New York shifted from Medicaid over to their respective Basic Health Plan programs.

- Another 427,000 were kicked off their Medicaid/CHIP plans...but then turned around, reapplied and were found to be eligible for Medicaid/CHIP regardless. I don't know how many actually re-enrolled, but I'm assuming the vast bulk of them have done so.

All told, that's at least 4.1 million of the 20.1 million who have found other comprehensive, extremely inexpensive healthcare coverage in one form or another...roughly 20%.

What about the other 16 million, though? Well, that's where things get interesting.

Around 4.1 million Americans turn 65 each year (roughly 1.2% of the total U.S. population).

I don't know the age distribution of the ~20 million who have been "unwound," but assuming it's fairly close to the nation as a whole, this suggests that perhaps 250,000 or so of them became eligible for Medicare instead over the past 12 months.

An unknown number have presumably gained employer coverage thanks in large part to the 2.8 million additional jobs which have been gained since March 2023.

The number of people enrolled in Medicaid soared over the pandemic due to federal restrictions on states removing members from the safety-net insurance program. However, many of those people may not have known their coverage had continued, a new study suggests.

Medicaid coverage as a share of the overall population jumped by 5.2 percentage points between 2019 and 2022, according to CMS statistics. However, the change in survey-reported Medicaid coverage was much smaller — an increase of 1.3 percentage points, according to the study published Friday in JAMA Health Forum.

The findings suggest the government needs to do a better job of communicating with Medicaid members about changes to their coverage — a particularly important goal as states recheck Medicaid eligibility, researchers said.

..The gap between administrative and self-reported Medicaid coverage increased from 1.7% of the population in 2019 to 5.6% in 2022. In 2019, 34 states and Washington, D.C. had a survey Medicaid undercount. By 2022, all 50 states and Washington, D.C. had an undercount, according to the study.

If I'm reading this correctly, if you take this gap literally and precisely, assuming it's based on the total U.S. population of around 334 million people, it suggests that up to 18.7 million Americans who were enrolled in Medicaid in 2022 had no idea they were enrolled in Medicaid.

This may sound stunning, but consider that if you don't know that you never receive any sort of notification (or assume it's spam and ignore it/throw it out) and are healthy all year, it may never occur to you. For that matter, even if you do visit the doctor, if you don't know you're enrolled in Medicaid it will never occur to you to even check...you likely won't visit at all or will go but pay out of pocket whether you can afford it or not.

This could be due to confusion among beneficiaries about how to report their coverage, but more likely many people who stayed on Medicaid during the COVID continuous enrollment might not have realized that, researchers said. Typically, Medicaid eligibility lasts a year before it needs to be renewed.

There's also the possibility that some of the unwinding population has been double enrolled in both Medicaid and employer-sponsored coverage all this time without ever knowing it. I kind of assumed there were safeguards against that sort of thing, but I could easily see how it could quietly slip through the system.

Of course, this is still speculation; it could be a nominal number of people in one of these situations. And even if only, say, 5 million people are actually completely uncovered post-unwinding, that would still be a major issue.

I'm just saying that it might not be nearly as bad as it seems...though it's still gonna take some time for the dust settle on the data for us to know how bad it really is.

UPDATE: Oh wow...I swear I didn't know about this before publishing the above, but someone just sent me a link to a new study published almost exactly one year ago by the Assistant Secretary for Planning & Evaluation (ASPE) which literally opens with:

Many Medicaid enrollees are employed, and in 2021, 15 percent of working enrollees reported having both Medicaid and employer sponsored health coverage. The intersection between Medicaid and employment has implications for employers and others as the pandemic-related Medicaid continuous enrollment ends.

Hah! Well, there you go. From the study:

- Approximately 2 million (15 percent) working Medicaid enrollees aged 19-64 report also having employer sponsored insurance (ESI) in 2021, and when accounting for spouses and dependent children of these individuals, over 4 million people could move to ESI after unwinding the Medicaid continuous enrollment provision. Medicaid is the payer of last resort; providers must first bill the enrollee’s ESI insurer and then bill Medicaid if any service is not fully covered by ESI.

- As the Medicaid continuous enrollment provision comes to an end starting April 1, 2023, many individuals may eventually transition to ESI. The U.S. Department of Health and Human Services is working closely with states and other stakeholders to maximize opportunities for Medicaid enrollees to enroll in other affordable coverage, including ESI, and our results indicate that employers have an important role to play in this process.

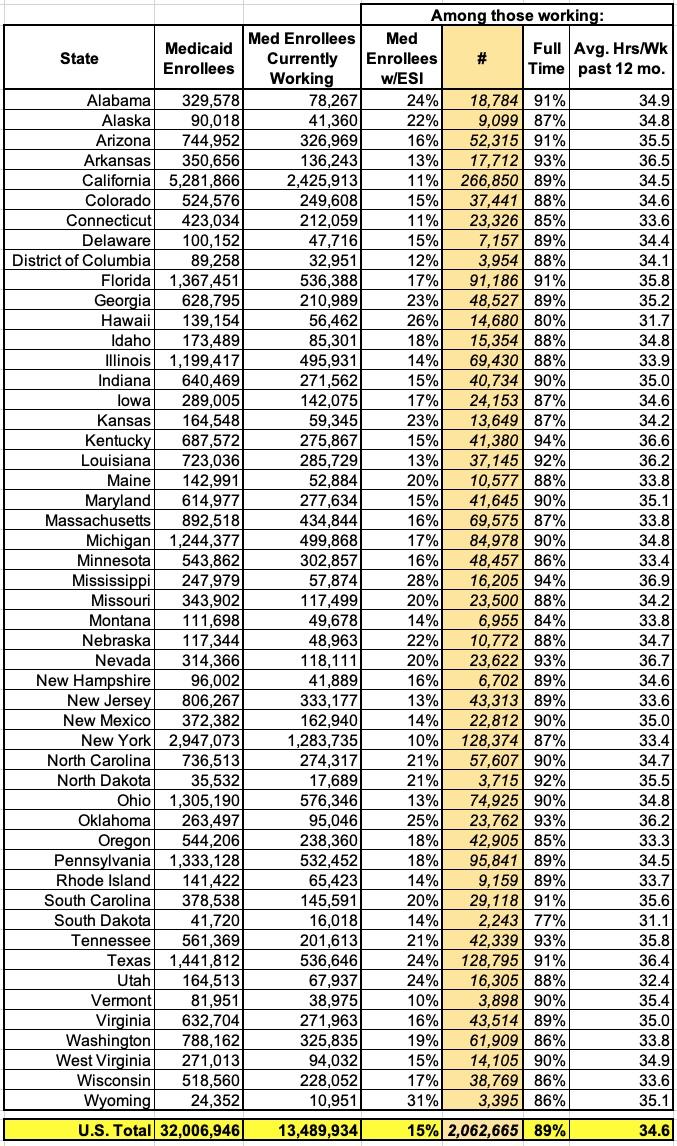

The study even includes a state-by-state breakout of how many Medicaid enrollees were employed as of a year ago and what percentage of them were estimated to also have employer-sponsored coverage at the time:

Appendix Table 1. Employment for Medicaid Enrollees Who Were Employed Ages 19-64 by State, 2021

Of course these are just estimates at the time and were already 2 years out of data by the time the Unwinding process began, so it's a big leap to suggest that 2 million (4 million including spouses/children) people in the Unwinding population already had ESI at the same time, but it's another important data point to consider.